ComEd 2001 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

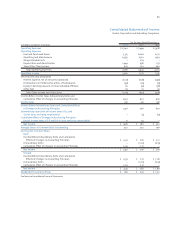

53

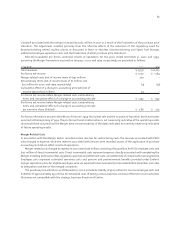

Consolidated Statements of Income

Exelon Corporation and Subsidiary Companies

For the Years Ended December 31,

in millions, except per share data 2001 2000 1999

Operating Revenues $ 15,140 $ 7,499 $ 5,478

Operating Expenses

Fuel and Purchased Power 5,313 2,606 2,152

Operating and Maintenance 4,393 2,310 1,454

Merger-Related Costs –276 –

Depreciation and Amortization 1,449 458 237

Taxes Other Than Income 623 322 262

Total Operating Expenses 11,778 5,972 4,105

Operating Income 3,362 1,527 1,373

Other Income and Deductions

Interest Expense, net of amounts capitalized (1,107) (608) (396)

Distributions on Preferred Securities of Subsidiaries (49) (24) (33)

Equity in Earnings (Losses) of Unconsolidated Affiliates 62 (41) (38)

Other, Net 79 53 59

Total Other Income and Deductions (1,015) (620) (408)

Income Before Income Taxes, Extraordinary Items and

Cumulative Effect of Changes in Accounting Principles 2,347 907 965

Income Taxes 931 341 358

Income Before Extraordinary Items and Cumulative Effects

of Changes in Accounting Principles 1,416 566 607

Extraordinary Items (net of income taxes of $2, and

$25 for 2000, and 1999, respectively) –(4) (37)

Cumulative Effect of Changes in Accounting Principles

(net of income taxes of $ 8 and $16 in 2001 and 2000, respectively) 12 24 –

Net Income $1,428 $ 586 $ 570

Average Shares of Common Stock Outstanding 320 202 196

Earnings Per Common Share:

Basic:

Income Before Extraordinary Items and Cumulative

Effects of Changes in Accounting Principles $ 4.42 $ 2.81 $ 3.10

Extraordinary Items –(0.02) (0.19)

Cumulative Effect of Changes in Accounting Principles 0.04 0.12 –

Net Income $4.46$2.91 $ 2.91

Diluted:

Income Before Extraordinary Items and Cumulative

Effects of Changes in Accounting Principles $ 4.39 $ 2.77 $ 3.08

Extraordinary Items –(0.02) (0.19)

Cumulative Effect of Changes in Accounting Principles 0.04 0.12 –

Net Income $4.43$2.87 $ 2.89

Dividends Per Common Share $1.82 $ 0.91 $ 1.00

See Notes to Consolidated Financial Statements