Cisco 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cisco Systems, Inc.Cisco Systems, Inc.

2010 Annual Report

Together

We Are

the Human

Network.

Table of contents

-

Page 1

Cisco Systems, Inc. 2010 Annual Report Together We Are the Human Network. -

Page 2

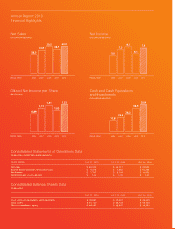

Annual Report 2010 Financial Highlights -

Page 3

... virtualization, collaboration and video to drive productivity and efficiency. The network enhances every aspect of our lives. Our customers recognize this. The data center has traditionally been a cost center built from isolated technologies with multiple points of integration, complexity and lack... -

Page 4

...Report 2010 Letter to Shareholders 85% of Fortune 500 companies More than 85 percent of Fortune 500 companies use Cisco Unified Communications for robust and feature-rich communications services accessible from a wide range of clients and endpoints, including enterprise telephony, unified messaging... -

Page 5

... to the ongoing success of our Nexus family of next-generation data center switches, which has attained an annualized revenue run rate of over $2 billion as of the fourth quarter of fiscal 2010. Cisco's Unified Computing Systems (UCS) offering, which also addresses the transition occurring in the... -

Page 6

... edge and branch routing systems in fiscal 2010, and received very positive customer feedback. Our collaboration technologies, including Unified Communications and Cisco TelePresence, each saw strong revenue growth. Other noteworthy product revenue growth included the success of our Flip video... -

Page 7

... Financial Statements, prepared in accordance with accounting principles generally accepted in the United States of America, and has full responsibility for their integrity and accuracy. Management, with oversight by Cisco's Board of Directors, has established and maintains a strong ethical... -

Page 8

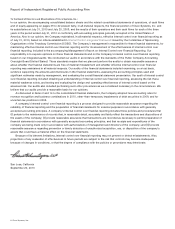

... on these financial statements and on the Company's internal control over financial reporting based on our integrated audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform... -

Page 9

... with the Consolidated Financial Statements and related notes which appear on pages 39 to 76 of this Annual Report: Years Ended July 31, 2010 July 25, 2009 July 26, 2008 July 28, 2007 July 29, 2006 Net sales Net income Net income per share-basic Net income per share-diluted Shares used in per... -

Page 10

... Our products and services are designed to address a wide range of customers' needs, including improving productivity, reducing costs, and gaining a competitive advantage. In addition, our products and services are designed to help customers build their own network infrastructures that support tools... -

Page 11

... and Cisco Nexus product families, which are designed to integrate the previously siloed technologies in the enterprise data center with a unified architecture. We are also seeking to capitalize on this market transition through the development of cloud-based product and service offerings, through... -

Page 12

... increases from sales of cable products and Cisco Unified Computing System. Net service revenue increased by 9% compared with fiscal 2009, reflecting increased service revenue across all of our geographic theaters. From a service offering perspective, both technical support services and advanced... -

Page 13

... assured. We assess collectibility based primarily on the creditworthiness of the customer as determined by credit checks and analysis, as well as the customer's payment history. In instances where final acceptance of the product, system, or solution is specified by the customer, revenue is deferred... -

Page 14

... Financial Condition and Results of Operations We elected to early adopt this accounting guidance at the beginning of our first quarter of fiscal 2010 on a prospective basis for applicable transactions originating or materially modified after July 25, 2009. The amount of product and service revenue... -

Page 15

... Financial Statements. Our products are generally covered by a warranty for periods ranging from 90 days to five years, and for some products we provide a limited lifetime warranty. We accrue for warranty costs as part of our cost of sales based on associated material costs, technical support labor... -

Page 16

... The determination of fair value of share-based payment awards on the date of grant using an option-pricing model is affected by our stock price as well as assumptions regarding a number of highly complex and subjective variables. For employee stock options and employee stock purchase rights, these... -

Page 17

... in the fourth fiscal quarter and between annual tests in certain circumstances for each reporting unit. Effective in fiscal 2010, the assessment of fair value for goodwill and purchased intangible assets is based on factors that market participants would use in an orderly transaction in accordance... -

Page 18

...the R&D tax credit laws; by transfer pricing adjustments including the effect of acquisitions on our intercompany R&D cost sharing arrangement and legal structure; by tax effects of nondeductible compensation; by tax costs related to intercompany realignments; by changes in accounting principles; or... -

