ComEd 2001 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

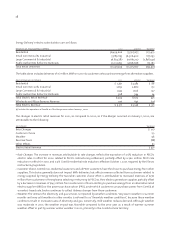

Off Balance Sheet Obligations

Generation owns 49.9% of the outstanding common stock of Sithe and has an option, beginning on December 18, 2002, to

purchase the remaining common stock outstanding (Remaining Interest) in Sithe.The purchase option expires on December

18, 2005. In addition, the Sithe stockholders who own in the aggregate the Remaining Interest have the right to require

Generation to purchase the Remaining Interest (Put Rights) during the same period in which Generation can exercise its

purchase option. At the end of this exercise period, if Generation has not exercised its purchase option and the other Sithe

stockholders have not exercised their Put Rights, Generation will have an additional one-time option to purchase shares from

the other stockholders in Sithe to bring Generation’s ownership in Sithe from the current 49.9% to 50.1% of Sithe’s total

outstanding common stock.

If Generation exercises its option to acquire the Remaining Interest, or if all the other Sithe stockholders exercise their

Put Rights, the purchase price for 70% of the Remaining Interest will be set at fair market value subject to a floor of $430

million and a ceiling of $650 million. The balance of the Remaining Interest will be valued at fair market value without

being subject to floor or ceiling prices. In either instance, interest shall accrue from the beginning of the exercise period.

If Generation increases its ownership in Sithe to 50.1% or more, Sithe will become a consolidated subsidiary and Exelon’s

financial results will include Sithe’s financial results from the date of purchase. At December 31, 2001, Sithe had total assets

of $4.2 billion and long-term debt of $2.3 billion, including $2.1 billion of non-recourse project debt, and excluding $107

million of non-recourse project debt associated with Sithe’s equity investments. For the year ended December 31, 2001 Sithe

had revenues of $1 billion. As of December 31, 2001 Exelon had a $725 million equity investment in Sithe.

Additionally, the debt on the books of Exelon’s unconsolidated equity investments and joint ventures is not reflected on

Exelon’s Consolidated Balance Sheets. Total investee debt, including the debt of Sithe described in the preceding paragraph,

is currently estimated to be $2.4 billion ($1.2 billion based on Exelon’s ownership interest of the investments).

Generation and British Energy, Generation’s joint venture partner in AmerGen, have each agreed to provide up to $100

million to AmerGen at any time for operating expenses.

Other Factors

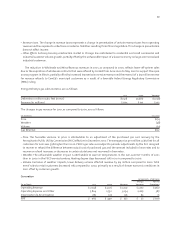

In 2001, Exelon adopted a cash balance pension plan. All management and electing union employees who joined Exelon or

one of its participating subsidiaries during 2001 became participants in the plan. Management employees who were active

participants in Exelon’s previous qualified defined benefit plans at December 31, 2000 and are employed by Exelon on

January 1, 2002 will be given a choice to convert to the cash balance plan. Participants in the cash balance plan, unlike

participants in the other defined benefit plans, may request a lump-sum cash payment upon employee termination which

may result in increased cash requirements from pension plan assets. Exelon may be required to increase future funding to

the pension plan as a result of these increased cash requirements.

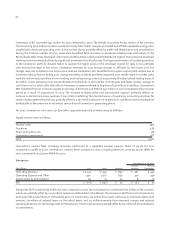

Due to the performance of the United States debt and equity markets in 2001, the value of assets held in trusts to satisfy

the obligations of pension and postretirement benefit plans and the eventual nuclear generating station decommissioning

has decreased. Also, as a result of the Merger and corporate restructuring, there was a larger than average number of

employees taking advantage of retirement benefits in 2001. These factors may also result in additional future funding

requirements of the pension and postretirement benefit plans. Contributions to the nuclear decommissioning trust funds of

$112 million offset net losses of $109 million, resulting in a 2% increase in the decommissioning trust funds balance at

December 31, 2001 compared to December 31, 2000. Exelon believes that the amounts being recovered from customers through

electric rates along with the earnings on the trust funds will be sufficient to fund its decommissioning obligations. For

additional information about nuclear decommissioning see Notes 1 and 12 of the Notes to Consolidated Financial Statements.