Cisco 2010 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2010 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

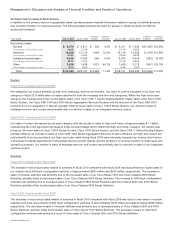

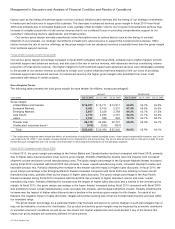

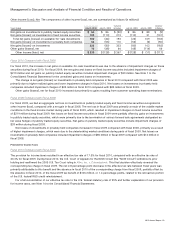

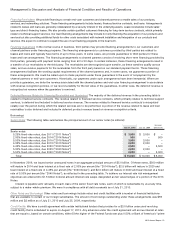

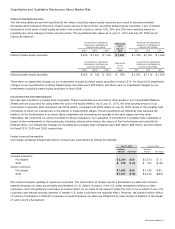

Other Income (Loss), Net The components of other income (loss), net, are summarized as follows (in millions):

Years Ended July 31, 2010 July 25, 2009

Variance

in Dollars July 25, 2009 July 26, 2008

Variance

in Dollars

Net gains on investments in publicly traded equity securities $66 $ 86 $ (20) $ 86 $ 88 $ (2)

Net gains (losses) on investments in fixed income securities 103 (110) 213 (110) 21 (131)

Total net gains (losses) on available-for-sale investments 169 (24) 193 (24) 109 (133)

Net gains (losses) on investments in privately held companies 54 (56) 110 (56) (6) (50)

Net gains (losses) on investments 223 (80) 303 (80) 103 (183)

Other gains (losses), net 16 (48) 64 (48) (114) 66

Other income (loss), net $ 239 $ (128) $ 367 $ (128) $ (11) $ (117)

Fiscal 2010 Compared with Fiscal 2009

For fiscal 2010, the increase in net gains on available-for-sale investments was due to the absence of impairment charges on these

securities during fiscal 2010. For fiscal 2009, the net gains and losses on fixed income securities included impairment charges of

$219 million and net gains on publicly traded equity securities included impairment charges of $39 million. See Note 7 to the

Consolidated Financial Statements for the unrealized gains and losses on investments.

The change in net gains (losses) on investments in privately held companies in fiscal 2010 compared with fiscal 2009 was

primarily due to higher realized gains and lower impairment charges in fiscal 2010. Net losses on investments in privately held

companies included impairment charges of $25 million in fiscal 2010 compared with $85 million in fiscal 2009.

Other gains (losses), net for fiscal 2010 increased due primarily to gains resulting from customer operating lease terminations.

Fiscal 2009 Compared with Fiscal 2008

For fiscal 2009, we had an aggregate net loss on investments in publicly traded equity and fixed income securities recognized in

other income (loss), compared with a net gain in fiscal 2008. The net loss in fiscal 2009 was primarily a result of the volatile market

conditions in the fixed income market during parts of fiscal 2009, which resulted in impairment charges on fixed income securities

of $219 million during fiscal 2009. Net losses on fixed income securities in fiscal 2009 were partially offset by gains on investments

in publicly traded equity securities, which were primarily due to the termination of various forward sale agreements designated as

fair value hedges of publicly traded equity securities. Net gains on publicly traded equity securities include impairment charges of

$39 million during fiscal 2009.

Net losses on investments in privately held companies increased in fiscal 2009 compared with fiscal 2008, primarily as a result

of higher impairment charges, which were due to the deteriorating market conditions during parts of fiscal 2009. Net losses on

investments in privately held companies included impairment charges of $85 million in fiscal 2009 compared with $12 million in

fiscal 2008.

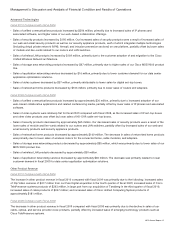

Provision for Income Taxes

Fiscal 2010 Compared with Fiscal 2009

The provision for income taxes resulted in an effective tax rate of 17.5% for fiscal 2010, compared with an effective tax rate of

20.3% for fiscal 2009. During fiscal 2010, the U.S. Court of Appeals for the Ninth Circuit (the “Ninth Circuit”) withdrew its prior

holding and reaffirmed the 2005 U.S. Tax Court ruling in Xilinx, Inc. v. Commissioner. This final decision effectively reversed the

corresponding tax charge in fiscal 2009. The net 2.8 percentage point decrease in the effective tax rate between fiscal years was

primarily attributable to this benefit and the absence in fiscal 2010 of the corresponding charge from fiscal 2009, partially offset by

the absence in fiscal 2010, of the fiscal 2009 tax benefit of $106 million, or 1.4 percentage points, related to the retroactive portion

of the U.S. federal R&D credit reinstatement.

For a full reconciliation of our effective tax rate to the U.S. federal statutory rate of 35% and further explanation of our provision

for income taxes, see Note 14 to the Consolidated Financial Statements.

2010 Annual Report 29