Cisco 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

6. Financing Receivables and Guarantees

(a) Financing Receivables

Financing receivables primarily consist of lease receivables, financed service contracts and loan receivables. Lease receivables

represent sales-type and direct-financing leases resulting from the sale of the Company’s and complementary third-party

products. These lease arrangements have terms of on average three years and are generally collateralized by a security interest in

the underlying assets. The revenue related to financed service contracts, which is primarily associated with technical support

services, is deferred and included in deferred service revenue. The revenue is recognized ratably over the period during which the

related services are to be performed, which is typically from one to three years.

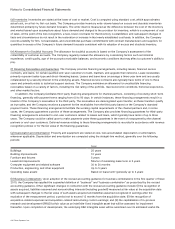

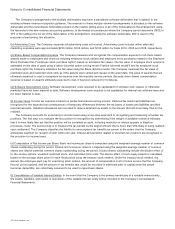

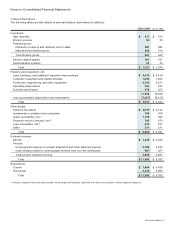

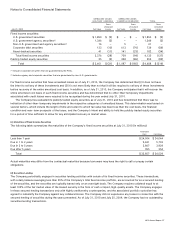

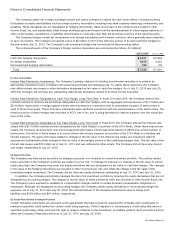

A summary of the Company’s financing receivables is presented as follows (in millions):

Lease

Receivables

Financed

Service

Contracts

Loan

Receivables

Financing

ReceivablesJuly 31, 2010

Gross $ 2,411 $ 1,773 $ 1,249 $ 5,433

Unearned income (215) — — (215)

Allowances (207) (21) (73) (301)

Total, net $ 1,989 $ 1,752 $ 1,176 $ 4,917

Reported as:

Current $ 813 $ 989 $ 501 $ 2,303

Noncurrent 1,176 763 675 2,614

Total, net $ 1,989 $ 1,752 $ 1,176 $ 4,917

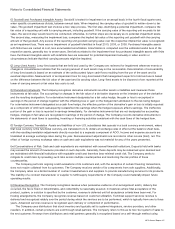

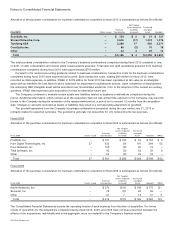

July 25, 2009

Lease

Receivables

Financed

Service

Contracts

Loan

Receivables

Financing

Receivables

Gross $ 1,996 $ 1,642 $ 861 $ 4,499

Unearned income (191) — — (191)

Allowances (213) (26) (88) (327)

Total, net $ 1,592 $ 1,616 $ 773 $ 3,981

Reported as:

Current $ 626 $ 940 $ 236 $ 1,802

Noncurrent 966 676 537 2,179

Total, net $ 1,592 $ 1,616 $ 773 $ 3,981

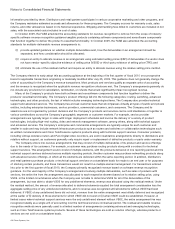

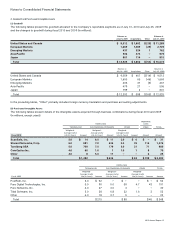

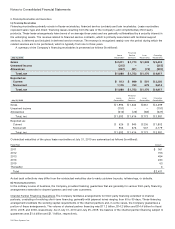

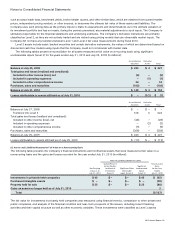

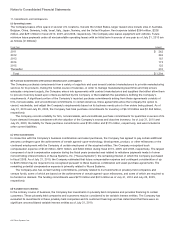

Contractual maturities of the gross lease receivables at July 31, 2010 are summarized as follows (in millions):

Fiscal Year Amount

2011 $ 961

2012 706

2013 454

2014 223

2015 63

Thereafter 4

Total $ 2,411

Actual cash collections may differ from the contractual maturities due to early customer buyouts, refinancings, or defaults.

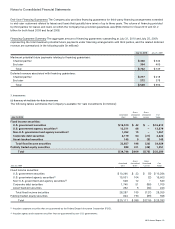

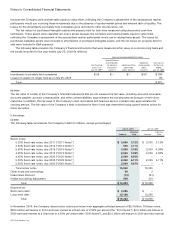

(b) Financing Guarantees

In the ordinary course of business, the Company provides financing guarantees that are generally for various third-party financing

arrangements extended to channel partners and end-user customers.

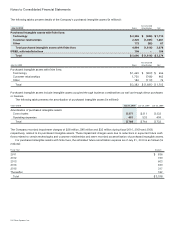

Channel Partner Financing Guarantees The Company facilitates arrangements for third-party financing extended to channel

partners, consisting of revolving short-term financing, generally with payment terms ranging from 60 to 90 days. These financing

arrangements facilitate the working capital requirements of the channel partners and, in some cases, the Company guarantees a

portion of these arrangements. The volume of channel partner financing was $17.2 billion, $14.2 billion and $14.4 billion for fiscal

2010, 2009, and 2008, respectively. As of July 31, 2010 and July 25, 2009, the balance of the channel partner financing subject to

guarantees was $1.4 billion and $1.1 billion, respectively.

54 Cisco Systems, Inc.