Page 19

... our enterprise market, the public sector showed relative strength across most of our geographic theaters, compared with other customer markets within the respective theaters. Service revenue increased across all theaters, led by higher sales in the Emerging Markets theater. 2010 Annual Report 17 -

Page 20

... with fiscal 2009 was across all of our customer markets in the United States and Canada theater, led by the commercial and enterprise markets. Within the enterprise market, net product sales to the U.S. federal government increased on a year-over-year basis for fiscal 2010. Our net product sales in... -

Page 21

... fiscal 2009 compared with fiscal 2008, primarily due to a decline in sales to the service provider market and a decline in sales to the enterprise market, excluding the public sector. Net product sales to the public sector within the enterprise market increased in this theater. 2010 Annual Report... -

Page 22

... market, and the tendency of service providers to make large and sporadic purchases. Our decline in sales of midrange and low-end routers was primarily due to a decline in sales of our integrated services routers. Switches Fiscal 2010 Compared with Fiscal 2009 The increase in net product sales... -

Page 23

... in other product revenue in fiscal 2009 compared with fiscal 2008 was primarily due to the decline in sales of our cable, optical, and service provider voice products, partially offset by increased sales of emerging technology products such as Cisco TelePresence systems. 2010 Annual Report 21 -

Page 24

... 2009, with particular strength in our Emerging Markets theater. Higher revenue from technical support service contracts and increased revenue from advanced services relating to consulting services for specific customer networking needs contributed to the growth in net service revenue in fiscal 2009... -

Page 25

...gross margins, such as the consumer market with our sales of Flip Video cameras, as well as Cisco Unified Computing System products. Our gross margins may also be impacted by the geographic mix of our revenue or by increased sales discounts, rebates, and product pricing, which may be attributable to... -

Page 26

... management does not include such information in measuring the performance of the operating segments. Fiscal 2010 Compared with Fiscal 2009 In fiscal 2010, the gross margin percentage in the United States and Canada theater declined compared with fiscal 2009, primarily due to higher sales discounts... -

Page 27

... and revenue deferrals; sales discounts; increases in material or labor costs, including share-based compensation expense; excess inventory and obsolescence charges; warranty costs; changes in shipment volume; loss of cost savings due to changes in component pricing; effects of value engineering... -

Page 28

... expenses related to travel, meeting and events, marketing programs and outside services. An additional factor that contributed to the decrease in sales and marketing expenses in fiscal 2009 was lower variable compensation expenses, partially offset by the enhanced early retirement and limited... -

Page 29

... subject to straightline vesting, a shorter vesting period of four years for most share-based awards granted in fiscal 2009, and an increase in the weightedaverage estimated grant date fair value for each share-based award. See Note 13 to the Consolidated Financial Statements. 2010 Annual Report 27 -

Page 30

...pricing model for products related to these acquisitions to be standard within the high-technology communications industry, and the applicable discount rates represent the rates that market participants would use for valuation of such intangible assets. For additional information regarding purchased... -

Page 31

... offset by the absence in fiscal 2010, of the fiscal 2009 tax benefit of $106 million, or 1.4 percentage points, related to the retroactive portion of the U.S. federal R&D credit reinstatement. For a full reconciliation of our effective tax rate to the U.S. federal statutory rate of 35% and further... -

Page 32

... R&D expenses due to the retroactive reinstatement of the U.S. federal R&D tax credit offset by tax costs of $174 million, or 2.3 percentage points, related to a transfer pricing adjustment for share-based compensation. The transfer pricing adjustment was a result of a decision by the Ninth Circuit... -

Page 33

... receivables, inventory and supply chain management, deferred revenue, excess tax benefits from share-based compensation, and the timing and amount of tax and other payments. For additional discussion, see "Part I, Item 1A. Risk Factors" in our 2010 Annual Report on Form 10-K. Accounts Receivable... -

Page 34

... goods. Distributor inventory and deferred cost of sales are related to unrecognized revenue on shipments to distributors and retail partners as well as shipments to customers. Manufactured finished goods consist primarily of build-to-order and build-to-stock products. Service-related spares consist... -

Page 35

Management's Discussion and Analysis of Financial Condition and Results of Operations Financing Receivables We provide financing to certain end-user customers and channel partners to enable sales of our products, services, and networking solutions. These financing arrangements include leases, ... -

Page 36

...,500 245 $ 8,765 $ 1,055 $ 1,149 $ 12,061 Operating Leases We lease office space in several U.S. locations. Outside the United States, larger leased sites are located in Australia, Belgium, China, Germany, India, Israel, Italy, Japan, Norway, and the United Kingdom. We also lease equipment and... -

