Columbia Sportswear 2000 Annual Report Download - page 32

Download and view the complete annual report

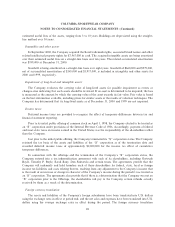

Please find page 32 of the 2000 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our Success Depends on our Proprietary Rights

We believe our registered and common law trademarks have signiÑcant value and are important to our

ability to create and sustain demand for our products. We also place signiÑcant value on our trade dress, the

overall appearance and image of our products. In markets outside the United States, it may be more diÇcult

for us to establish our proprietary rights and to challenge successfully use of those rights by other parties. We

will also face additional challenges as we extend our brand into new product categories, in part through our

licensing program. Although we have not been materially inhibited from selling products in connection with

trademark or trade dress disputes, we could encounter more obstacles as we expand our product line and the

geographic scope of our marketing. From time to time, we discover products that are counterfeit reproductions

of our products or trade dress ""knock oÅs.'' If we are unsuccessful in challenging a party's products on the

basis of trademark or trade dress infringement, continued sales of these products could adversely impact our

sales and our brand and result in the shift of consumer preference away from our products. The actions we

take to establish and protect trademarks and other proprietary rights may not be adequate to prevent imitation

of our products by others or to prevent others from seeking to block sales of our products as violations of

proprietary rights. In addition, we could incur substantial costs in legal actions relating to our use of

intellectual property or the use of our intellectual property rights by others.

Our Business Is AÅected by Seasonality and Fluctuations in Operating Results

Our results of operations have Öuctuated and are likely to Öuctuate signiÑcantly from period to period.

Our products are marketed on a seasonal basis, with a product mix now weighted substantially toward the fall

season. Our results of operations for the quarter ending September 30 in the past have been much stronger

than the results for the other quarters. This seasonality, along with other factors that are beyond our control,

including general economic conditions, changes in consumer behavior, weather conditions, availability of

import quotas and currency exchange rate Öuctuations, could adversely aÅect our business and cause our

results of operations to Öuctuate. Results of operations in any period should not be considered indicative of the

results to be expected for any future period.

We Face Risks of Product Liability and Warranty Claims

Our products are used in outdoor activities, sometimes in severe conditions. Although we have not

experienced any signiÑcant expense as the result of product recalls or product liability claims, this could occur

in the future and have a material adverse aÅect on our business. Substantially all of our products are backed by

a lifetime limited warranty for defects in quality and workmanship. We maintain a warranty reserve for future

warranty claims, but the actual costs of servicing future warranty claims could exceed the reserve and have a

material adverse aÅect on us.

Our Common Stock Price May Be Volatile

The price of our common stock has Öuctuated substantially since our initial public oÅering. Our common

stock is traded on the Nasdaq National Market, which has experienced and is likely to experience signiÑcant

price and volume Öuctuations that could adversely aÅect the market price of our common stock without regard

to our operating performance. We also believe factors such as Öuctuations in Ñnancial results, variances from

Ñnancial market expectations, changes in earnings estimates by analysts, or announcements by us or

competitors may cause the market price of the common stock to Öuctuate, perhaps substantially.

Item 7a. Quantitative and Qualitative Disclosures about Market Risk

The information required by this item is included in Management's Discussion and Analysis of Financial

Condition and Results of Operations and is incorporated herein by this reference.

20