Dell 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

January 30, 2004, respectively. All of the shares available for future grants as of February 3, 2006 are under the 2002 Incentive Plan.

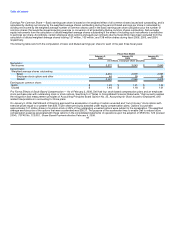

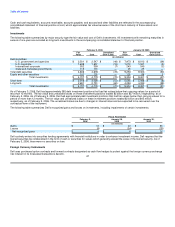

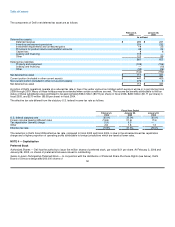

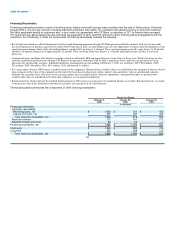

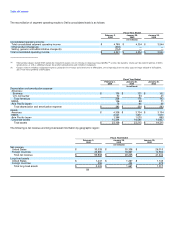

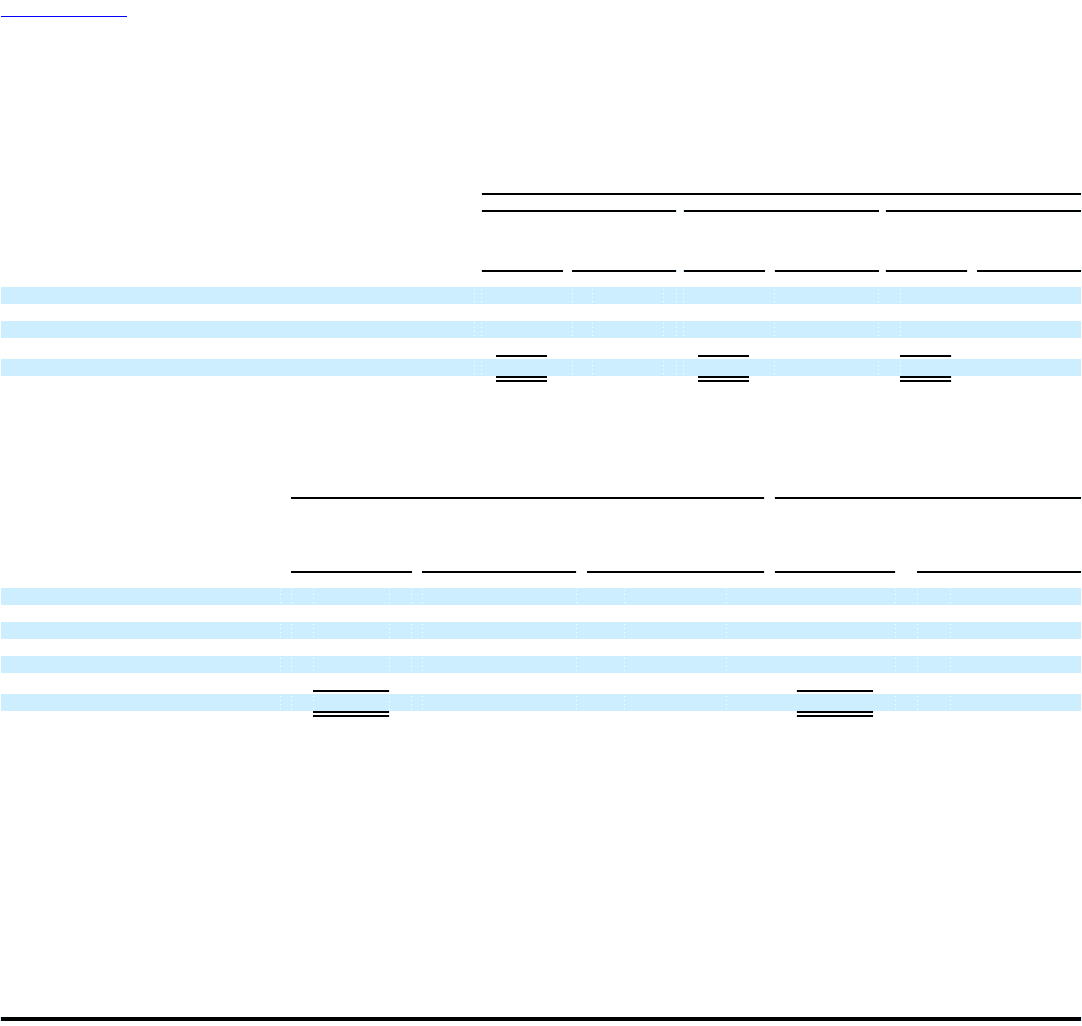

The following table summarizes stock option activity for the Stock Plans:

