Dell 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

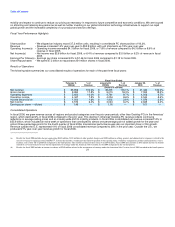

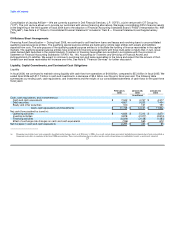

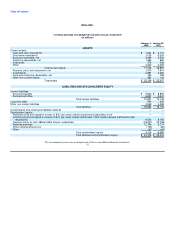

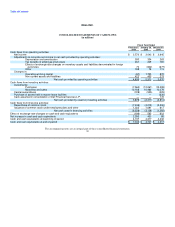

• Investing Activities — Cash provided by investing activities during fiscal 2006 was $3.9 billion, as compared to $2.3 billion cash used in fiscal 2005 and

$2.8 billion cash used in fiscal 2004. Cash generated or used in investing activities principally consists of net maturities and sales or purchases of

investments, and capital expenditures for property, plant, and equipment. In fiscal 2006, we re-invested a lower amount of proceeds from maturities and

sales of investments to build liquidity for share repurchases, which totaled $7.2 billion for fiscal 2006 as compared to $4.2 billion during the same period last

year. This was partially offset by an increase in capital expenditures during fiscal 2006 as we continued to focus on investing in our global infrastructure in

order to support our rapid global growth. In fiscal 2005, the decrease in cash used in investing activities compared to fiscal 2004, was primarily due to the

purchase of $636 million in assets during fiscal 2004 that were held in master lease facilities.

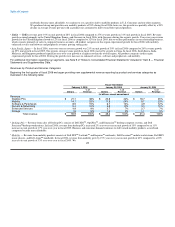

We historically maintained master lease facilities which provided us with the ability to lease certain real property, buildings, and equipment to be

constructed or acquired. These leases were accounted for as operating leases. During fiscal 2004, we paid $636 million to purchase all of the assets covered

by our master lease facilities. Accordingly, the assets formerly covered by these facilities are included in our consolidated statement of financial position and

we have no remaining lease commitments.

• Financing Activities — Cash used in financing activities during fiscal 2006 was $6.2 billion, as compared to $3.1 billion in fiscal 2005 and $1.4 billion in

fiscal 2004. Financing activities primarily consist of the repurchase of our common stock, partially offset by proceeds from the issuance of common stock

under employee stock plans and other items. In fiscal 2006, the year-over-year increase in cash used in financing activities is due primarily to the increase in

share repurchases of 204 million shares at an aggregate cost of $7.2 billion, compared to 119 million shares at an aggregate cost of $4.2 billion in fiscal 2005

and 63 million at an aggregate costs of $2.0 billion in fiscal 2004. In fiscal 2005, the increase in share repurchases compared to fiscal 2004 drove the year-

over-year increase in cash used in financing activities.

We typically generate annual cash flows from operating activities in amounts greater than net income, driven mainly by our efficient cash conversion cycle,

the growth in accrued service liabilities and deferred revenue, and non-cash depreciation and amortization expenses. We currently believe that our fiscal

2007 cash flows from operations will exceed net income and be more than sufficient to support our operations and capital requirements. We currently

anticipate that we will continue to utilize our strong liquidity and cash flows from operations to repurchase our common stock, make capital investments,

and fund various financing assets on Dell's balance sheet. However, we may access the capital markets later in fiscal 2007 to fund DFS funding requirements

as well as other potential uses for cash.

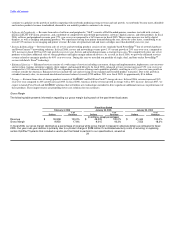

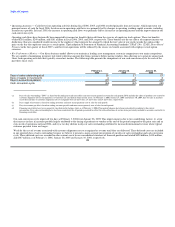

Capital Commitments

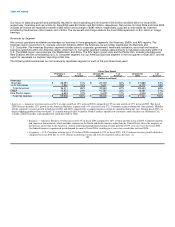

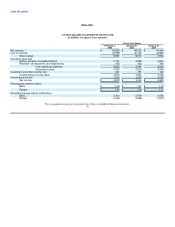

Share Repurchase Program — We have a share repurchase program that authorizes us to purchase shares of common stock in order to both

distribute cash to stockholders and manage dilution resulting from shares issued under our equity compensation plans. However, we do not

currently have a policy that requires the repurchase of common stock in conjunction with share-based payment arrangements. As of

February 3, 2006, Dell's share repurchase program authorized the purchase of up to 1.5 billion shares of common stock at an aggregate cost

not to exceed $30 billion.

We expect to continue to repurchase shares of common stock through a systematic program of open market purchases. As of the end of fiscal

2006, we had cumulatively repurchased 1.4 billion shares for an aggregate cost of approximately $25.6 billion. During fiscal 2006, we

repurchased 204 million shares of common stock for an aggregate cost of $7.2 billion. During fiscal 2005, we repurchased 119 million shares of

common stock for an aggregate cost of $4.2 billion. We currently expect to spend at least $1.2 billion in share repurchases for the first quarter

of fiscal 2007. 29