Dell 1999 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1999 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

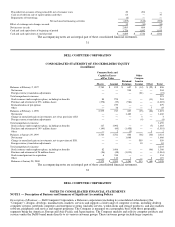

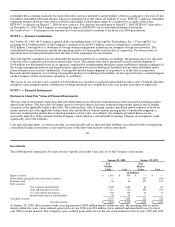

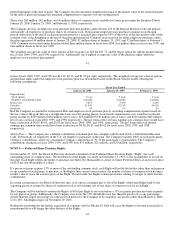

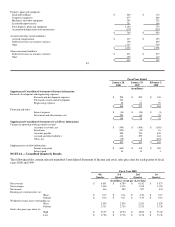

The components of the Company's net deferred tax asset are as follows:

Fiscal Year Ended

January 28, January 29, February 1,

2000 1999 1998

(in millions)

Deferred tax assets:

Deferred service contract revenue $ 125 $ 118 $ 124

Inventory and warranty provisions 60 45 24

Provisions for product returns and doubtful accounts 30 25 20

Loss carryforwards 219 — —

Credit carryforwards 101 — —

535 188 168

Deferred tax liabilities:

Unrealized gains on investments (303) (2) —

Other (74) (49) (62)

(377) (51) (62)

Gross and net deferred tax asset $ 158 $ 137 $ 106

Tax loss carryforwards will generally expire between 2018 and 2020. Credit carryforwards will generally expire between 2003 and

2020.

The effective tax rate differed from statutory U.S. federal income tax rate as follows:

Fiscal Year Ended

January 28, January 29, February 1,

2000 1999 1998

U.S. federal statutory rate 35.0 % 35.0 % 35.0 %

Foreign income taxed at different rates (6.0) (7.0) (4.6)

Nondeductible purchase of in-process technology 2.8 0.0 0.0

Other 0.2 2.0 0.6

Effective tax rates 32.0 % 30.0 % 31.0 %

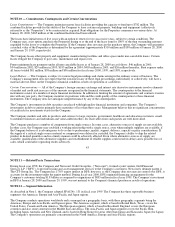

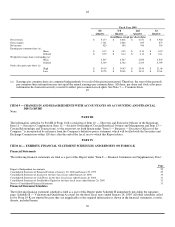

NOTE 5 — Financing Arrangements

The Company maintains a $250 million revolving credit facility, which expires in June 2002. Commitment fees for this facility are

payable quarterly and are based on specific liquidity requirements. Commitment fees paid in fiscal years 2000, 1999, and 1998 were

not material. At January 28, 2000 and January 29, 1999, this facility was unused.

NOTE 6 — Preferred Stock

Authorized Shares — The Company has the authority to issue five million shares of preferred stock, par value $.01 per share. At

January 28, 2000 and January 29, 1999, no shares of preferred stock were issued or outstanding.

Series A Junior Participating Preferred Stock — In conjunction with the distribution of Preferred Share Purchase Rights (see

Note 9 — Preferred Share Purchase Rights), the Company's Board of Directors designated 200,000 shares of preferred stock as

Series A Junior Participating Preferred Stock ("Junior Preferred Stock") and reserved such shares for issuance upon exercise of the

Preferred Share Purchase Rights. At January 28, 2000 and January 29, 1999, no shares of Junior Preferred Stock were issued or

outstanding.

39

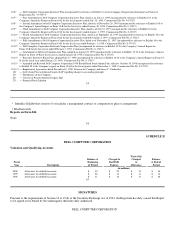

NOTE 7 — Common Stock

Authorized Shares — On July 16, 1999, the Company's stockholders approved an amendment to the Company's Certificate of

Incorporation to increase the number of shares of common stock, par value $.01 per share, that the Company is authorized to issue

from three billion to seven billion.

Stock Splits — On each of March 6, 1998, September 4, 1998 and March 5, 1999, the Company effected a two-for-one common stock

split by paying a 100% stock dividend to stockholders of record as of February 27, 1998, August 28, 1998 and February 26, 1999,

respectively. All share and per share information included in the accompanying consolidated financial statements and related notes has

been restated to reflect these stock splits.