Dell 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

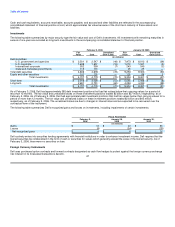

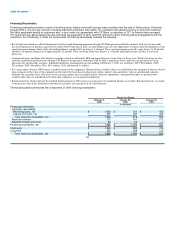

Financing Receivables

Financing receivables primarily consist of revolving loans, leases and small business loans resulting from the sale of Dell products. Financing

through DFS is one of many sources of funding that Dell's customers may select. For customers who desire revolving or term loan financing,

Dell sells equipment directly to customers who, in turn, enter into agreements with CIT Bank, a subsidiary of CIT, to finance their purchases.

For customers who desire lease financing, Dell sells the equipment to DFS, and DFS enters into direct financing lease arrangements with the

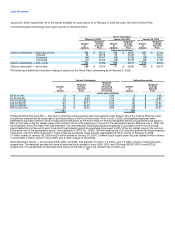

customers. As of February 3, 2006, the components of financing receivables included the following:

• Revolving loans which are offered through private label credit financing programs through CIT Bank provide qualified customers with a revolving credit

line for the purchase of products and services sold by Dell. From time to time, account holders may have the opportunity to finance their Dell purchases with

special programs during which, if the outstanding balance is paid in full, no interest is charged. These special programs generally range from 3 to 24 months

and have a weighted average life of approximately 12 months. Other revolving loans bear interest at a variable annual percentage rate that is tied to the

prime rate.

• Commercial leases and loans with business customers which are offered by DFS and generally have a term of two to three years. Fixed term loans are also

offered to qualified small businesses through CIT Bank for the purchase of products sold by Dell. Commercial leases and loans are presented net of an

allowance for uncollectible accounts. Scheduled maturities of minimum lease outstanding at February 3, 2006, are as follows: 2007: $52 million; 2008:

$25 million; 2009: $8 million; 2010: $0.3 million; 2011 and beyond: $- million.

• For certain types of leases, DFS retains a residual interest in the equipment. Estimated lease residual values are established at the inception of the lease based

upon estimates of the value of the equipment at the end of the lease based on historical studies, industry data and future value-at-risk demand valuation

methods. On a periodic basis, Dell assesses the carrying amount of its recorded residual values for impairment. Anticipated declines in specific future

residual values that are considered to be other-than-temporary are recognized immediately.

• Retained interests which represent the residual beneficial interest Dell retains in certain pools of securitized finance receivables. Retained interests are stated

at the present value of the estimated net beneficial cash flows after payment of all senior interests.

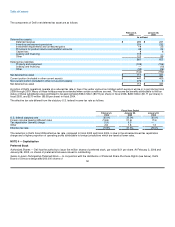

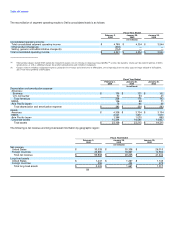

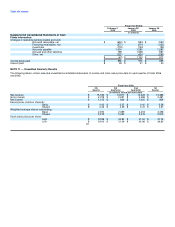

The following table summarizes the components of Dell's financing receivables:

Fiscal Year Ended

February 3, January 28, January 30,

2006 2005 2004

(in millions)

Financing receivables:

Customer receivables:

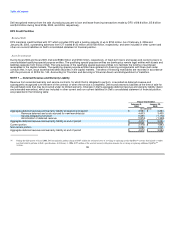

Revolving loans, net $ 1,026 $ 731 $ 455

Leases and loans, net 300 187 165

Total customer receivables, net 1,326 918 620

Residual interests 272 241 212

Retained interest and other 90 25 —

Financing receivables, net $ 1,688 $ 1,184 $ 832

Short-term $ 1,363 $ 985 $ 712

Long-term 325 199 120

Total financing receivables, net $ 1,688 $ 1,184 $ 832

54