Columbia Sportswear 2000 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2000 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COLUMBIA SPORTSWEAR COMPANY

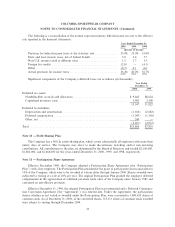

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

estimated useful lives of the assets, ranging from 3 to 10 years. Buildings are depreciated using the straight-

line method over 30 years.

Intangibles and other assets:

In September 2000, the Company acquired the Sorel trademark rights, associated brand names and other

related intellectual property rights for $7,967,000 in cash. The acquired intangible assets are being amortized

over their estimated useful lives on a straight-line basis over ten years. The related accumulated amortization

was $199,000 at December 31, 2000.

Goodwill is being amortized on a straight-line basis over eight years. Goodwill of $660,000 and $979,000,

net of accumulated amortization of $345,000 and $1,917,000, is included in intangibles and other assets for

2000 and 1999, respectively.

Impairment of long-lived and intangible assets:

The Company evaluates the carrying value of long-lived assets for possible impairment as events or

changes arise indicating that such assets should be reviewed. If an asset is determined to be impaired, the loss

is measured as the amount by which the carrying value of the asset exceeds its fair value. Fair value is based

on the best information available, including prices for similar assets or the results of valuation techniques. The

Company has determined that its long-lived assets as of December 31, 2000 and 1999 are not impaired.

Income taxes:

Deferred income taxes are provided to recognize the eÅect of temporary diÅerences between tax and

Ñnancial statement reporting.

Prior to its initial public oÅering of common stock on April 1, 1998, the Company elected to be treated as

an ""S'' corporation under provisions of the Internal Revenue Code of 1986. Accordingly, payment of federal

and most state taxes on income earned in the United States was the responsibility of the shareholders rather

than the Company.

Just prior to the initial public oÅering, the Company terminated its ""S'' corporation status. The Company

retained the tax basis of the assets and liabilities of the ""S'' corporation as of the termination date and

recorded deferred income taxes of approximately $2,000,000 for the income tax eÅect of cumulative

temporary diÅerences.

In connection with the oÅerings and the termination of the Company's ""S'' corporation status, the

Company entered into a tax indemniÑcation agreement with each of its shareholders, including Gertrude

Boyle, Timothy P. Boyle, Sarah Bany, Don Santorufo and certain trusts. The agreements provide that the

Company will indemnify and hold harmless each of these shareholders for federal, state, local or foreign

income tax liabilities and costs relating thereto, resulting from any adjustment to the Company's income that

is the result of an increase or change in character of the Company's income during the period it was treated as

an ""S'' corporation. The agreements also provide that if there is a determination that the Company was not an

""S'' corporation prior to the OÅerings, the shareholders will pay to the Company certain refunds actually

received by them as a result of the determination.

Foreign currency translation:

The assets and liabilities of the Company's foreign subsidiaries have been translated into U.S. dollars

using the exchange rates in eÅect at period end, and the net sales and expenses have been translated into U.S.

dollars using the average exchange rates in eÅect during the period. The foreign currency translation

28