CVS 2000 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2000 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Significant Accounting Policies

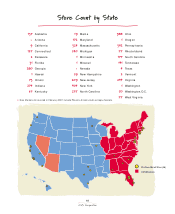

Description of business ~ CVS Corporation

(“CVS” or the “Company”) is principally in the

retail drugstore business. As of December 30,

2000, the Company operated 4,133 retail and specialty pharmacy

drugstores and various mail order facilities located in 31 states

and the District of Columbia. See Note 9 for further information

about the Company’s business segments.

Basis of presentation ~ The consolidated financial statements

include the accounts of the Company and its wholly-owned

subsidiaries. All material intercompany balances and transactions

have been eliminated.

Fiscal Year ~ The Company operates on a “52/53 week” fiscal

year. Fiscal year 2000 ended December 30, 2000 and included

52 weeks. Fiscal 1999 and 1998 ended on January 1, 2000 and

December 26, 1998 and included 53 weeks and 52 weeks,

respectively. Unless otherwise noted, all references to years

relate to the Company’s fiscal year.

Use of estimates ~ The preparation of financial statements in

conformity with generally accepted accounting principles requires

management to make estimates and assumptions that affect the

reported amounts in the consolidated financial statements and

accompanying notes. Actual results could differ from those

estimates.

Reclassifications ~ Certain reclassifications have been made to

the consolidated financial statements of prior years to conform to

the current year presentation.

Cash and cash equivalents ~ Cash and cash equivalents consist

of cash and temporary investments with maturities of three months

or less when purchased.

Accounts receivable ~ Accounts receivable are stated net of an

allowance for uncollectible accounts of $45.7 million and $41.1

million as of December 30, 2000 and January 1, 2000, respectively.

The balance primarily includes amounts due from third party

providers (e.g., pharmacy benefit managers, insurance companies

and governmental agencies) and vendors.

Inventories ~ Inventories are stated at the lower of cost or

market using the first-in, first-out method.

Financial instruments ~ Financial instruments include cash

and cash equivalents, accounts receivable, accounts payable and

short-term borrowings. Due to the short-term nature of these

instruments, the Company’s carrying value approximates fair

value.The fair value of long-term debt was $290 million as of

December 30, 2000. The Company has no investments in

derivative financial instruments.

Property and equipment ~ Depreciation of property and

equipment is computed on a straight-line basis, generally over the

estimated useful lives of the asset or, when applicable, the term

of the lease, whichever is shorter. Estimated useful lives generally

range from 10 to 40 years for buildings and improvements, 3 to

10 years for fixtures, equipment and software and 5 to 10 years for

leasehold improvements.

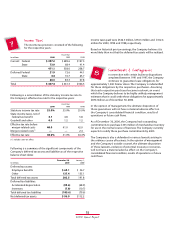

Following are the components of property and equipment

included in the consolidated balance sheets as of the respective

balance sheet dates:

Impairment of long-lived assets ~ The Company primarily

groups and evaluates fixed and intangible assets at an individual

store level, which is the lowest level at which individual cash flows

can be identified. Goodwill is allocated to individual stores based

on historical store contribution, which approximates store cash

flow. Other intangible assets (i.e., patient prescription files and

favorable lease interests) are typically store specific and, therefore,

are directly assigned to individual stores.When evaluating assets

for potential impairment, the Company first compares the

carrying amount of the asset to the asset’s estimated future

cash flows (undiscounted and without interest charges). If the

estimated future cash flows used in this analysis are less than the

carrying amount of the asset, an impairment loss calculation is

prepared.The impairment loss calculation compares the carrying

amount of the asset to the asset’s estimated future cash flows

(discounted and with interest charges). If the carrying amount

exceeds the asset’s estimated future cash flows (discounted

and with interest charges), an impairment loss is recorded.

Notes to Consolidated Financial Statements

26

CVS Corporation

1

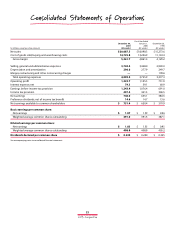

December 30, January 1,

In millions 2000 2000

Land $ 97.1 $ 89.6

Buildings and improvements 333.1 239.1

Fixtures, equipment and software 1,536.6 1,488.4

Leasehold improvements 632.3 585.3

Capital leases 2.2 2.2

2,601.3 2,404.6

Accumulated depreciation and

amortization (859.2) (803.6)

$ 1,742.1 $ 1,601.0