Fiscal Year Ended

February 3, 2006 January 28, 2005 January 30, 2004

Weighted- Weighted- Weighted-

Number Average Number Average Number Average

of Exercise of Exercise of Exercise

Options Price Options Price Options Price

(share data in millions)

Options outstanding — beginning of year 369 $ 29.70 378 $ 28.30 387 $ 27.09

Granted 45 39.76 52 34.35 51 30.01

Exercised (44) 20.47 (45) 22.30 (35) 14.92

Cancelled (27) 34.05 (16) 32.39 (25) 31.62

Options outstanding — end of year 343 31.86 369 29.70 378 28.30

Options exercisable — end of year 288 $ 33.04 171 $ 28.99 154 $ 26.74

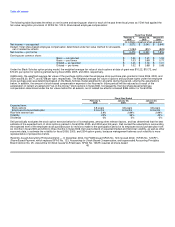

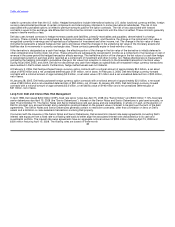

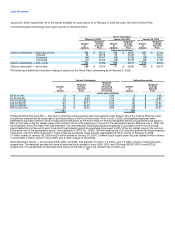

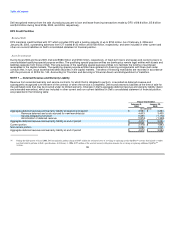

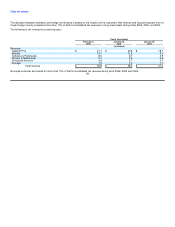

The following is additional information relating to options for the Stock Plans outstanding as of February 3, 2006:

Options Outstanding Options Exercisable

Weighted-

Weighted- Average Weighted-

Number Average Remaining Number Average

of Exercise Contractual of Exercise

Shares Price Life (Years) Shares Price

(share data in millions)

$0.01-$1.49 3 $ 1.26 0.35 3 $ 1.08

$1.50-$14.99 10 $ 8.35 1.52 10 $ 6.85

$15.00-$24.99 55 $ 22.83 5.34 38 $ 21.01

$25.00-$34.99 123 $ 29.17 6.56 85 $ 27.62

$35.00-$39.99 83 $ 36.97 5.86 83 $ 37.55

$40.00 and over 69 $ 42.55 6.69 69 $ 40.57

343 288

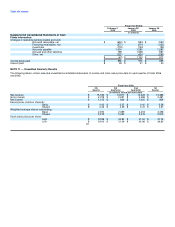

Employee Stock Purchase Plan — Dell has an employee stock purchase plan that qualifies under Section 423 of the Internal Revenue Code

and permits substantially all employees to purchase shares of Dell's common stock. Prior to July 1, 2005, participating employees were

permitted to purchase common stock through payroll deductions at the end of each six-month participation period at a purchase price equal to

85% of the lower of the fair market value of the common stock at the beginning or the end of the participation period. Effective July 1, 2005, the

Dell Employee Stock Purchase Plan was amended. The amended plan allows participating employees to purchase common stock through

payroll deductions at the end of each three-month participation period at a purchase price equal to 85% of the fair market value of the common

stock at the end of the participation period. Upon adoption of SFAS No. 123(R), Dell will expense the 15% discount received by the participating

employees. Common stock reserved for future employee purchases under the plan aggregated 16 million shares at February 3, 2006,

21 million shares at January 28, 2005 and 25 million shares at January 30, 2004. Common stock issued under this plan totaled 5 million shares

in fiscal 2006, 4 million shares in fiscal 2005, and 4 million shares in fiscal 2004.

Restricted Stock Grants — During fiscal 2006, 2005, and 2004, Dell granted 1.0 million, 0.4 million, and 0.6 million shares of restricted stock,

respectively. The weighted average fair value of restricted stock granted in fiscal 2006, 2005, and 2004 was $39.67, $35.14 and $27.92,

respectively. For substantially all restricted stock grants, at the date of grant, the recipient has all rights of a

52