CVS 2000 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2000 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

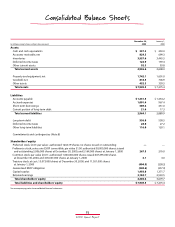

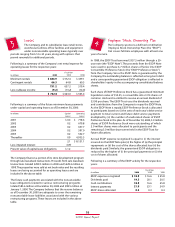

Borrowing and Credit Agreements

Following is a summary of the Company’s

borrowings as of the respective balance sheet

dates:

The Company’s commercial paper program is supported by a

$670 million, five-year unsecured revolving credit facility, which

expires on May 30, 2002 and a $995 million, unsecured revolving

credit facility, which expires on May 25, 2001 (collectively, the

“Credit Facilities”). The Credit Facilities require the Company to

pay a quarterly facility fee of 0.07%, regardless of usage.The

Company can also obtain up to $35.0 million of short-term

financing through various uncommitted lines of credit.

Interest paid totaled $98.3 million in 2000, $69.0 million in

1999 and $70.7 million in 1998.The weighted average interest

rate for short-term borrowings was 6.9% as of December 30,

2000 and 6.2% as of January 1, 2000.

In February 1999, the Company issued $300 million of 5.5%

unsecured senior notes due February 15, 2004. The proceeds

from the issuance were used to repay outstanding commercial

paper borrowings.

The Credit Facilities and unsecured senior notes contain

customary restrictive financial and operating covenants.The

covenants do not materially effect the Company’s financial or

operating flexibility.

As of December 30, 2000, the aggregate long-term debt maturing

during the next five years, excluding capital lease obligations, is:

$21.6 million in 2001, $26.3 million in 2002, $32.1 million in 2003,

$323.3 million in 2004 and $28.0 million in 2005.

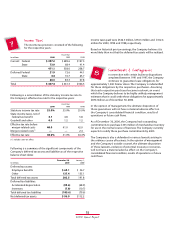

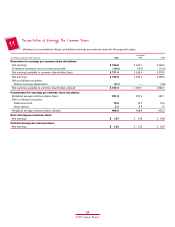

When computing diluted earnings per common share, the

Company assumes that the ESOP preference stock is converted

into common stock and all dilutive stock options are exercised.

After the assumed ESOP preference stock conversion, the ESOP

trust would hold common stock rather than ESOP preference

stock and would receive common stock dividends (currently

$0.23 per share) rather than ESOP preference stock dividends

(currently $3.90 per share). Since the ESOP Trust uses the dividends

it receives to service its debt, the Company would have to increase

its contribution to the ESOP trust to compensate it for the lower

dividends.This additional contribution would reduce the Company’s

net earnings, which in turn, would reduce the amounts that would

be accrued under the Company’s incentive compensation plans.

Diluted earnings per common share is computed by dividing: (i)

net earnings, after accounting for the difference between the

dividends on the ESOP preference stock and common stock and

after making adjustments for the incentive compensation plans

by (ii) Basic Shares plus the additional shares that would be

issued assuming that all dilutive stock options are exercised and

the ESOP preference stock is converted into common stock.

New Accounting Pronouncements ~ Effective fiscal 2001, the

Company adopted SFAS No. 133,“Accounting for Derivative

Instruments and Hedging Activities,” as amended by SFAS 138,

“Accounting for Certain Derivative Instruments and Certain

Hedging Activities—an amendment to FASB Statement No.

133.”These statements, which established the accounting and

financial reporting requirements for derivative instruments,

require companies to recognize derivatives as either assets or

liabilities on the balance sheet and measure those instruments at

fair value.The adoption of this standard did not have a material

effect on the Company’s consolidated financial statements.

During the fourth quarter of 2000, the Company adopted Staff

Accounting Bulletin 101,“Revenue Recognition in Financial

Statements.”The bulletin summarizes the application of generally

accepted accounting principles to revenue recognition in

financial statements.The adoption of this standard did not have

a material effect on the Company’s consolidated financial

statements.

Notes to Consolidated Financial Statements

28

CVS Corporation

2

December 30, January 1,

In millions 2000 2000

Commercial paper $ 589.6 $ 451.0

ESOP note payable(1) 240.6 257.0

5.5% unsecured senior notes 300.0 300.0

Mortgage notes payable 16.6 17.3

Capital lease obligations 1.2 1.5

1,148.0 1,026.8

Less:

Short-term borrowings (589.6) (451.0)

Current portion of long-term debt (21.6) (17.3)

$ 536.8 $ 558.5

(1) See Note 4 for further information about the Company’s ESOP Plan.