ComEd 2001 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

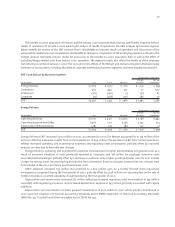

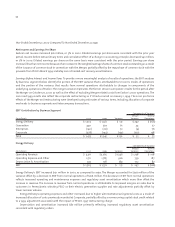

Generation’s EBIT increased $522 million for 2001 compared to 2000. The Merger accounted for $22 million of the variance.

The remaining $500 million increase resulted primarily from higher margins on market and affiliate wholesale energy sales,

coupled with decreased operating costs at the nuclear plants, partially offset by additional depreciation and amortization.

During the first five months of 2001, Generation benefited from increases in wholesale market prices, particularly in the

Pennsylvania-New Jersey-Maryland control area and Mid-America Interconnected Network regions.The increase in wholesale

market prices was primarily driven by significant increases in fossil fuel prices. The large concentration of nuclear generation

in the Generation portfolio allowed Exelon to capture the higher prices in the wholesale market for sales to non-affiliates

with minimal increase in fuel prices. Generation revenues for 2001 include charges to affiliates for line losses. Line loss

charges were not included in pro forma 2000 revenue. Generation also benefited from higher nuclear plant output due to

increased capacity factors during 2001. Energy marketing activities positively impacted 2001 results. Mark-to-market gains

were $16 million and $14 million on non-trading and trading energy contracts, respectively offset by realized trading losses of

$6 million. Lower operating costs are attributable to reductions in the number of employees and fewer nuclear outages in

2001 than in 2000, which offset the effect of increases in reserves related to litigation of $30 million. In addition, Generation’s

EBIT benefited from an increase in equity in earnings of AmerGen and Sithe of $90 million in 2001 compared to the prior year

period as a result of acquisitions in 2000. The increase in depreciation and amortization expense primarily reflects an

increase in decommissioning expense of $140 million reflecting the discontinuance of regulatory accounting practices for

certain nuclear generating stations,partially offset by a $90 million reduction in depreciation and decommissioning expense

attributable to the extension of estimated service lives of Generation’s generating plants.

For 2001, Generation’s sales were 201,879 GWhs, approximately 60% of which were to affiliates.

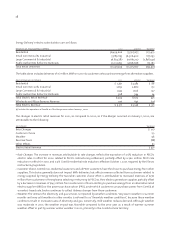

Supply sources were as follows:

Nuclear units 54%

Purchases 37%

Fossil and hydro units 3%

Generation investments 6%

Total 100%

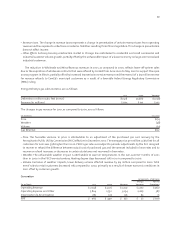

Generation’s nuclear fleet, including AmerGen, performed at a weighted average capacity factor of 94.4% for 2001

compared to 93.8% in 2000. Generation’s nuclear fleet’s production costs, including AmerGen, were $12.79 per MWh for

2001, compared to $14.65 per MWh for 2000.

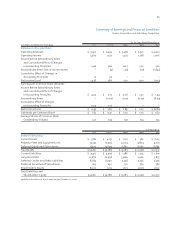

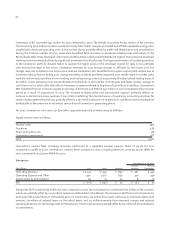

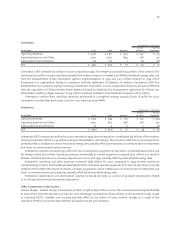

Enterprises

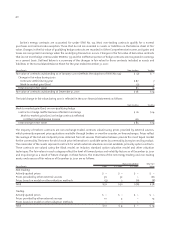

Components of Variance

Merger Normal

(in millions) 2001 2000 Variance Variance Operations

Operating Revenue $ 2,292 $ 1,395 $ 897 $ 467 $ 430

Operating Expense and Other 2,330 1,500 830 491 339

Depreciation & Amortization 69 35 34 8 26

EBIT $ (107) $ (140) $ 33 $ (32) $ 65

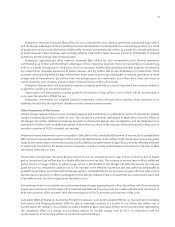

Enterprises’ EBIT increased $33 million for 2001 compared to 2000. Normal operations contributed $65 million of the variance,

which was partially offset by a $32 million reduction attributable to the Merger. The increase in EBIT from normal operations

primarily reflects $27 million of net realized gains on investments, $23 million from lower net losses in communications joint

ventures, $21 million of reduced losses on the sale of assets, and $15 million primarily from improved margins and reduced

operating expenses of retail energy sales in Pennsylvania.These increases were partially offset by $13 million of net writedowns

on investments.