Page 37

..., product, or other milestones, or continued employment with us of certain employees of acquired entities. See Note 11 to the Consolidated Financial Statements. We also have certain funding commitments primarily related to our investments in privately held companies and venture funds, some... -

Page 38

...investment return consistent with preserving principal and managing risk. At any time, a sharp rise in market interest rates could have a material adverse impact on the fair value of our fixed income investment portfolio. Conversely, declines in interest rates, including the impact from lower credit... -

Page 39

... and potential for financial return. Our impairment charges on investments in privately held companies were $25 million, $85 million, and $12 million for fiscal 2010, 2009 and 2008, respectively. Foreign Currency Exchange Risk Our foreign exchange forward and option contracts are summarized as... -

Page 40

... Forward Forward Forward and option contracts-forecasted transactions related to operating expenses and service cost of sales contracts-current assets and liabilities contracts-net investments in foreign subsidiaries contracts-long-term customer financings contracts-investments Up to 18 months... -

Page 41

... taxes payable Deferred revenue Other long-term liabilities Total liabilities Commitments and contingencies (Note 11) Equity: Cisco shareholders' equity: Preferred stock, no par value: 5 shares authorized; none issued and outstanding Common stock and additional paid-in capital, $0.001 par value... -

Page 42

... per-share amounts) Years Ended July 31, 2010 July 25, 2009 July 26, 2008 NET SALES: Product Service Total net sales COST OF SALES: Product Service Total cost of sales GROSS MARGIN OPERATING EXPENSES: Research and development Sales and marketing General and administrative Amortization of purchased... -

Page 43

... taxes Excess tax benefits from share-based compensation In-process research and development Net (gains) losses on investments Change in operating assets and liabilities, net of effects of acquisitions: Accounts receivable Inventories Lease receivables, net Accounts payable Income taxes payable... -

Page 44

... of accounting standard - other-than-temporary impairments of debt securities Issuance of common stock Repurchase of common stock Tax benefits from employee stock incentive plans, including transfer pricing adjustments Purchase acquisitions Share-based compensation expense BALANCE AT JULY 25, 2009... -

Page 45

...cost or equity method. The Company monitors these investments for impairments and makes appropriate reductions in carrying values if the Company determines that an impairment charge is required based primarily on the financial condition and near-term prospects of these companies. 2010 Annual Report... -

Page 46

...extended to end-user customers related to leases and loans, which typically have terms of up to three years. The Company could be called upon to make payments under these guarantees in the event of nonpayment by the channel partners or end-user customers. Deferred revenue relating to these financing... -

Page 47

... uses distributors that stock inventory and typically sell to systems integrators, service providers, and other resellers. In addition, certain products are sold through retail partners. The Company refers to this as its two-tier system of sales to the end customer. Revenue from distributors and... -

Page 48

... as unified communications and Cisco TelePresence systems products along with technical support services. Consumer products, including Linksys wireless routers and Pure Digital video recorders, are sold in standalone arrangements directly to distributors and retailers without support, as customers... -

Page 49

... recognition for multiple-element arrangements could differ materially from the results in the current period. The Company is currently unable to determine the impact that the newly adopted accounting guidance could have on its revenue as these go-to-market strategies evolve. 2010 Annual Report 47 -

Page 50

...-pricing model ("lattice-binomial model") and for employee stock purchase rights the Company estimates the fair value using the Black-Scholes model. The Company measures the fair value of restricted stock and restricted stock units as if the awards were vested and issued on the grant date. The value... -

Page 51

...used for the following, among others Revenue recognition Allowances for receivables and sales returns Inventory valuation and liability for purchase commitments with contract manufacturers and suppliers Warranty costs Share-based compensation expense Fair value measurements and other-than-temporary... -

Page 52

... as follows (in millions): Net Tangible Assets Acquired/ (Liabilities Assumed) Purchased Intangible Assets Fiscal 2009 Shares Issued Purchase Consideration Goodwill IPR&D PostPath, Inc. Pure Digital Technologies, Inc. Pure Networks, Inc. Tidal Software, Inc. Other Total Fiscal 2008 - 27... -

Page 53

... allocated to the Company's reportable segments as of July 31, 2010 and July 25, 2009 and the changes to goodwill during fiscal 2010 and 2009 (in millions): Balance at July 25, 2009 Balance at July 31, 2010 Acquisitions Other United States and Canada European Markets Emerging Markets Asia Pacific... -

