Dell 1999 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 1999 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dell Computer Corporation

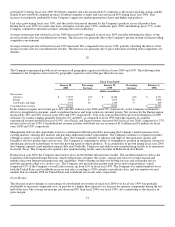

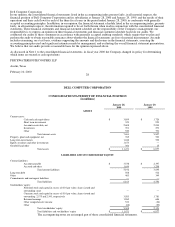

In our opinion, the consolidated financial statements listed in the accompanying index present fairly, in all material respects, the

financial position of Dell Computer Corporation and its subsidiaries at January 28, 2000 and January 29, 1999, and the results of their

operations and their cash flows for each of the three fiscal years in the period ended January 28, 2000, in conformity with generally

accepted accounting principles. In addition, in our opinion, the financial statement schedule listed in the accompanying index, presents

fairly, in all material respects, the information required to be set forth therein when read in conjunction with the consolidated financial

statements. These financial statements and financial statement schedule are the responsibility of the Company's management; our

responsibility is to express an opinion on these financial statements and financial statement schedule based on our audits. We

conducted our audits of these statements in accordance with generally accepted auditing standards, which require that we plan and

perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit

includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the

accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation.

We believe that our audits provide a reasonable basis for the opinion expressed above.

As discussed in Note 1 to the consolidated financial statements, in fiscal year 2000 the Company changed its policy for determining

which items are treated as cash equivalents.

PRICEWATERHOUSECOOPERS LLP

Austin, Texas

February 10, 2000

28

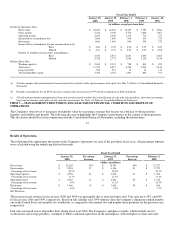

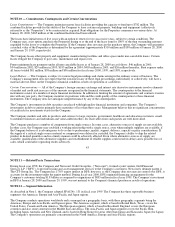

DELL COMPUTER CORPORATION

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(in millions)

January 28, January 29,

2000 1999

ASSETS

Current assets:

Cash and cash equivalents $ 3,809 $ 1,726

Short term investments 323 923

Accounts receivable, net 2,608 2,094

Inventories 391 273

Other 550 791

Total current assets 7,681 5,807

Property, plant and equipment, net 765 523

Long term investments 1,048 532

Equity securities and other investments 1,673 —

Goodwill and other 304 15

Total assets $ 11,471 $ 6,877

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities:

Accounts payable $ 3,538 $ 2,397

Accrued and other 1,654 1,298

Total current liabilities 5,192 3,695

Long term debt 508 512

Other 463 349

Commitments and contingent liabilities — —

Total liabilities 6,163 4,556

Stockholders' equity:

Preferred stock and capital in excess of $.01 par value; shares issued and

outstanding: none — —

Common stock and capital in excess of $.01 par value; shares issued and

outstanding: 2,575 and 2,543, respectively 3,583 1,781

Retained earnings 1,260 606

Other comprehensive income 533 (36)

Other (68) (30)

Total stockholders' equity 5,308 2,321

Total liabilities and stockholders' equity $ 11,471 $ 6,877

The accompanying notes are an integral part of these consolidated financial statements.