ComEd 2001 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

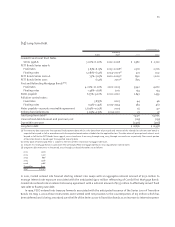

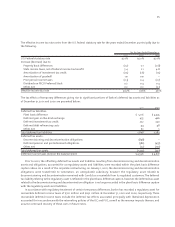

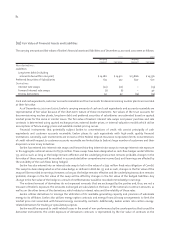

In 1998, PECO entered into treasury forwards and forward starting interest rate swaps to manage interest rate exposure

associated with the anticipated issuance of the Series 1999-A Transition Bonds. On March 18, 1999, these instruments were

settled with net proceeds of $80 million to PECO which were deferred and are being amortized over the life of the Series

1999-A Transition Bonds as a reduction of interest expense.

In connection with the refinancing of a portion of the two floating rate series of transition bonds in the first quarter of

2001, PECO settled $318 million of a forward starting interest rate swap resulting in a $6 million gain which is reflected in

other income and deductions due to the transaction no longer being probable. Also,in connection with the refinancing, PECO

settled a portion of the interest rate swaps and the remaining portion of the forward starting interest rate swaps resulting

in gains of $25 million, which were deferred and are being amortized over the expected remaining lives of the related debt.

At December 31, 2001 and 2000, the aggregate unamortized net gain on the settlement of PECO transactions was $55

million and $51 million, respectively.

Prepayment premiums of $39 million,offset by unamortized issuance premiums of $17 million,associated with the early

retirement of debt in 2001 have been deferred in regulatory assets and will be amortized to interest expense over the life

of the related new debt issuance consistent with regulatory recovery. In 2000 and 1999, Exelon incurred extraordinary

charges aggregating $6 million ($4 million, net of tax) and $62 million ($37 million, net of tax), respectively for prepayment

premiums and the write-offs of unamortized deferred financing costs associated with the early retirement of debt.

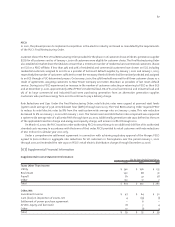

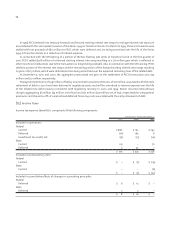

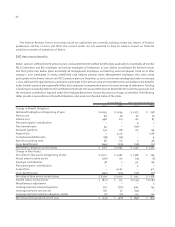

(15) Income Taxes

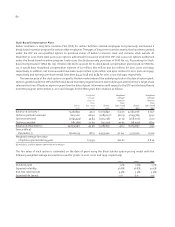

Income tax expense (benefit) is comprised of the following components:

For the Years Ended December 31,

2001 2000 1999

Included in operations:

Federal

Current $880 $ 163 $ 293

Deferred (61) 163 6

Investment tax credit, net (14) (15) (14)

State

Current 119 – 72

Deferred 730 1

$931 $ 341 $ 358

Included in extraordinary item:

Federal

Current $– $(2) $ (19)

State

Current ––(6)

$– $(2) $ (25)

Included in cumulative effects of changes in accounting principles:

Federal

Deferred $6 $13 $–

State

Deferred 23–

$8 $16 $–