CVS 2000 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2000 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

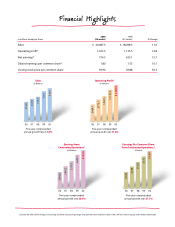

The year 2000 was an exceptional year for CVS by any measure. We achieved con-

tinued strong financial results, including record sales,operating profit and net earnings.

We also made significant strides toward our goal of being the most customer-focused,

innovative and convenient healthcare service retailer in America, with four comple-

mentary and growing healthcare businesses—CVS/pharmacy, ProCare, PharmaCare,

and CVS.com—serving the needs of all our customers.

Excellent Financial Performance and

Shareholder Returns

Net sales for the year reached a record $20.1 bil-

lion, up 13% from $17.7 billion in 1999 (on a compa-

rable 52-week basis), while same store sales surged

11% and led the industry. Net earnings, excluding a

one-time gain of $19 million related to a litigation

settlement, advanced to a record $735 million, or

$1.80 per share, up 18% from $1.52 per share in 1999

on a comparable 52-week basis.We continue to gen-

erate significant free cash flow, reaching $384 million

in 2000, ahead of our goal and significantly higher

than the $233 million we reported in 1999. This out-

standing performance solidified our track record of

meeting or beating Wall Street’s expectations every

quarter since we became a stand-alone public com-

pany in the Fall of 1996, and has translated into

excellent returns for our shareholders.

For the year, CVS’ share price climbed more than 50%, compared with a 6% decline

in the Dow Jones Industrial Average, and a 10% decline in the S&P 500 Index. In con-

trast to 1999, when investors flocked to technology stocks and, more specifically, to

pure-play Internet stocks, investors have now come back to companies such as CVS

that offer the best of both worlds: old economy fundamentals with above average

growth and new economy innovation.

America’s Pharmacy Leader

The drugstore industry remains extremely vibrant, possessing

perhaps the most compelling growth demographics in all of

retail—and CVS is America’s #1 Pharmacy. With 4,133 locations,

we operate more drugstores than any other company in the U.S.

Our pharmacy business continues to register phenomenal same

store sales growth, up nearly 18% in 2000. In fact, more

prescriptions are filled at CVS/pharmacy than at any other

retailer. The $140 billion pharmacy industry will continue to

be among the fastest-growing segments of the retail sector,

To Our Shareholders

CVS pharmacists filled approximately 300 million

prescriptions in 2000, providing pharmacy

counseling to millions of customers.

“We are a recognized

leader in our industry and

believe CVS is better

positioned than at any

time in the Company’s

history to capitalize on

the significant opportunities

in healthcare.”

2

CVS Corporation