ComEd 2001 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

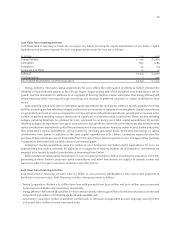

Unbilled Energy Revenues

Revenues related to the sale of energy are generally recorded when service is rendered or energy is delivered to customers.

However, the determination of the energy sales to individual customers is based on the reading of their meters which are

read on a systematic basis throughout the month. At the end of each month, amounts of energy delivered to customers

since the date of the last meter reading are estimated and the corresponding unbilled revenue is estimated. This unbilled

revenue is estimated each month based on daily generation volumes, estimated customer usage by class, line losses and

applicable customer rates based on regression analyses reflecting significant historical trends and experience. Customer

accounts receivable as of December 31, 2001 include unbilled energy revenues of $361 million.

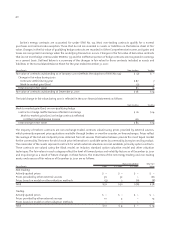

Contract Accounting

Enterprises recognizes contract revenue and profits on certain long-term fixed-price contracts by the percentage-of-completion

method of accounting. In determining the amount of revenue to recognize Exelon is required to estimate the total costs

and profits expected to be recorded under the contract over its contract term, and the recoverability of costs related to

change orders. Changes in these estimates could result in the recognition of differences in earnings.

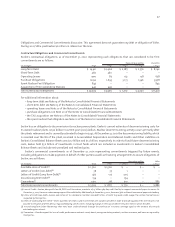

Environmental Costs

As of December 31, 2001 Exelon had accrued liabilities of $156 million for environmental investigation and remediation costs.The

liabilities are based upon estimates with respect to the number of sites for which Exelon will be responsible, the scope and cost

of work to be performed at each site, the portion of costs that will be shared with other parties and the timing of the remediation

work. Where timing and amounts of expenditures can be reliably estimated, amounts are discounted. Where timing and

amounts cannot be reliably estimated,a range is estimated and the low end of the range is recognized on an undiscounted basis.

Estimates can be affected by factors including future changes in technology, changes in regulations or requirements of local

governmental authorities and actual costs of disposal.

Outlook

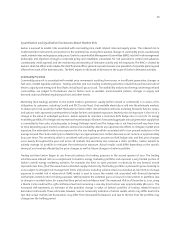

Changes in the Utility Industry

The electric utility industry in the United States remains in transition. It is moving from a fully regulated industry,

consisting primarily of integrated companies combining generation, transmission and distribution, to competitive

wholesale generation markets with continuing regulation of transmission and distribution. The transition has resulted in

substantial disposition of generating assets by formerly integrated companies, the creation of separate, and in some cases,

stand alone, generating companies and consolidation. During 2001, however, the pace of transition slowed. This slowdown

was due primarily to public and governmental reactions to issues associated with deregulation efforts in California and the

collapse of the wholesale electricity market in California.

At the Federal level, the FERC remains committed to the development of wholesale generation markets. Although its

proposal for the development of large regional transmission organizations (RTOs) to facilitate markets has been delayed, it

is planning an initiative to standardize wholesale markets in the United States. At the state level, concerns raised by the

California experiences have stalled new retail competition initiatives and slowed the separation of generation from

regulated transmission and distribution assets.

Exelon believes that the transition in the electric utility industry will continue, albeit at a slower pace than previously,

particularly at the state level.This slower transition will be reflected in reduced industry consolidation in the near term and

reduced disaggregation of regulated to unregulated services. These uncertainties may limit opportunities for Exelon to

pursue its plans to expand its generation portfolio.

Exelon also believes that competition for electric generation services has created new risks and uncertainties in the

industry. Some of these risks were clearly illustrated in California—the risks of inadequate generation, having load

obligations without owning generation, and price volatility.The situation in California also illustrated the need for additional

infrastructure to support competitive markets. The uncertainties include future prices of generation services in both the