Columbia Sportswear 2000 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2000 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Note 8 Ì Shareholders' Equity

The Company is authorized to issue 50,000,000 shares of common stock. At December 31, 2000 and

1999, 25,709,447 and 25,350,307 shares of common stock were issued and outstanding.

On June 9, 1999, the shareholders of the Company approved the 1999 Employee Stock Purchase Plan

(""ESPP''). 500,000 shares of common stock are authorized for issuance under the ESPP, which allows

qualiÑed employees of the Company to purchase shares on a quarterly basis up to Ñfteen percent of their

respective compensation. The purchase price of the shares is equal to eighty Ñve percent of the lesser of the

closing price of the Company's common stock on the Ñrst or last trading day of the respective quarter. As of

December 31, 2000 and 1999, 48,083 and 21,582 shares of common stock had been issued under the ESPP.

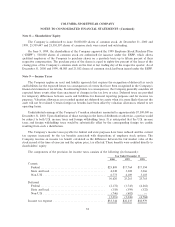

Note 9 Ì Income Taxes

The Company applies an asset and liability approach that requires the recognition of deferred tax assets

and liabilities for the expected future tax consequences of events that have been recognized in the Company's

Ñnancial statements or tax returns. In estimating future tax consequences, the Company generally considers all

expected future events other than enactment of changes in the tax laws or rates. Deferred taxes are provided

for temporary diÅerences between assets and liabilities for Ñnancial reporting purposes and for income tax

purposes. Valuation allowances are recorded against net deferred tax assets when it is more likely than not the

asset will not be realized. Certain foreign tax beneÑts have been oÅset by valuation allowances related to net

operating losses.

Undistributed earnings of the Company's Canadian subsidiary amounted to approximately $7,300,000 on

December 31, 2000. Upon distribution of those earnings in the form of dividends or otherwise, a portion would

be subject to both U.S. income taxes and foreign withholding taxes. It is anticipated that the U.S. income

taxes and foreign withholding taxes would be substantially oÅset by the corresponding foreign tax credits

resulting from such a distribution.

The Company's income taxes payable for federal and state purposes have been reduced and the current

tax expense increased, by the tax beneÑts associated with dispositions of employee stock options. The

Company receives an income tax beneÑt calculated as the diÅerence between the fair market value of the

stock issued at the time of exercise and the option price, tax eÅected. These beneÑts were credited directly to

shareholders' equity.

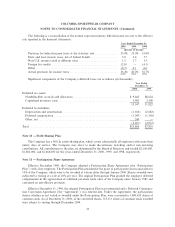

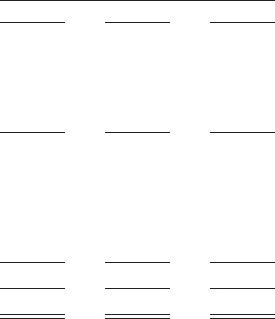

The components of the provision for income taxes consists of the following (in thousands):

Year Ended December 31

2000 1999 1998

Current:

Federal ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $25,809 $17,764 $17,594

State and localÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 4,038 3,308 3,066

Non-U.S ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 6,773 4,189 3,103

36,620 25,261 23,763

Deferred:

Federal ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (2,172) (1,745) (4,262)

State and localÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (158) (599) (522)

Non-U.S ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (746) (682) Ì

(3,076) (3,026) (4,784)

Income tax expense ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $33,544 $22,235 $18,979

32