ComEd 2001 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

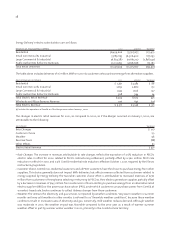

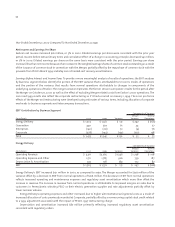

Year Ended December 31, 2000 Compared To Year Ended December 31,1999

Net Income and Earnings Per Share

Exelon’s net income increased $16 million, or 3% in 2000. Diluted earnings per share were consistent with the prior year

period. Income before extraordinary items and cumulative effect of a change in accounting principle, decreased $41 million,

or 7% in 2000. Diluted earnings per share on the same basis were consistent with the prior period. Earnings per share

increased less than net income because of an increase in the weighted average shares of common stock outstanding as a result

of the issuance of common stock in connection with the Merger, partially offset by the repurchase of common stock with the

proceeds from PECO’s March 1999 and May 2000 stranded cost recovery securitizations.

Earnings Before Interest and Income Taxes To provide a more meaningful analysis of results of operations, the EBIT analyses

by business segment below identify the portion of the EBIT variance that is attributable to Unicom’s results of operations

and the portion of the variance that results from normal operations attributable to changes in components of the

underlying operations of Exelon.The merger variance represents the former Unicom companies’ results for the period after

the Merger on October 20, 2000 as well as the effect of excluding Merger-related costs from Exelon’s 2000 operations. The

2000 and 1999 results also reflect the corporate restructuring as if it had occurred on January 1, 1999. The 2000 pro forma

effects of the Merger and restructuring were developed using estimates of various items, including allocation of corporate

overheads to business segments and intercompany transactions.

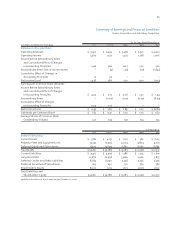

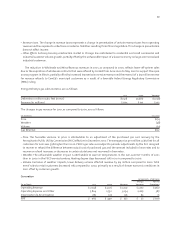

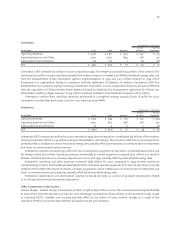

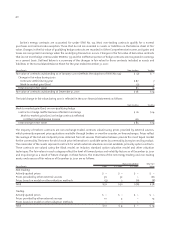

EBIT Contribution by Business Segment

Components of Variance

Merger Normal

(in millions) 2000 1999 Variance Variance Operations

Energy Delivery $ 1,503 $ 1,372 $ 131 $ 297 $ (166)

Generation 440 379 61 34 27

Enterprises (140) (212) 72 (4) 76

Corporate (328) (194) (134) (272) 138

Total $ 1,475 $ 1,345 $ 130 $ 55 $ 75

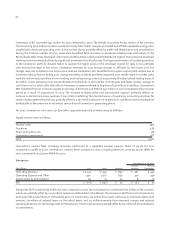

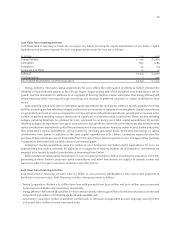

Energy Delivery

Components of Variance

Merger Normal

(in millions) 2000 1999 Variance Variance Operations

Operating Revenue $ 4,511 $3,265 $ 1,246 $ 1,138 $ 108

Operating Expense and Other 2,711 1,785 926 739 187

Depreciation & Amortization 297 108 189 102 87

EBIT $ 1,503 $ 1,372 $ 131 $ 297 $ (166)

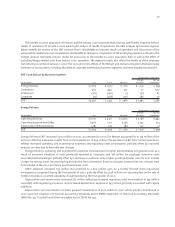

Energy Delivery’s EBIT increased $131 million in 2000, as compared to 1999. The Merger accounted for $297 million of the

variance offset by a decrease in EBIT from normal operations of $166 million. The decrease in EBIT from normal operations

reflects increased operating and maintenance expenses and regulatory asset amortization which more than offset the

increase in revenue. The increase in revenue from normal operations is attributable to improved margins on sales due to

customers in Pennsylvania selecting PECO as their electric generation supplier and rate adjustments partially offset by

lower summer volume.

Energy Delivery’s operating expenses and other increased due to higher administrative and general costs as a result of

increased allocation of costs previously recorded at Corporate, partially offset by a nonrecurring capital stock credit related

to a 1999 adjustment associated with the impact of PECO’s 1997 restructuring charge.

Depreciation and amortization increased $87 million primarily reflecting increased regulatory asset amortization

consistent with regulatory orders.