Page 54

...assets acquired through business combinations as well as through direct purchases or licenses. The following table presents the amortization of purchased intangible assets (in millions): Years Ended July 31, 2010 July 25, 2009 July 26, 2008 Amortization of purchased intangible assets: Cost of sales... -

Page 55

..., 2010 July 25, 2009 Inventories: Raw materials Work in process Finished goods: Distributor inventory and deferred cost of sales Manufactured finished goods Total finished goods Service-related spares Demonstration systems Total Property and equipment, net: Land, buildings, and building & leasehold... -

Page 56

... direct-financing leases resulting from the sale of the Company's and complementary third-party products. These lease arrangements have terms of on average three years and are generally collateralized by a security interest in the underlying assets. The revenue related to financed service contracts... -

Page 57

... - (86) (34) (127) (89) $ 10,284 15,603 540 1,705 223 28,355 928 $ 29,283 $ (216) Includes corporate securities that are guaranteed by the Federal Deposit Insurance Corporation (FDIC). Includes agency and corporate securities that are guaranteed by non-U.S. governments. 2010 Annual Report 55 (2) -

Page 58

Notes to Consolidated Financial Statements (b) Gains and Losses on Available-for-Sale Investments The following tables present the gross and net realized gains and losses related to the Company's available-for-sale investments (in millions): Years Ended July 31, 2010 July 25, 2009 July 26, 2008 ... -

Page 59

... has been less than the cost basis, the financial condition and near-term prospects of the issuer, and the Company's intent and ability to hold the publicly traded equity securities for a period of time sufficient to allow for any anticipated recovery in market value. (c) Maturities of Fixed Income... -

Page 60

...31, 2010 FAIR VALUE MEASUREMENTS Level 1 Level 2 Level 3 Total Balance Level 1 JULY 25, 2009 FAIR VALUE MEASUREMENTS Level 2 Level 3 Total Balance Assets Cash equivalents: Money market funds U.S. government securities U.S. government agency securities(1) Corporate debt securities Available-for-sale... -

Page 61

... to other private and public companies, and analysis of the financial condition and near-term prospects of the issuers, including recent financing activities and their capital structure as well as other economic variables. These investments were classified as Level 3 assets 2010 Annual Report 59 -

Page 62

... discount Hedge accounting adjustment Total Reported as: Short-term debt Long-term debt Total $ 10,295 In November 2009, the Company issued senior unsecured notes in an aggregate principal amount of $5.0 billion. Of these notes, $500 million will mature in 2014 and bear interest at a fixed rate... -

Page 63

... discount; and, if applicable, adjustments related to hedging. Based on market prices, the fair value of the Company's senior notes was $16.3 billion and $10.5 billion as of July 31, 2010 and July 25, 2009, respectively. Interest is payable semiannually on each class of the senior fixed-rate notes... -

Page 64

... YEARS ENDED (EFFECTIVE PORTION) Line Item in Statements of Operations July 31, 2010 July 25, 2009 Foreign currency derivatives Interest rate derivatives Other derivatives Total $ 33 23 - $ 56 $ (116) (42) (2) $ (160) Operating expenses Cost of sales-service Interest expense Operating expenses... -

Page 65

...not have any equity derivatives outstanding at July 31, 2010 and July 25, 2009. In addition, the Company periodically manages the risk of its investment portfolio by entering into equity derivatives that are not designated as accounting hedges. The changes in the fair value of these derivatives were... -

Page 66

...purchases components from a variety of suppliers and uses several contract manufacturers to provide manufacturing services for its products. During the normal course of business, in order to manage manufacturing lead times and help ensure adequate component supply, the Company enters into agreements... -

Page 67

...of sales based on associated material product costs, labor costs for technical support staff, and associated overhead. The Company's products are generally covered by a warranty for periods ranging from 90 days to five years, and for some products the Company provides a limited lifetime warranty. In... -

Page 68

... the tax benefit related to employee stock incentive plans are recorded as an increase to common stock and additional paid-in capital. (b) Other Repurchases of Common Stock For the years ended July 31, 2010 and July 25, 2009, the Company repurchased approximately 5.6 million and 1.1 million shares... -

Page 69

... may purchase a limited number of shares of the Company's stock at a discount of up to 15% of the lesser of the market value at the beginning of the offering period or the end of each 6-month purchase period. Prior to July 1, 2009 the offering period was six months. The Purchase Plan is scheduled to... -

