Cisco 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

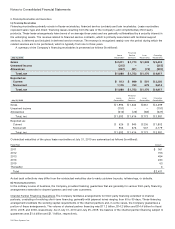

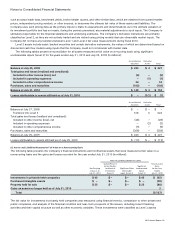

(u) Use of Estimates The preparation of financial statements and related disclosures in conformity with accounting principles

generally accepted in the United States requires management to make estimates and judgments that affect the amounts reported in

the Consolidated Financial Statements and accompanying notes. Estimates are used for the following, among others:

• Revenue recognition

• Allowances for receivables and sales returns

• Inventory valuation and liability for purchase commitments with contract manufacturers and suppliers

• Warranty costs

• Share-based compensation expense

• Fair value measurements and other-than-temporary impairments

• Goodwill and purchased intangible asset impairments

• Income taxes

• Loss contingencies

The actual results experienced by the Company may differ materially from management’s estimates.

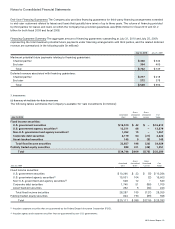

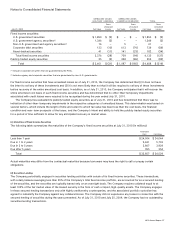

(v) Recent Accounting Standards or Updates In June 2009, the FASB issued revised guidance for the consolidation of variable

interest entities. In February 2010, the FASB issued amendments to the consolidation requirements, exempting certain investment

funds from the June 2009 guidance for the consolidation of variable interest entities. The June 2009 guidance for the consolidation

of variable interest entities replaces the quantitative-based risks and rewards approach with a qualitative approach that focuses on

identifying which enterprise has the power to direct the activities of a variable interest entity that most significantly impact the

entity’s economic performance and has the obligation to absorb losses or the right to receive benefits from the entity that could be

potentially significant to the variable interest entity. The accounting guidance also requires an ongoing reassessment of whether an

enterprise is the primary beneficiary and requires additional disclosures about an enterprise’s involvement in variable interest

entities. This accounting guidance is effective for the Company beginning in the first quarter of fiscal 2011. Upon adoption, the

application of the revised guidance for the consolidation of variable interest entities did not have a material impact to the

Company’s Consolidated Financial Statements.

In June 2009, the FASB issued revised guidance for the accounting of transfers of financial assets. This guidance eliminates the

concept of a qualifying special-purpose entity, removes the scope exception for qualifying special-purpose entities when applying

the accounting guidance related to the consolidation of variable interest entities, changes the requirements for derecognizing

financial assets, and requires enhanced disclosure. This accounting guidance is effective for the Company beginning in the first

quarter of fiscal 2011. Upon adoption, the application of the revised guidance for the accounting of transfers of financial assets did

not have a material impact to the Company’s Consolidated Financial Statements.

In July 2010, the FASB issued an accounting update to provide guidance to enhance disclosures related to the credit quality of

a company’s financing receivables portfolio and the associated allowance for credit losses. Pursuant to this accounting update, a

company is required to provide a greater level of disaggregated information about its allowance for credit loss with the objective of

facilitating users’ evaluation of the nature of credit risk inherent in the company’s portfolio of financing receivables, how that risk is

analyzed and assessed in arriving at the allowance for credit losses, and the changes and reasons for those changes in the

allowance for credit losses. The revised disclosures as of the end of the reporting period are effective for the Company beginning in

the second quarter of fiscal 2011, and the revised disclosures related to activities during the reporting period are effective for the

Company beginning in the third quarter of fiscal 2011. The Company is currently evaluating the impact of this accounting update on

its financial disclosures.

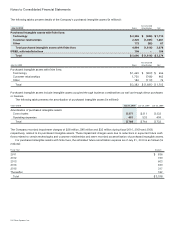

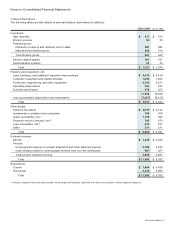

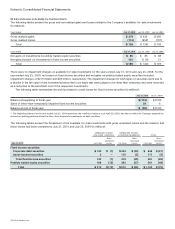

3. Business Combinations

The Company completed seven business combinations during fiscal 2010. A summary of the more significant acquisitions

completed in fiscal 2010 is as follows:

• In December 2009, the Company acquired ScanSafe, Inc. (“ScanSafe”), a provider of hosted web security to help build a

borderless network security architecture that combines network and cloud-based services for advanced security enforcement.

• In December 2009, the Company acquired Starent Networks, Corp. (“Starent”), a provider of IP-based mobile infrastructure for

mobile and converged carriers, to enhance the Company’s portfolio of products to provide an integrated architecture to offer

rich, quality multimedia experiences to mobile subscribers.

• In April 2010, the Company acquired Tandberg ASA (“Tandberg”), a leader in video communications. With this acquisition, the

Company expects that it will be able to combine innovations with multivendor interoperability capabilities to provide a platform

significantly more attractive to its customers and partners.

• In July 2010, the Company acquired CoreOptics Inc. (“CoreOptics”), a designer of digital signal processing solutions for high-

speed optical networking applications.

2010 Annual Report 49