Best Buy 2000 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2000 Best Buy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

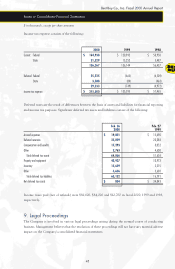

$ in thousands, except per share amounts

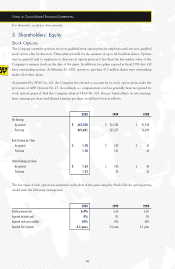

5. Shareholders’ Equity

Stock Options

The Company currently sponsors two non-qualified stock option plans for employees and one non-qualified

stock option plan for directors. These plans provide for the issuance of up to 48.8 million shares. Options

may be granted only to employees or directors at option prices not less than the fair market value of the

Company’s common stock on the date of the grant. In addition, two plans expired in fiscal 1998 that still

have outstanding options. At February 26, 2000, options to purchase 17.0 million shares were outstanding

under all of these plans.

As permitted by SFAS No. 123, the Company has elected to account for its stock option plans under the

provisions of APB Opinion No. 25. Accordingly, no compensation cost has generally been recognized for

stock options granted. Had the Company adopted SFAS No. 123, the pro forma effects on net earnings,

basic earnings per share and diluted earnings per share would have been as follows:

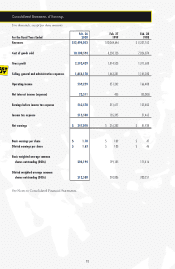

2000 1999 1998

Net Earnings

As reported $ 347,070 $ 216,282 $ 81,938

Pro forma 321,881 201,257 76,099

Basic Earnings per Share

As reported $ 1.70 $ 1.09 $ .47

Pro forma 1.58 1.01 .43

Diluted Earnings per Share

As reported $ 1.63 $ 1.03 $ .46

Pro forma 1.52 .96 .43

The fair value of each option was estimated on the date of the grant using the Black-Scholes option pricing

model with the following assumptions:

2000 1999 1998

Risk-free interest rate 6.4% 5.6% 6.8%

Expected dividend yield 0% 0% 0%

Expected stock price volatility 50% 50% 60%

Expected life of options 4.5 years 4.9 years 4.2 years

Notes to Consolidated Financial Statements