ComEd 2001 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

wholesale and retail markets, supply and demand volatility, and changes in customer profiles that may impact margins on

various electric service offerings. These uncertainties create additional risk for participants in the industry, including Exelon,

and may result in increased volatility in operating results from year to year.

Energy Delivery

Exelon believes that its energy delivery business will provide a significant and steady source of earnings for investment in

growth opportunities. Exelon’s primary goals for its energy delivery companies, ComEd and PECO, are to deliver reliable

service, to improve customer service and to sustain productive regulatory relationships. Achieving these goals is expected

to maximize the value of Exelon’s energy delivery assets.

Under restructuring regulations adopted at the Federal and state levels, the role of electric utilities in the supply and delivery

of energy is changing. Energy Delivery continues to be obligated to provide reliable delivery systems under cost-based rates. It

remains obligated, as a provider of last resort, to supply generation service during the transition period to a competitive supply

marketplace to customers who do not or cannot choose an alternate supplier. Retail competition for generation services has

resulted in reduced revenues from regulated rates and the sale of increasing amounts of energy at market-based rates.

Energy Delivery’s revenues will be affected by rate reductions and rate freezes currently in effect at ComEd and PECO. The

rate freezes limit Energy Delivery’s ability to recover increased expenses and the costs of investments in new transmission and

distribution facilities through rates. As a result, Energy Delivery’s future results of operations will be dependent on its ability:

– to deliver electricity and, in the case of PECO, gas, to its customers cost-effectively, particularly in light of the current caps

on rates and ComEd capital expenditure requirements,

– to realize cost savings from the Merger and synergies to offset increased costs on new investments and inflation while its

delivery rates are capped and,

– to manage its provider of last resort responsibilities.

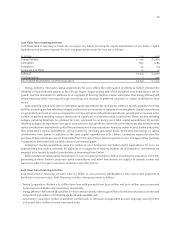

ComEd’s results of operations will be affected by a legislatively mandated 5% residential base rate reduction that became

effective in October 2001, a base rate freeze that will remain generally effective until at least January 1, 2005 and the collection of

transition charges through at least 2006. PECO’s results of operations will be affected by agreed-upon rate reductions of $200

million,in aggregate,for the period 2002 through 2005 and caps (subject to limited exceptions for significant increases in Federal

or state taxes or other significant changes in law or regulation that do not allow PECO to earn a fair rate of return) on its

transmission and distribution rates through December 31, 2006 as a result of settlements previously reached with the PUC.

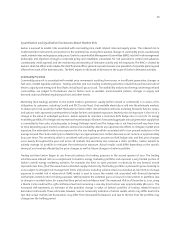

ComEd’s obligations to make capital expenditures, combined with the rate freeze, could affect its earnings during the rate

freeze period. ComEd is obligated to make capital expenditures with respect to its transmission and distribution system,

including defined projects within the City of Chicago (City) as a result of a settlement agreement with the City and at least

$2 billion during the period 1999 through 2004 on transmission and distribution facilities outside of the City as a result of

Illinois legislation. Given ComEd’s commitments to improve the reliability of its transmission and distribution system,ComEd

expects that its capital expenditures will exceed depreciation on its rate base assets through at least 2002. The base rate

freeze will generally preclude rate recovery on and of those investments prior to January 1, 2005. Unless ComEd can offset the

additional carrying costs against cost savings, its return on investment may be reduced during the period of the rate freeze

and until rate increases are approved authorizing a return of and on this new investment.

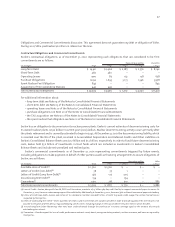

PECO’s results will be affected by annual increases in amortization of its stranded cost recovery through 2010. PECO has

been authorized to recover stranded costs of $5.3 billion ($4.9 billion of unamortized costs at December 31, 2001) over a twelve-

year period ending December 31, 2010 with a return on the unamortized balance of 10.75%. In 2001, revenue attributable to

stranded cost recovery was $797 million and is scheduled to increase to $932 million by 2010, the final year of stranded cost

recovery. Amortization of PECO’s stranded cost recovery, which is a regulatory asset, is included in depreciation and

amortization. The amortization expense for 2001 was $271 million and will increase to $879 million by 2010.

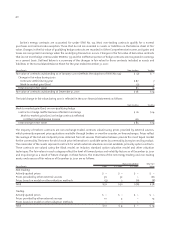

A substantial portion of Energy Delivery’s customers have the right to choose their electricity suppliers. All of ComEd’s

non-residential customers have this right, and all of its residential customers will have this right as of May 1, 2002. All of

PECO’s retail customers have this right. At December 31, 2001, approximately 21% of ComEd’s small commercial and