Dell 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Earnings Per Common Share — Basic earnings per share is based on the weighted effect of all common shares issued and outstanding, and is

calculated by dividing net income by the weighted average shares outstanding during the period. Diluted earnings per share is calculated by

dividing net income by the weighted average number of common shares used in the basic earnings per share calculation plus the number of

common shares that would be issued assuming exercise or conversion of all potentially dilutive common shares outstanding. Dell excludes

equity instruments from the calculation of diluted weighted average shares outstanding if the effect of including such instruments is antidilutive

to earnings per share. Accordingly, certain employee stock options and equity put contracts (during fiscal 2004) have been excluded from the

calculation of diluted weighted average shares totaling 127 million, 103 million, and 138 million shares during fiscal 2006, 2005, and 2004,

respectively.

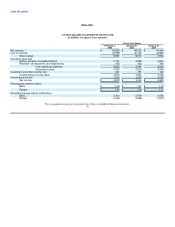

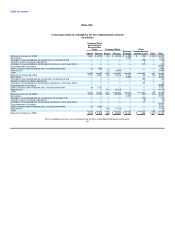

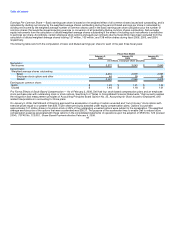

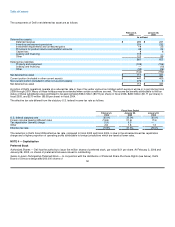

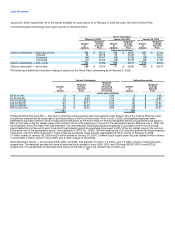

The following table sets forth the computation of basic and diluted earnings per share for each of the past three fiscal years:

Fiscal Year Ended

February 3, January 28, January 30,

2006 2005 2004

(in millions, except per share amounts)

Numerator:

Net income $ 3,572 $ 3,043 $ 2,645

Denominator:

Weighted average shares outstanding:

Basic 2,403 2,509 2,565

Employee stock options and other 46 59 54

Diluted 2,449 2,568 2,619

Earnings per common share:

Basic $ 1.49 $ 1.21 $ 1.03

Diluted $ 1.46 $ 1.18 $ 1.01

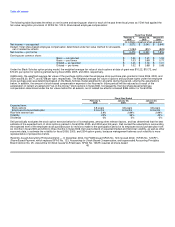

Pro Forma Effects of Stock-Based Compensation — As of February 3, 2006, Dell had four stock-based compensation plans and an employee

stock purchase plan with outstanding stock or stock options. See Note 5 of "Notes to Consolidated Financial Statements." Dell currently applies

the recognition and measurement principles of Accounting Principles Board Opinion No. 25, Accounting for Stock Issued to Employees, and

related Interpretations in accounting for those plans.

On January 5, 2006, Dell's Board of Directors approved the acceleration of vesting of certain unvested and "out-of-money" stock options with

exercise prices equal to or greater than $30.75 per share previously awarded under equity compensation plans. Options to purchase

approximately 101 million shares of common stock or 29% of the outstanding unvested options were subject to the acceleration. The weighted

average exercise price of the options that were accelerated was $36.37. The purpose of the acceleration was to enable Dell to reduce future

compensation expense associated with these options in the consolidated statements of operations upon the adoption of SFAS No. 123 (revised

2004), ("SFAS No. 123(R)"), Share-Based Payment effective February 4, 2006.

44