ComEd 2001 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

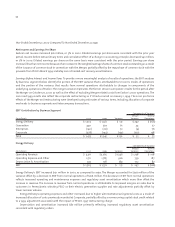

The aggregate fair value exposure of the interest rate swaps that would have resulted from a hypothetical 50 basis point

decrease in the spot yield at December 31, 2001 is estimated to be $34 million. If these derivative instruments had been

terminated at December 31, 2001, this estimated fair value represents the amount that would be paid by Exelon to the

counterparties.

The aggregate fair value exposure of the interest rate swaps that would have resulted from a hypothetical 50 basis

point increase in the spot yield at December 31, 2001 is estimated to be $11 million. If these derivative instruments

had been terminated at December 31, 2001, this estimated fair value represents the amount to be paid by Exelon to the

counterparties.

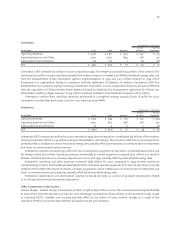

Equity Price Risk

Exelon maintains trust funds, as required by the Nuclear Regulatory Commission (NRC), to fund certain costs of

decommissioning its nuclear plants. As of December 31, 2001, these funds are reflected at fair value on Exelon’s Consolidated

Balance Sheets.The mix of securities is designed to provide returns to be used to fund decommissioning and to compensate

for inflationary increases in decommissioning costs. However, the equity securities in the trusts are exposed to price

fluctuations in equity markets, and the value of fixed rate, fixed income securities are exposed to changes in interest rates.

Exelon actively monitors the investment performance and periodically reviews asset allocation in accordance with Exelon’s

nuclear decommissioning trust fund investment policy. A hypothetical 10% increase in interest rates and decrease in equity

prices would result in a $204 million reduction in the fair value of the trust assets.

Critical Accounting Policies

The preparation of financial statements in conformity with Generally Accepted Accounting Principles requires that

management apply accounting policies and make estimates and assumptions that affect results of operations and the

reported amounts of assets and liabilities in the financial statements. The following areas represent those that

management believes are particularly important to the financial statements and that require the use of estimates and

assumptions to describe matters that are inherently uncertain:

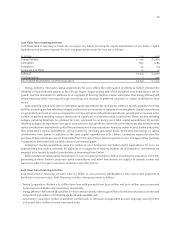

Accounting for Derivative Instruments

Exelon uses derivative financial instruments primarily to manage its commodity price and interest rate risks. Derivative

financial instruments are accounted for under SFAS No. 133. Accounting for derivatives continues to evolve through

guidance issued by the Derivatives Implementation Group (DIG) of the Financial Accounting Standards Board.To the extent

that changes by the DIG modify current guidance, including the normal purchases and normal sales determination, the

accounting treatment for derivatives may change.

Energy Contracts To manage its utilization of generation supply (including owned and contracted assets), Exelon enters into

contracts to purchase or sell electricity, fossil fuels, and ancillary products such as transmission rights and congestion

credits, and emission allowances. These energy marketing contracts are considered derivatives under SFAS 133 unless a

determination is made that they qualify for a SFAS No. 133 normal purchases and normal sales exclusion. If the exclusion

applies, those contracts are not marked-to-market and are not reflected in the financial statements until delivery occurs.

The availability of the normal purchases and normal sales exclusion to specific contracts is based on a determination

that excess generation is available for a forward sale and similarly a determination that at certain times generation supply

will be insufficient to serve load. This determination is based on internal models that forecast customer demand and

generation supply. The models include assumptions regarding customer load growth rates, which are influenced by the

economy, weather and the impact of customer choice, and generating unit availability, particularly nuclear generating unit

capability factors.The critical assumptions used in the determination of normal purchases and normal sales are consistent

with assumptions used in the general corporate planning process.