Cisco 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Although timing of the resolution of audits is highly uncertain, the Company does not believe it is reasonably possible that the

total amount of unrecognized tax benefits as of July 31, 2010 will materially change in the next 12 months.

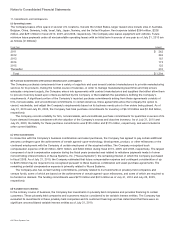

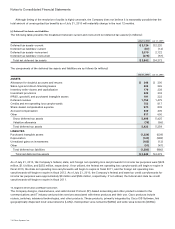

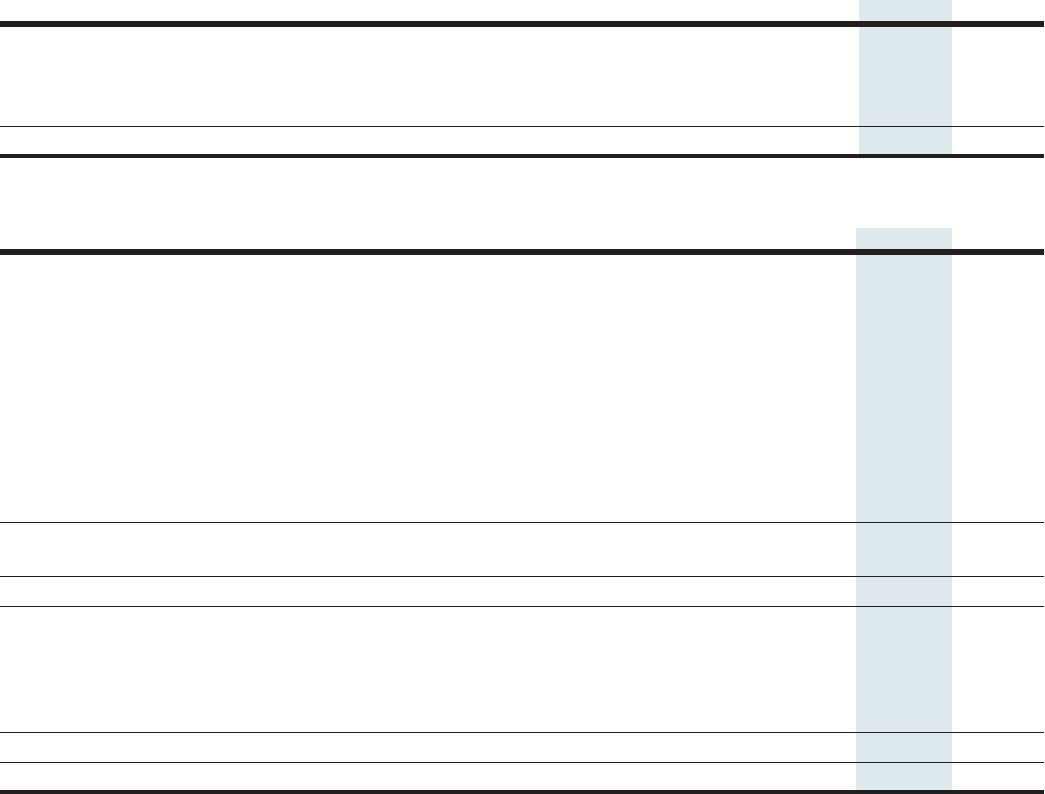

(c) Deferred Tax Assets and Liabilities

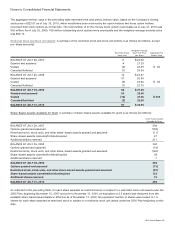

The following table presents the breakdown between current and noncurrent net deferred tax assets (in millions):

July 31, 2010 July 25, 2009

Deferred tax assets—current $ 2,126 $ 2,320

Deferred tax liabilities—current (87) (12)

Deferred tax assets—noncurrent 2,079 2,122

Deferred tax liabilities—noncurrent (276) (57)

Total net deferred tax assets $ 3,842 $ 4,373

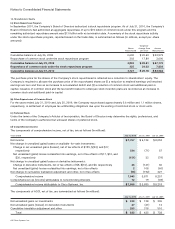

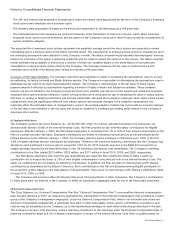

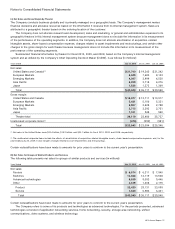

The components of the deferred tax assets and liabilities are as follows (in millions):

July 31, 2010 July 25, 2009

ASSETS

Allowance for doubtful accounts and returns $ 248 $ 300

Sales-type and direct-financing leases 224 226

Inventory write-downs and capitalization 176 238

Investment provisions 329 333

IPR&D, goodwill, and purchased intangible assets 191 222

Deferred revenue 1,752 1,475

Credits and net operating loss carryforwards 752 817

Share-based compensation expense 970 809

Accrued compensation 339 405

Other 517 600

Gross deferred tax assets 5,498 5,425

Valuation allowance (76) (66)

Total deferred tax assets 5,422 5,359

LIABILITIES

Purchased intangible assets (1,224) (639)

Depreciation (120) (288)

Unrealized gains on investments (185) (12)

Other (51) (47)

Total deferred tax liabilities (1,580) (986)

Total net deferred tax assets $ 3,842 $ 4,373

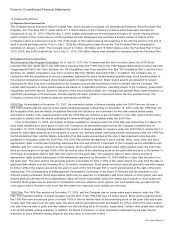

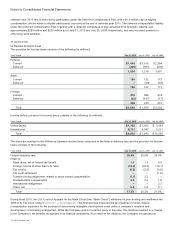

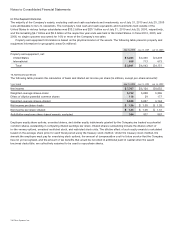

As of July 31, 2010, the Company’s federal, state, and foreign net operating loss carryforwards for income tax purposes were $325

million, $1.6 billion, and $252 million, respectively. If not utilized, the federal net operating loss carryforwards will begin to expire in

fiscal 2019, the state net operating loss carryforwards will begin to expire in fiscal 2011, and the foreign net operating loss

carryforwards will begin to expire in fiscal 2012. As of July 31, 2010, the Company’s federal and state tax credit carryforwards for

income tax purposes were approximately $8 million and $584 million, respectively. If not utilized, the federal and state tax credit

carryforwards will begin to expire in fiscal 2011.

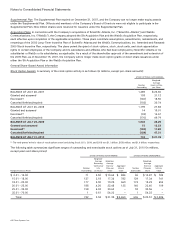

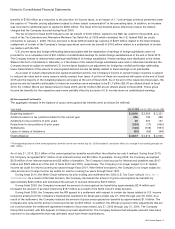

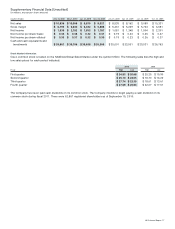

15. Segment Information and Major Customers

The Company designs, manufactures, and sells Internet Protocol (IP)-based networking and other products related to the

communications and IT industry and provides services associated with these products and their use. Cisco products include

routers, switches, advanced technologies, and other products. These products, primarily integrated by Cisco IOS Software, link

geographically dispersed local-area networks (LANs), metropolitan-area networks (MANs) and wide-area networks (WANs).

74 Cisco Systems, Inc.