Columbia Sportswear 2000 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2000 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

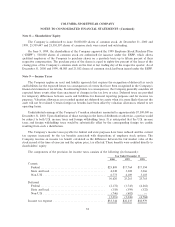

Note 4 Ì Property, Plant, and Equipment, Net

Property, plant, and equipment consist of the following (in thousands):

December 31,

2000 1999

Land ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 5,766 $ 4,740

Buildings ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 30,589 25,432

Machinery and equipment ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 61,642 59,078

Furniture and Ñxtures ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 6,624 6,751

Leasehold improvementsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 11,329 10,720

Construction in progress ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 9,034 444

124,984 107,165

Less accumulated depreciationÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 48,322 38,205

$ 76,662 $ 68,960

Note 5 Ì Short Term Borrowings and Credit Lines

The Company has available an unsecured operating line of credit providing for borrowings in an aggregate

amount not to exceed at any time outstanding (1) $50,000,000 during the period of July 15 through

December 15 of the calendar year, (2) $25,000,000 during the period of December 16 through February 15 of

the calendar year and (3) $10,000,000 at all other times. The maturity date of this agreement is June 30, 2002.

Interest, payable monthly, is computed at the bank's prime rate minus up to 2.05% per annum, representing an

eÅective interest rate of 7.50% at December 31, 2000 and 6.50% at December 31, 1999. The agreement also

includes a Ñxed rate option based on the LIBOR rate plus up to 65 basis points. The balance outstanding was

$0 and $9,145,000 at December 31, 2000 and 1999, respectively. The unsecured operating line of credit

requires the Company to comply with certain covenants including a Capital Ratio, which limits indebtedness

to tangible net worth. If the Company defaults on its payments, it is prohibited, subject to certain exceptions,

from making dividend payments or other distributions.

The Company also has available an unsecured revolving line of credit of $25,000,000 with a $75,000,000

import line of credit to issue documentary letters of credit on a sight basis. The combined limit under this

agreement is $100,000,000. The revolving line accrues interest at the bank's prime rate minus 2% per annum.

The revolving line also has a Ñxed rate option based on the bank's cost of funds plus 45 basis points. There was

no balance outstanding on this line as of December 31, 2000 and 1999.

The Company is party to certain Buying Agency Agreements pursuant to which the Company is provided

unsecured lines of credit. These lines of credit are used to Ñnance the purchase of goods outside the U.S.

which are produced by the Company's independent manufacturers. The available funds are limited to

$156,680,000 with a sublimit of $72,677,000 on the import line of credit. Borrowings bear interest at a range of

.35% to .75% above the LIBOR rate (LIBOR rate: 6.4% and 6.0% as of December 31, 2000 and 1999,

respectively). These agreements expire in 2001 will automatically renew for three-year terms unless either

party elects otherwise. The balance outstanding on the import line of credit was $20,525,000 and $15,383,000

at December 31, 2000 and 1999, respectively, and is included in accounts payable. At December 31, 2000, the

Company had $72,105,000 of Ñrm purchase orders placed under these Ñnancing arrangements.

CSCL has available a line of credit providing for borrowing to a maximum of C$19,650,000

(US$13,110,000 at December 31, 2000). As of December 31, 2000 and 1999, there was no balance

outstanding on this line.

30