Dell 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

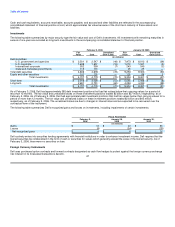

Dell recognized revenue from the sale of products pursuant to loan and lease financing transactions made by DFS of $6.6 billion, $5.6 billion

and $4.5 billion during fiscal 2006, 2005, and 2004, respectively.

DFS Credit Facilities

Residual Debt

DFS maintains credit facilities with CIT which provides DFS with a funding capacity of up to $750 million. As of February 3, 2006 and

January 28, 2005, outstanding advances from CIT totaled $133 million and $158 million, respectively, and were included in other current and

other non-current liabilities on Dell's consolidated statement of financial position.

Asset Securitization

During fiscal 2006 and fiscal 2005, Dell sold $586 million and $160 million, respectively, of fixed-term loans and leases and revolving loans to

unconsolidated qualifying special purpose entities. The qualifying special purpose entities are bankruptcy remote legal entities with assets and

liabilities separate from those of Dell. The sole purpose of the qualifying special purpose entities is to facilitate the funding of purchased

receivables in the capital markets. The qualifying special purpose entities have entered into financing arrangements with three multi-seller

conduits that, in turn, issue asset-backed debt securities in the capital markets. Transfers of financing receivables are recorded in accordance

with the provisions of SFAS No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishment of Liabilities.

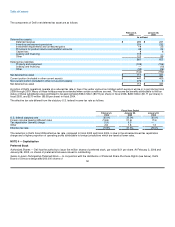

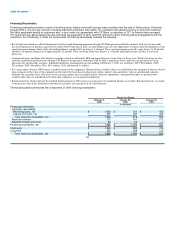

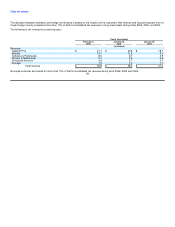

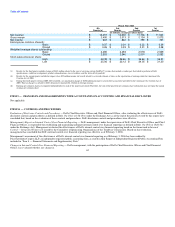

NOTE 7 — Deferred Revenue and Warranty Liability

Revenue from extended warranty and service contracts, for which Dell is obligated to perform, is recorded as deferred revenue and

subsequently recognized over the term of the contract or when the service is completed. Dell records warranty liabilities at the time of sale for

the estimated costs that may be incurred under its limited warranty. Changes in Dell's aggregate deferred revenue and warranty liability (basic

and extended warranties), which are included in other current and non-current liabilities on Dell's consolidated statement of financial position,

are presented in the following table:

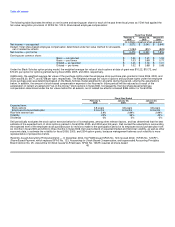

Fiscal Year Ended

February 3, January 28,

2006 2005

(in millions)

Aggregate deferred revenue and warranty liability at beginning of period $ 3,594 $ 2,694

Revenue deferred and costs accrued for new warranties(a) 4,603 3,435

Service obligations honored (1,651) (1,176)

Amortization of deferred revenue (1,974) (1,359)

Aggregate deferred revenue and warranty liability at end of period $ 4,572 $ 3,594

Current portion $ 2,478 $ 1,893

Non-current portion 2,094 1,701

Aggregate deferred revenue and warranty liability at end of period $ 4,572 $ 3,594

(a) During the third quarter of fiscal 2006, Dell recognized a product charge of $307 million for estimated costs of servicing or replacing certain OptiPlexTM systems that include a vendor

part that failed to perform to Dell's specifications. At February 3, 2006, $197 million of the accrued warranty obligation remains for servicing or replacing additional OptiPlexTM

systems. 55