CVS 2000 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2000 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

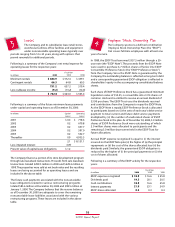

•Sales to customers covered by third party insurance programs

have continued to increase and, thus, have become a larger

part of our total pharmacy business. On average, our gross

margin on third party pharmacy sales is lower than our gross

margin on cash pharmacy sales.

• Our third party gross margin rates have historically reflected

varying degrees of pressure due to the efforts of managed

care organizations and other pharmacy benefit managers

to reduce prescription drug costs.To address this trend, we

have dropped and/or renegotiated a number of third party

programs that fell below our minimum profitability

standards.These continuing efforts have resulted in a

stabilization of third party rates. However, in the event this

trend were to continue and we elect to drop additional

programs and/or decide not to participate in future

programs that fall below our minimum profitability

standards, we may not be able to sustain our current rate of

sales growth.

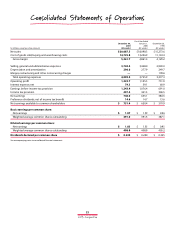

Total operating expenses were 20.1% of net sales in 2000. This

compares to 20.6% of net sales in 1999 and 22.1% in 1998. As

you review our performance in this area, please remember to

consider the impact of the following nonrecurring gain and charge:

•During 2000, we recorded a $19.2 million pre-tax ($11.5

million after-tax) nonrecurring gain in total operating

expenses, which represented a partial payment of our share

of the settlement proceeds from a class action lawsuit

against certain manufacturers of brand name prescription

drugs.The timing and amount of any future payments have

yet to be determined.

•During 1998, we recorded a $147.3 million pre-tax ($101.3

million after-tax) charge in total operating expenses for

direct and other merger-related costs pertaining to the

CVS/Arbor merger transaction and related restructuring

activities. In addition, we incurred $31.3 million of

nonrecurring costs ($18.4 million after-tax) in connection

with eliminating Arbor’s information technology systems

and Revco’s noncompatible store merchandise fixtures.

Please read Note 10 to the consolidated financial statements

for other important information about the CVS/Arbor merger.

If you exclude the effect of the nonrecurring gain and charges

we recorded in 2000 and 1998, respectively, comparable total

operating expenses as a percentage of net sales were 20.2% in

2000, 20.6% in 1999 and 20.9% in 1998.

What have we done to improve our comparable total operating

expenses as a percentage of net sales?

•Our strong sales performance has consistently allowed our

net sales to grow at a faster pace than total operating

expenses.

•Our information technology initiatives have led to greater

productivity, which has resulted in lower operating costs,

particularly at the store level.

Operating profit increased $187.2 million in 2000 to $1.3 billion.

This compares to $1.1 billion in 1999 and $751.9 million in 1998.

If you exclude the effect of the nonrecurring gain we recorded in

total operating expenses in 2000 and the nonrecurring charges

we recorded in gross margin and in total operating expenses in

1998, our comparable operating profit increased $168.0 million

in 2000 to $1.3 billion (or 14.8%).This compares to $1.1 billion in

1999 and $940.5 million in 1998. Comparable operating profit as

a percentage of net sales was 6.5% in 2000, 6.3% in 1999 and 6.2%

in 1998.

Interest expense, net consisted of the following:

The increase in interest expense in 2000 was primarily due to

higher average interest rates and higher average borrowing levels

during the year.

Income tax provision ~ Our effective income tax rate was 40.0%

in 2000, 41.0% in 1999 and 44.4% in 1998. The decrease in our

effective income tax rate in 2000 and 1999 was primarily due to

lower state income taxes. Our effective income tax rate was

higher in 1998 because certain components of the nonrecurring

charges we recorded in conjunction with the CVS/Arbor merger

transaction were not deductible for income tax purposes.

Net earnings increased $110.9 million to $746.0 million (or $1.83

per diluted share) in 2000.This compares to $635.1 million (or $1.55

per diluted share) in 1999 and $384.5 million (or $0.95 per diluted

share) in 1998. If you exclude the effect of the nonrecurring gain we

recorded in total operating expenses in 2000 and the nonrecurring

charges we recorded in gross margin and in total operating

expenses in 1998, our comparable net earnings increased $99.4

million to $734.5 million (or $1.80 per diluted share) in 2000.This

compares to $635.1 million (or $1.55 per diluted share) in 1999 and

$510.1 million (or $1.26 per diluted share) in 1998.

Fiscal Year

In millions 2000 1999 1998

Interest expense $ 84.1 $ 66.1 $ 69.7

Interest income (4.8) (7.0) (8.8)

Interest expense, net $ 79.3 $ 59.1 $ 60.9

19

2000 Annual Report