ComEd 2001 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

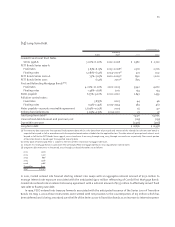

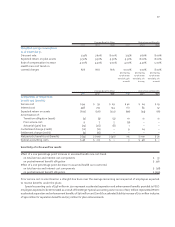

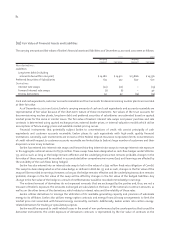

At December 31, 2001, the options outstanding, based on ranges of exercise prices, were as follows:

Options Outstanding Options Exercisable

Weighted

Average

Remaining Weighted Weighted

Contractual Average Average

Range of Number Life Exercise Number Exercise

Exercise Prices Outstanding (years) Price Exercisable Price

$10.01–$20.00 597,400 6.14 $ 19.68 597,400 $ 19.68

$20.01–$30.00 1,639,611 4.40 25.03 1,639,611 25.03

$30.01–$40.00 5,395,604 7.54 37.85 3,069,046 37.63

$40.01–$50.00 1,438,206 7.43 41.56 1,023,557 41.21

$50.01–$60.00 4,332,775 8.82 59.46 1,669,077 59.49

$60.01–$70.00 636,400 9.04 67.30 7,502 64.97

Total 14,039,996 8,006,193

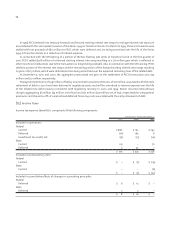

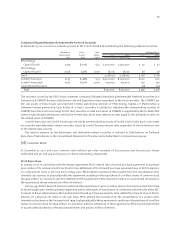

Under Exelon’s LTIP 195,725 shares and 120,300 shares of common stock awards were issued during 2000 and 1999,

respectively. Vesting for the common stock awards is over a period not to exceed 10 years from the grant date. Compensation

cost of $14 million associated with these awards is amortized to expense over the vesting period. The related accumulated

amortization was approximately $12 million, $7 million and $2 million at December 31, 2001, 2000 and 1999, respectively.

Additionally under Exelon’s LTIP, 426,794 and 159,129 Exelon common share awards were granted during 2001 and 2000,

respectively. Compensation cost of $30 million is to be accrued to expense over the vesting period of up to 5 years from the

date of the grant.The related accumulated amortization was approximately $17 million and $6 million at December 31, 2001

and 2000, respectively.

In June 2001, the Board of Directors of Exelon approved the Employee Stock Purchase Plan (ESPP).The purpose of the ESPP

is to provide employees of Exelon, and its subsidiary companies the right to purchase shares of Exelon’s common stock at

below-market prices. A total of 5,000,000 shares of Exelon’s common stock have been reserved for issuance under the ESPP.

Employees’ purchases are limited to no more than 125 shares per quarter and no more than $25,000 in fair market value in

any plan year. During 2001, employees purchased 137,648 shares of Exelon common stock under the ESPP.