Dell 1999 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 1999 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

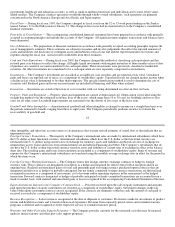

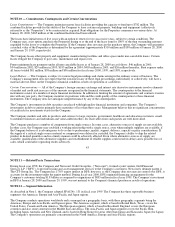

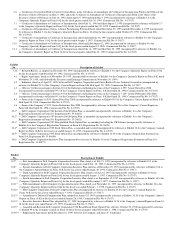

NOTE 10 — Commitments, Contingencies and Certain Concentrations

Lease Commitments — The Company maintains master lease facilities providing the capacity to fund up to $782 million. The

combined facilities provide for the ability of the Company to lease certain real property, buildings and equipment (collectively

referred to as the "Properties") to be constructed or acquired. Rent obligations for the Properties commence on various dates. At

January 28, 2000, $365 million of the combined facilities had been utilized.

The leases have initial terms of five years with an option to renew for two successive years, subject to certain conditions. The

Company may, at its option, purchase the Properties during or at the end of the lease term for 100% of the then outstanding amounts

expended by the lessor to complete the Properties. If the Company does not exercise the purchase option, the Company will guarantee

a residual value of the Properties as determined by the agreement (approximately $310 million and $189 million at January 28, 2000

and January 29, 1999, respectively).

The Company leases other property and equipment, manufacturing facilities and office space under non-cancelable leases. Certain

leases obligate the Company to pay taxes, maintenance and repair costs.

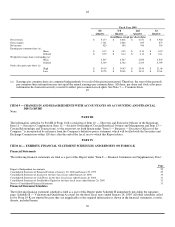

Future minimum lease payments under all non-cancelable leases as of January 28, 2000 are as follows: $46 million in 2001;

$34 million in 2002; $29 million in 2003; $183 million in 2004; $405 million in 2005; and $26 million thereafter. Rent expense under

all leases totaled $81 million, $58 million and $36 million for fiscal years 2000, 1999, and 1998, respectively.

Legal Matters — The Company is subject to various legal proceedings and claims arising in the ordinary course of business. The

Company's management does not expect that the outcome in any of these legal proceedings, individually or collectively, will have a

material adverse effect on the Company's financial condition, results of operations or cash flows.

Certain Concentrations — All of the Company's foreign currency exchange and interest rate derivative instruments involve elements

of market and credit risk in excess of the amounts recognized in the financial statements. The counterparties to the financial

instruments consist of a number of major financial institutions. In addition to limiting the amount of agreements and contracts it enters

into with any one party, the Company monitors its positions with and the credit quality of the counterparties to these financial

instruments. The Company does not anticipate nonperformance by any of the counterparties.

The Company's investments in debt securities are placed with high quality financial institutions and companies. The Company's

investments in debt securities primarily have maturities of less than three years. Management believes that no significant concentration

of credit risk for investments exists for the Company.

The Company markets and sells its products and services to large corporate, government, healthcare and education customers, small-

to-medium businesses and individuals and value-added resellers. Its receivables from such parties are well diversified.

The Company purchases a number of components from single sources. In some cases, alternative sources of supply are not available.

In other cases, the Company may establish a working relationship with a single source, even when multiple suppliers are available, if

the Company believes it is advantageous to do so due to performance, quality, support, delivery, capacity or price considerations. If

the supply of a critical single-source material or component were delayed or curtailed, the Company's ability to ship the related

product in desired quantities and in a timely manner could be adversely affected. Even where alternative sources of supply are

available, qualification of the alternative suppliers and establishment of reliable supplies could result in delays and a possible loss of

sales, which could affect operating results adversely.

43

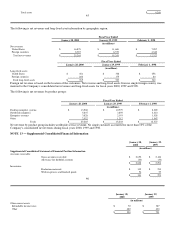

NOTE 11 — Related Party Transactions

During fiscal year 1998, the Company and Newcourt Credit Group Inc. ("Newcourt"), formed a joint venture, Dell Financial

Services L.P. ("DFS"), to provide leasing and asset management services to the Company's customers. Newcourt's ultimate parent is

The CIT Group, Inc. The Company has a 70% equity interest in DFS; however, as the Company does not exercise control over DFS, it

accounts for the investment under the equity method. During fiscal year 2000, DFS originated financing arrangements for the

Company's customers totaling $1.8 billion as compared to originations of $895 million in fiscal year 1999. The Company's investment

in DFS at January 28, 2000 and January 29, 1999, was not material to the Company's financial position or results of operations.

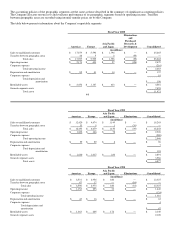

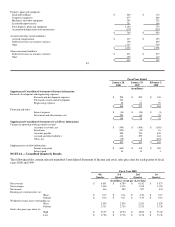

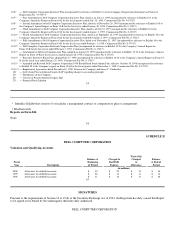

NOTE 12 — Segment Information

As described in Note 1, the Company adopted SFAS No. 131 in fiscal year 1999. The Company has three reportable business

segments: the Americas, Europe and Asia-Pacific and Japan regions.

The Company conducts operations worldwide and is managed on a geographic basis, with those geographic segments being the

Americas, Europe and Asia-Pacific and Japan regions. The Americas segment, which is based in Round Rock, Texas, covers the

United States, Canada and Latin America. The European segment, which is based in Bracknell, England, covers the European

countries and also some countries in the Middle East and Africa. The Asia-Pacific and Japan segment covers the Pacific Rim,

including Japan, Australia and New Zealand, and is based in Hong Kong (for areas other than Japan) and Kawasaki, Japan (for Japan).

The Company's operations are primarily concentrated in the North America, Europe and Asia-Pacific regions.