CVS 2000 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2000 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

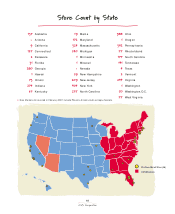

natural extension from our #1 position in Detroit, the

4th largest drugstore market. Since our acquisition

of Michigan-based Arbor Drugs, Inc. in 1998, we have

reinforced and built upon our presence in this highly

attractive market.

Economic Lift from Relocations

Store relocations, the third leg of our real estate

strategy, are highly productive investments for CVS.

When we relocate a store from an inline shopping

center to a freestanding, convenient corner location,

we typically generate 25% to 35% higher front-end

sales, improved margins and a better return on invest-

ed capital than the stores they replace. The new sites,

which are in higher-profile locations with convenient

parking, have more appeal to consumers. Today, nearly

40% of our stores are in freestanding locations. Our

goal over the next five to seven years is to reach 80%.

Although the number of relocations will decrease over

time, our relocation strategy will remain an important

component of our overall growth strategy.

CVS Procare

America’s #1 Specialty Pharmacy:

CVS ProCare

During 2000, we solidified CVS’ position as the

leading provider of specialty pharmacy services

through our CVS ProCare subsidiary. We now operate

46 ProCare apothecaries in 18 urban markets across

the U.S., and, with our September 2000 acquisition of

Stadtlander Pharmacy, we have established ProCare

as the largest specialty mail order pharmacy in the

nation. Importantly, we are the only specialty phar-

macy provider offering integrated retail and mail

order services.

We launched ProCare with the objective of

providing a pharmacy resource uniquely focused

on serving patients with chronic conditions, such as

HIV/AIDS, organ transplants, infertility, multiple scle-

rosis and cancer. Estimated at $14 billion in size today,

the specialty pharmacy market is growing at an annual

rate of 20%, with much of this growth being driven by

medical advancements.

ProCare pharmacists are active patient advocates and partner with physicians, pharmaceutical

manufacturers and other healthcare providers to offer in-depth patient treatment and counseling services.