Page 70

...2003 Long-Term Incentive Plan of Scientific-Atlanta and the WebEx Communications, Inc. Amended and Restated 2000 Stock Incentive Plan, respectively. The plans permit the grant of stock options, stock, stock units, and stock appreciation rights to certain employees of the Company and its subsidiaries... -

Page 71

... from the available share-based award balance. Effective as of November 12, 2009, the equivalent number of shares was revised to 1.5 shares for each share awarded as restricted stock or subject to a restricted stock unit award under the 2005 Plan beginning on this date. 2010 Annual Report 69 -

Page 72

... for stock options, stock purchase rights, restricted stock, and restricted stock units granted to employees. The following table summarizes share-based compensation expense (in millions): Years Ended July 31, 2010 July 25, 2009 July 26, 2008 Cost of sales-product Cost of sales-service Share-based... -

Page 73

... market for the Company's employee stock options. (c) Employee 401(k) Plans The Company sponsors the Cisco Systems, Inc. 401(k) Plan (the "Plan") to provide retirement benefits for its employees. As allowed under Section 401(k) of the Internal Revenue Code, the Plan provides for tax-deferred salary... -

Page 74

...Ended July 31, 2010 July 25, 2009 July 26, 2008 Federal statutory rate Effect of: State taxes, net of federal tax benefit Foreign income at other than U.S. rates Tax credits Tax audit settlement Transfer pricing adjustment related to share-based compensation Nondeductible compensation International... -

Page 75

... of "Transfer pricing adjustment related to share-based compensation" in the preceding table. In addition, an increase was recorded to additional paid-in capital for $566 million. The fiscal 2010 tax benefits above effectively reverse the related charges that the Company incurred during fiscal 2009... -

Page 76

... 25, 2009 ASSETS Allowance for doubtful accounts and returns Sales-type and direct-financing leases Inventory write-downs and capitalization Investment provisions IPR&D, goodwill, and purchased intangible assets Deferred revenue Credits and net operating loss carryforwards Share-based compensation... -

Page 77

... makes financial decisions and allocates resources based on the information it receives from its internal management system. Sales are attributed to a geographic theater based on the ordering location of the customer. The Company does not allocate research and development, sales and marketing, or... -

Page 78

... the average share price for each fiscal period using the treasury stock method. Under the treasury stock method, the amount the employee must pay for exercising stock options, the amount of compensation cost for future service that the Company has not yet recognized, and the amount of tax benefits... -

Page 79

... $ 2,201 $ 0.37 $ 0.37 $ 26,763 Stock Market Information Cisco common stock is traded on the NASDAQ Global Select Market under the symbol CSCO. The following table lists the high and low sales prices for each period indicated: 2010 Fiscal High Low High 2009 Low First quarter Second quarter Third... -

Page 80

... shareholder returns. Comparison of 5-Year Cumulative Total Return Among Cisco Systems, Inc., the S&P Information Technology Index and the S&P 500 Index $160 $140 $120 $100 $80 $60 $40 Cisco Systems, Inc. $20 $0 July 2005 July 2006 July 2007 July 2008 July 2009 July 2010 S&P Information Technology... -

Page 81

... and Planning Bob Singleton SVP, Customer Advocacy Asia Pacific, Japan, and Emerging Markets Kristine A. Snow SVP, Cisco Systems Capital Robert W. Soderbery SVP, Ethernet Switching Technology Group Padmasree Warrior SVP, Chief Technology Officer Tae Yoo SVP, Corporate Affairs 2010 Annual Report 79 -

Page 82

... financial information without charge, contact: Investor Relations Cisco Systems, Inc. 170 West Tasman Drive San Jose, CA 95134-1706 408 227-CSCO (2726) www.cisco.com/go/investors Cisco's stock trades on the NASDAQ Global Select Market under the ticker symbol CSCO. Forward-Looking Statement Transfer... -

Page 83

..., home networking, security, storage area networking, TelePresence systems, unified communications, unified computing, video systems, and wireless. As an innovator in the communications and information technology industry, Cisco and our valued partners sell Cisco hardware, software, and services to... -

Page 84

WORLDWIDE OFFICES Americas Headquarters San Jose, California, USA Asia Pacific Headquarters Singapore Europe Headquarters Amsterdam, Netherlands Cisco has more than 200 offices worldwide. Addresses, phone numbers, and fax numbers are listed on the Cisco website at www.cisco.com/go/o ces.