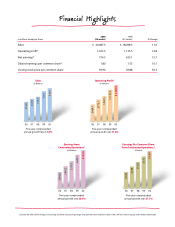

CVS 2000 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2000 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

America’s #1 Pharmacy

Customer-focused, innova-

tive and convenient healthcare

strategies have propelled CVS

to #1 on the list of U.S. drug-

store chains. More people filled

their prescriptions at CVS last

year than at any other drugstore.

Our pharmacy sales climbed

17% to nearly $13 billion, repre-

senting 63% of our total annual

revenues. Moreover, given the

highly attractive fundamentals

of the retail pharmacy industry,

we expect this strong growth to

continue.

Key Trends Driving Growth

The retail pharmacy industry is a $140 billion market

with a projected compound annual growth rate of

more than 13% through 2004. The increases in phar-

maceutical sales are being fueled by the convergence

of a number of positive trends. Drug companies are

introducing a steady stream of new pharmaceuticals

into the marketplace, while investing heavily to

advertise these products directly to the consumer.

It is estimated that 35 “block-

buster”drugs, with the poten-

tial to generate more than $1

billion in annual sales each, are

in the final stages of trial.This

strong pipeline bodes well for

the future, as 40% of pharma-

ceutical sales are historically

generated by drugs developed

within the preceding five years.

At the same time, patents

on an estimated $40 billion

worth of branded drugs are set

to expire over the next 10 years,

opening the door for generic

alternatives. That’s good news

for our customers, who will

benefit from lower prices.

Demographic trends and the expansion of man-

aged care are also playing substantial roles in driving

retail pharmacy

growth. With mem-

bers of the “Baby

Boom” generation

moving into their

50s, demand for pre-

scriptions should con-

tinue to accelerate.

Individuals over age

65 take approximately

16 prescriptions per

year, compared to about

six prescriptions annually

for Americans under age

45. We have found that

when people switch from

no prescription coverage to

a managed care plan requiring

only a customer co-pay, prescription use nearly dou-

bles. These trends, coupled with the possibility of a

prescription drug benefit for Medicare enrollees, pro-

vide further catalysts for continued pharmacy growth.

Positioned for Growth

Demand for prescriptions continues to

rise as the population ages, and CVS

continues to capture an increasing

share of this growing market.

CVS led the industry with an 18% increase

in pharmacy same store sales in 2000.

…the most

customer-focused...

“More people trust

CVS for their

healthcare needs

than any other

drugstore chain

in America.”

6

CVS Corporation