Dell 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

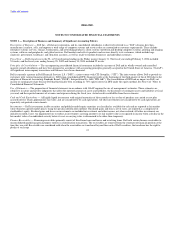

the assets, and Dell has surrendered control over the rights and obligations of the receivables. Gains and losses from the sale of fixed-term

loans and leases and revolving loans are recognized in the period the sale occurs, based upon the relative fair value of the assets sold and the

remaining retained interests. The retained interests are recorded in financing receivables at fair value. Dell estimates fair value based on the

present value of future expected cash flows using assumptions for estimated credit losses and prepayment rates.

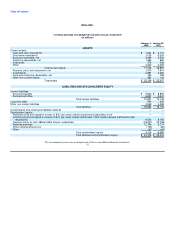

Inventories — Inventories are stated at the lower of cost or market with cost being determined on a first-in, first-out basis.

Property, Plant, and Equipment — Property, plant, and equipment are carried at depreciated cost. Depreciation is provided using the straight-

line method over the estimated economic lives of the assets, which range from ten to thirty years for buildings and two to five years for all other

assets. Leasehold improvements are amortized over the shorter of five years or the lease term. Gains or losses related to retirements or

disposition of fixed assets are recognized in the period incurred. Dell performs reviews for the impairment of fixed assets whenever events or

changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Dell capitalizes eligible internal-use software

development costs incurred subsequent to the completion of the preliminary project stage. Development costs are amortized over the shorter of

the expected useful life of the software or five years.

Foreign Currency Translation — The majority of Dell's international sales are made by international subsidiaries, most of which have the

U.S. dollar as their functional currency. Local currency transactions of international subsidiaries that have the U.S. dollar as the functional

currency are remeasured into U.S. dollars using current rates of exchange for monetary assets and liabilities and historical rates of exchange

for nonmonetary assets and liabilities. Gains and losses from remeasurement of monetary assets and liabilities are included in investment and

other income, net. Dell's subsidiaries that do not have the U.S. dollar as their functional currency translate assets and liabilities at current rates

of exchange in effect at the balance sheet date. Revenue and expenses from these international subsidiaries are translated using the monthly

average exchange rates in effect for the period in which the items occur. The resulting gains and losses from these foreign currency translation

adjustments are included as a component of stockholders' equity.

Hedging Instruments — Dell applies Statement of Financial Accounting Standards ("SFAS") No. 133, Accounting for Derivative Instruments and

Hedging Activities, as amended, which establishes accounting and reporting standards for derivative instruments and hedging activities.

SFAS No. 133 requires Dell to recognize all derivatives as either assets or liabilities in its consolidated statement of financial position and

measure those instruments at fair value.

Treasury Stock — Effective with the beginning of the second quarter of fiscal 2002, Dell began holding repurchased shares of its common stock

as treasury stock. Prior to that date, Dell retired all such repurchased shares, which were recorded as a reduction to retained earnings. Dell

accounts for treasury stock under the cost method and includes treasury stock as a component of stockholders' equity.

Revenue Recognition — Net revenue includes sales of hardware, software and peripherals, and services (including extended service contracts

and professional services). These products and services are sold either separately or as part of a multiple-element arrangement. Dell allocates

revenue from multiple-element arrangements to the elements based on the relative fair value of each element, which is generally based on the

relative sales price of each element when sold separately. The allocation of fair value for a multiple-element software arrangement is based on

vendor specific objective evidence ("VSOE") or in absence of VSOE for delivered elements, the residual method. In the absence of VSOE for

undelivered elements, revenue is deferred and subsequently recognized over the term of the arrangement. For sales of extended warranties

with a separate contract price, Dell defers revenue equal to the separately stated price. Revenue associated with undelivered elements is

deferred and recorded when delivery occurs. Product revenue is recognized, net of an

42