Dell 1999 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 1999 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

offerings. The Company is not aware of any material Year 2000 readiness issues associated with its hardware offerings. The Company

plans to continue to monitor the situation closely.

Although the Company attempted to ascertain the Year 2000 status of third party software and peripherals loaded on or distributed

with Company computer systems, it does not and cannot guarantee the Year 2000 status of any software or peripherals provided by

third parties.

Costs

The total costs of the Company's Year 2000 readiness program were not material to its financial condition or results of operation. All

costs were charged to expense as incurred, and did not include potential costs related to any customer issues or other claims or the cost

of internal software and hardware replaced in the normal course of business.

Risks/ Contingency Plans

Prior to the Year 2000 date change, the Company believed that the most likely worst-case scenarios would have involved the

interruption of crucial suppliers as a result of infrastructure failures or third party vendor failures. To date, no such interruptions or

failures have occurred. The Company currently believes that the likelihood of the occurrence of any such events due to the Year 2000

date change is low.

Recently Issued Accounting Pronouncements

In June 1998, the Financial Accounting Standards Board ("FASB") issued Statement of Financial Accounting Standards ("SFAS")

No. 133, "Accounting for Derivative Instruments and Hedging Activities." In June 1999, The FASB issued SFAS No. 137, in which it

agreed to defer for one year the implementation date of SFAS No. 133. See Note 1 of Notes to Consolidated Financial Statements

included in "Item 8 — Financial Statements and Supplementary Data."

In December 1999, the Securities and Exchange Commission issued Staff Accounting Bulletin No. 101, "Revenue Recognition in

Financial Statements." See Note 1 of Notes to Consolidated Financial Statements included in "Item 8 — Financial Statements and

Supplementary Data."

In March 2000, the Emerging Issues Task Force ("EITF") issued EITF Issue No. 00-7, Application of EITF Issue No. 96-13,

"Accounting for Derivative Financial Instruments Indexed to, and Potentially Settled in, a Company's Own Stock, to Equity

Derivative Transactions That Contain Certain Provisions That Require Cash Settlement If Certain Events Occur." See Note 1 of Notes

to Consolidated Financial Statements included in "Item 8 — Financial Statements and Supplementary Data."

ITEM 7A — QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Response to this item is included in "Item 7 — Management's Discussion and Analysis of Financial Condition and Results of

Operations — Market Risk."

26

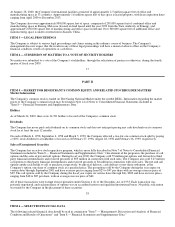

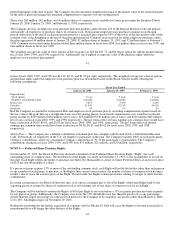

ITEM 8 — FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

Page

Financial Statements:

Report of Independent Accountants 28

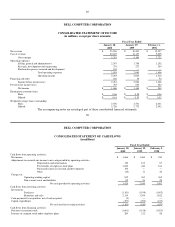

Consolidated Statement of Financial Position at January 28, 2000 and January 29, 1999 29

Consolidated Statement of Income for the three fiscal years ended January 28, 2000 30

Consolidated Statement of Cash Flows for the three fiscal years ended January 28, 2000 31

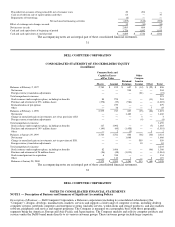

Consolidated Statement of Stockholders' Equity for the three fiscal years ended January 28, 2000 32

Notes to Consolidated Financial Statements 33

Financial Statement Schedule:

For the three fiscal years ended January 28, 2000

Schedule II — Valuation and Qualifying Accounts 55

All other schedules are omitted because they are not applicable.

27

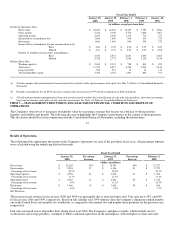

REPORT OF INDEPENDENT ACCOUNTANTS

To the Board of Directors and Stockholders of