CVS 2000 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2000 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Liquidity & Capital Resources

Liquidity ~ We generally finance our working capital and capital

expenditure requirements with internally generated funds and

our commercial paper program. In addition, we may elect to use

additional long-term borrowings and/or other financing sources

in the future to support our continued growth.

Our commercial paper program is supported by a $670 million,

five-year unsecured revolving credit facility, which expires on

May 30, 2002 and a $995 million unsecured revolving credit

facility, which expires on May 25, 2001. We can also obtain short-

term financing through various uncommitted lines of credit. As

of December 30, 2000, we had $589.6 million of commercial

paper outstanding at a weighted average interest rate of 6.9%.

Our credit facilities and unsecured senior notes contain customary

restrictive financial and operating covenants.We do not believe

that the restrictions contained in these covenants materially

affect our financial or operating flexibility.

On March 6, 2000, the Board of Directors approved a common

stock repurchase program, which allows the Company to

acquire up to $1 billion of its common stock. During 2000, we

repurchased 4.7 million shares of common stock at an aggregate

cost of $163.2 million.

On September 18, 2000, the Company completed the acquisition

of certain assets of Stadtlander Pharmacy of Pittsburgh,

Pennsylvania, a subsidiary of Bergen Brunswig Corporation, for

$124 million in cash plus the assumption of certain liabilities. The

results of operations of Stadtlander have been included in the

consolidated financial statements since this date.

Capital Resources ~ Although there can be no assurance and

assuming market interest rates remain favorable, we currently

believe that we will continue to have access to capital at attractive

interest rates in 2001. We further believe that our cash on hand

and cash provided by operations, together with our ability to

obtain additional short-term and long-term financing, will be

sufficient to cover our future working capital needs, capital

expenditures and debt service requirements for at least the next

12 months.

Net Cash Provided by Operations ~ Net cash provided by

operations increased to $780.2 million in 2000.This compares

to $726.3 million in 1999 and $292.4 million in 1998. The

improvement in net cash provided by operations was primarily

the result of higher net earnings. As of December 30, 2000, the

future cash payments associated with various restructuring

programs totaled $105.2 million, which primarily consists of

continuing lease obligations extending through 2020.

Capital Expenditures ~ Our capital expenditures, before the

effect of the sale-leaseback transactions discussed below,

totaled $695.3 million in 2000. This compared to $722.7 million,

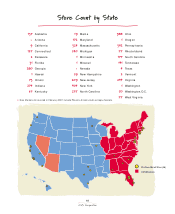

in 1999 and $502.3 million in 1998. During 2000, we opened

158 new stores, relocated 230 existing stores and closed 123

stores.This includes 34 new ProCare stores and 1 relocation.We

also entered three new major markets in 2000 including

Chicago, Illinois, Tampa and Orlando, Florida. As of December

30, 2000, we operated 4,133 retail and specialty pharmacy

stores in 31 states and the District of Columbia.This compares to

4,098 stores as of January 1, 2000.The Company finances a

portion of its store development program through sale-leaseback

transactions. Proceeds from sale-leaseback transactions totaled

$299.3 million in 2000 and $229.2 million in 1999.The properties

were sold at net book value and the resulting leases are being

accounted for as operating leases.

Recent Accounting Pronouncements

Effective fiscal 2001, we adopted Statement of Financial

Accounting Standards No. 133,“Accounting for

Derivative

Instruments and Hedging Activities,” as amended by SFAS 138,

“Accounting for Certain Derivative Instruments and Certain

Hedging Activities—an amendment to FASB Statement No. 133.”

These statements, which established the accounting and

financial reporting requirements for derivative instruments,

require companies to recognize derivatives as either assets or

liabilities on the balance sheet and measure those instruments

at fair value.The adoption of this standard did not have a

material effect on our consolidated financial statements.

During the fourth quarter of 2000, we adopted the Staff Accounting

Bulletin 101,“Revenue Recognition in Financial Statements.”

This bulletin summarizes the application of generally accepted

accounting principles to revenue recognition in financial

statements.The adoption of this standard did not have a material

effect on our consolidated financial statements.

Cautionary Statement Concerning

Forward-Looking Statements

We have made forward-looking statements in this Annual Report

that are subject to risks and uncertainties that could cause actual

results to differ materially. For these statements, we claim the

protection of the safe harbor for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995.

We strongly recommend that you become familiar with the specific

risks and uncertainties that we have outlined for you under the

caption “Cautionary Statement Concerning Forward-Looking

Statements” in our Annual Report on Form 10-K for the fiscal

year ended December 30, 2000.

Management’s Discussion and Analysis of

Financial Condition and Results of Operation

20

CVS Corporation