Columbia Sportswear 2000 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2000 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

adjustments are included as a separate component of shareholders' equity and are not currently adjusted for

income taxes as they relate to indeÑnite net investments in non-U.S. operations.

Fair value of Ñnancial instruments:

Based on borrowing rates currently available to the Company for bank loans with similar terms and

maturities, the fair value of the Company's long-term debt approximates the carrying value. Furthermore, the

carrying value of all other Ñnancial instruments potentially subject to valuation risk (principally consisting of

cash and cash equivalents, accounts receivable and accounts payable) also approximate fair value because of

their short-term maturities.

Advertising costs:

Advertising costs are expensed as incurred. Advertising expense was $27,343,000, $20,725,000, and

$18,666,000 for the years ended December 31, 2000, 1999, and 1998, respectively.

Product warranty:

Substantially all of the Company's products carry lifetime warranty provisions for defects in quality and

workmanship. Warranty expense was approximately $3,325,000, $3,127,000, and $2,852,000 for the years

ended December 31, 2000, 1999 and 1998, respectively.

Recent Accounting Pronouncements

In December 1999, the Securities and Exchange Commission issued StaÅ Accounting Bulletin

(SAB) No. 101, ""Revenue Recognition in Financial Statements.'' The eÅective date of the bulletin was

delayed by the issuance of SAB No. 101A and SAB No. 101B and was eÅective for the Company's fourth

quarter of Ñscal year 2000. The adoption of this bulletin did not have a material eÅect on the Company's

consolidated Ñnancial statements.

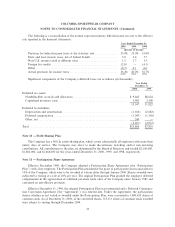

Note 3 Ì Inventories, Net

Inventories consist of the following (in thousands):

December 31,

2000 1999

Raw materialsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 4,298 $ 3,459

Work in process ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 9,217 9,197

Finished goods ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 94,828 76,406

108,343 89,062

Less inventory valuation allowance ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (3,055) (2,597)

$105,288 $86,465

29