ComEd 2001 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

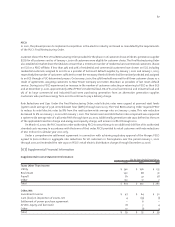

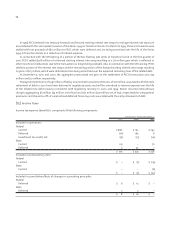

(05) Accounting Changes

On January 1, 2001, Exelon recognized a non-cash gain of $12 million, net of income taxes, in earnings and deferred a non-

cash gain of $44 million, net of income taxes, in Accumulated Other Comprehensive Income, a component of shareholders’

equity, to reflect the adoption of SFAS No. 133, as amended.

During the fourth quarter of 2000, as a result of the synchronization of accounting policies with Unicom in connection

with the Merger, PECO changed its method of accounting for nuclear outage costs to record such costs as incurred.

Previously, PECO accrued these costs over the operating unit cycle. As a result of the change in accounting method for

nuclear outage costs, PECO recorded income of $24 million, net of income taxes of $16 million. The change is reported as a

cumulative effect of a change in accounting principle on the Consolidated Statements of Income as of December 31, 2000,

representing the balance of the nuclear outage cost reserve at January 1, 2000.

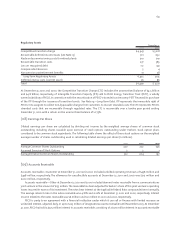

(06) Regulatory Issues

ComEd

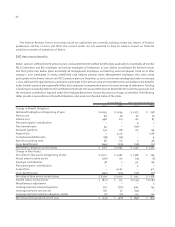

In 2001, the phased process to implement competition in the electric industry continued as mandated by the requirements

of the Illinois restructuring legislation.

Customer Choice As of December 31, 2001, all non-residential customers were eligible to choose a new electric supplier or elect

the power purchase option which allows the purchase of electric energy from ComEd at market-based prices. ComEd’s

residential customers become eligible to choose a new electric supplier in May 2002. As of December 31, 2001, approximately

18,700 non-residential customers, representing approximately 22% of ComEd’s annual retail kilowatt-hour sales, had elected

to purchase their electric energy from an alternate electric supplier or had chosen the power purchase option. Customers

who receive energy from an alternative supplier continue to pay a delivery charge. ComEd is unable to predict the long term

impact of customer choice on results of operations.

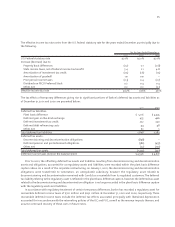

Rate Reductions and Return on Common Equity Threshold The Illinois restructuring legislation provided a 15% residential

base rate reduction effective August 1, 1998 with an additional 5% residential base rate reduction effective October 1, 2001.

ComEd’s operating revenues were reduced by approximately $24 million in 2001 due to the 5% residential rate reduction.

Notwithstanding the rate reductions and subject to certain earnings tests, a rate freeze is generally in effect until at least

January 1, 2005. A utility may request a rate increase during the rate freeze period only when necessary to ensure the

utility’s financial viability. Under the Illinois legislation, if the earned return on common equity of a utility during this period

exceeds an established threshold, one-half of the excess earnings must be refunded to customers. The threshold rate of

return on common equity is based on the 30-Year Treasury Bond rate plus 8.5% in the years 2000 through 2004. Earnings

for purposes of ComEd’s threshold include ComEd’s net income calculated in accordance with GAAP and reflect the

amortization of regulatory assets and goodwill. As a result of the Illinois legislation, at December 31, 2001, ComEd had a

regulatory asset with an unamortized balance of $277 million that it expects to fully recover and amortize by the end

of 2004. Consistent with the provisions of the Illinois legislation, regulatory assets may be recovered at amounts that

provide ComEd an earned return on common equity within the Illinois legislation earnings threshold.The earned return on

common equity and the threshold return on common equity for ComEd are each calculated on a two-year average basis.

ComEd did not trigger the earnings sharing provision in 2000 or 2001 and does not currently expect to trigger the earnings

sharing provisions in the years 2002 through 2004.