Columbia Sportswear 2000 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2000 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

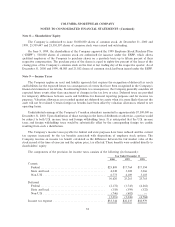

If the Company had accounted for the Plan in accordance with SFAS No. 123, the Company's net

income and earnings per share would approximate the pro forma disclosures below (in thousands, except per

share amounts):

2000 1999 1998

As Reported Proforma As Reported Proforma As Reported Proforma

Net income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $58,611 $56,435 $33,008 $31,878 $32,744 $32,030

Net income per share Ì basic ÏÏÏÏÏÏÏÏ $ 2.28 $ 2.20 $ 1.30 $ 1.26 $ 1.38 $ 1.35

Net income per share Ì dilutedÏÏÏÏÏÏÏ $ 2.22 $ 2.14 $ 1.29 $ 1.24 $ 1.36 $ 1.33

The eÅects of applying SFAS No. 123 in this pro forma disclosure are not indicative of future amounts.

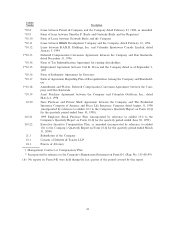

The following table summarizes information about stock options outstanding at December 31, 2000:

Options Outstanding

Options Exercisable

Weighted Average

Remaining Number of

Range of Number Contractual Weighted Average Shares Weighted Average

Exercise Prices Outstanding Life (yrs) Exercise Price Exercisable Exercise Price

$ 9.68 Ó 14.50 516,838 7.12 $10.93 212,441 $10.53

$ 15.20 Ó 19.63 712,680 8.02 18.64 230,175 18.77

$ 23.56 Ó 27.19 343,014 9.40 26.07 32,119 25.79

$ 34.06 Ó 43.31 10,750 9.87 34.71 24 43.31

$ 9.68 Ó 43.31 1,583,282 8.04 $17.84 474,759 $15.56

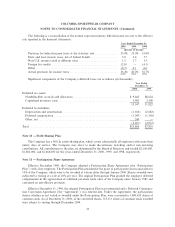

Note 14 Ì Segment Information

The Company operates predominantly in one industry segment: the design, production, marketing and

selling of active outdoor apparel, including outerwear, sportswear, rugged footwear and related accessories.

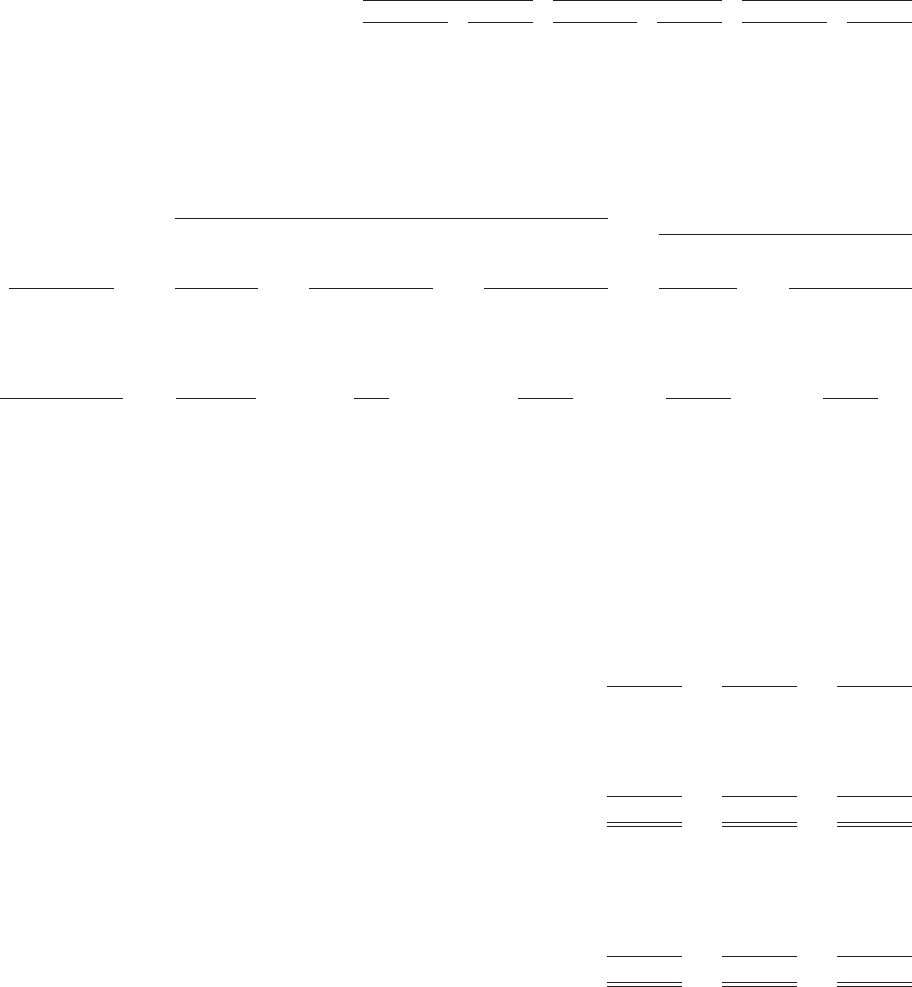

The geographic distribution of the Company's net sales, income before income tax, identiÑable assets,

interest expense, and depreciation and amortization expense are summarized in the following table (in

thousands) for the years ended December 31, 2000, 1999 and 1998. Inter-geographic net sales, which are

recorded at a negotiated mark-up and eliminated in consolidation, are not material.

2000 1999 1998

Net sales to unrelated entities:

United StatesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $438,854 $341,583 $335,897

Canada ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 63,117 50,428 38,782

Other International ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 112,854 78,492 52,599

$614,825 $470,503 $427,278

Income (loss) before income tax:

United StatesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 77,296 $ 50,014 $ 50,132

Canada ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 11,977 8,074 7,370

Other International ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5,371 3,887 (189)

Less interest and other income (expense) and eliminations ÏÏÏÏÏÏ (2,489) (6,732) (5,590)

$ 92,155 $ 55,243 $ 51,723

36