Dell 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

manage our total cash and investments balances to preserve principal and liquidity while maximizing the return on the investment portfolio

through the full investment of available funds. We diversify our investment portfolio by investing in multiple types of investment-grade securities

and through the use of third-party investment managers. Based on our investment portfolio and interest rates at February 3, 2006, a 100 basis

point increase or decrease in interest rates would result in a decrease or increase of approximately $60 million in the fair value of the

investment portfolio. Changes in interest rates may affect the fair value of the investment portfolio; however, unrealized gains or losses are not

recognized in net income unless the investments are sold or the loss is considered to be other than temporary.

Debt

We have entered into interest rate swap arrangements that convert our fixed interest rate expense to a floating rate basis to better align the

associated interest rate characteristics to our cash and investments portfolio. The interest rate swaps qualify for hedge accounting treatment

pursuant to SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities, as amended. We have designated the issuance of the

Senior Notes and Senior Debentures and the related interest rate swap agreements as an integrated transaction. The difference between our

carrying amounts and fair value of our long-term debt and related interest rate swaps was not material at February 3, 2006 and January 28,

2005. The differential to be paid or received on the interest rate swap agreements is accrued and recognized as an adjustment to interest

expense as interest rates change.

Risk Factors Affecting Dell's Business and Prospects

There are numerous risk factors that affect our business and the results of our operations. These risk factors include general economic and

business conditions; the level of demand for our products and services; the level and intensity of competition in the technology industry and the

pricing pressures that have resulted; our ability to timely and effectively manage periodic product transitions, as well as component availability

and cost; our ability to develop new products based on new or evolving technology and the market's acceptance of those products; our ability to

manage our inventory levels to minimize excess inventory, declining inventory values, and obsolescence; the product, customer, and

geographic sales mix of any particular period; our ability to effectively manage our operating costs; and the effect of armed hostilities, terrorism,

natural disasters, or public health issues on the economy generally, on the level of demand for our products and services, and on our ability to

manage our supply and delivery logistics in such an environment. For a discussion of these and other risk factors affecting Dell's business and

prospects, see "Item 1A — Risk Factors."

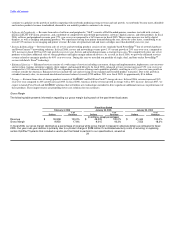

Critical Accounting Policies

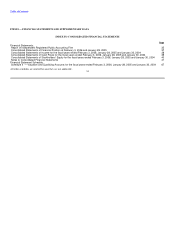

We prepare our financial statements in conformity with accounting principles generally accepted in the United States of America ("GAAP"). The

preparation of GAAP financial statements requires certain estimates, assumptions, and judgments to be made that may affect our consolidated

statement of financial position and results of operations. We believe our most critical accounting policies relate to revenue recognition, warranty

accruals, and income taxes. We have discussed the development, selection, and disclosure of our critical accounting policies with the Audit

Committee of Dell's Board of Directors. These critical accounting policies and our other accounting policies are described in Note 1 of "Notes to

Consolidated Financial Statements" included in "Item 8 — Financial Statements and Supplementary Data."

Revenue Recognition — Dell frequently enters into sales arrangements with customers that contain multiple elements or deliverables such as

hardware, software, peripherals, and services. Judgments and estimates are critical to ensure compliance with GAAP. These judgments relate

to the allocation of the proceeds received from an arrangement to the multiple elements, the determination of whether any undelivered

elements are essential to the functionality of the delivered elements, and

32