Best Buy 2000 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2000 Best Buy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

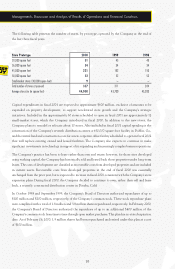

$ in thousands, except per share amounts

Fiscal Period(1) 2000 1999(6) 1998(6) 1997(6)

Statement of Earnings Data

Revenues $ 12,494,023 $ 10,064,646 $ 8,337,762 $ 7,757,692

Gross profit 2,393,429 1,814,523 1,311,688 1,045,890

Selling, general and administrative expenses 1,854,170 1,463,281 1,145,280 1,005,675

Operating income 539,259 351,242 166,408 40,215

Earnings (loss) before cumulative effect

of accounting change 347,070 216,282 81,938 (6,177)

Net earnings (loss) 347,070 216,282 81,938 (6,177)

Per Share Data(2)

Earnings (loss) before cumulative effect

of accounting change $ 1.63 $ 1.03 $ .46 $ (.04)

Net earnings (loss) 1.63 1.03 .46 (.04)

Common stock price: High 80.50 49.00 15.30 6.56

Low 40.50 14.75 2.16 1.97

Operating and Other Data

Comparable store sales change(3) 11.1% 13.5% 2.0% (4.7%)

Number of stores (year-end) 357 311 284 272

Average revenues per store(4) $ 37,200 $ 33,700 $ 29,600 $ 29,300

Gross profit percentage 19.2% 18.0% 15.7% 13.5%

Selling, general and administrative expense

percentage 14.8% 14.5% 13.7% 13.0%

Operating income percentage 4.3% 3.5% 2.0% .5%

Inventory turns(5) 7.2 6.6 5.6 4.6

Year-End Balance Sheet Data

Working capital $ 453,411 $ 662,111 $ 666,172 $ 563,083

Total assets 2,995,342 2,531,623 2,070,371 1,740,399

Long-term debt, including current portion 30,650 60,597 225,322 238,016

Convertible preferred securities –– 229,854 230,000

Shareholders’ equity 1,095,985 1,033,945 535,712 428,796

This table should be read in conjunction with Management’s Discussion and

Analysis of Results of Operations and Financial Condition, beginning on page 20,

and the Consolidated Financial Statements and Notes, beginning on page 30.

(1) Fiscal 1996contained 53weeks. All other periods presented contained52 weeks.

(2) Earnings per share is presented on a diluted basis and reflects two-for-one

stock splits in March 1999, May 1998 and April 1994, and a three-for-two stock

split in September 1993.

(3) Comparable stores are stores open at least 14 full months.

(4) Average revenues per store is based upon total revenues for the period divided

by the weighted average number of stores open during such period.

(5) Inventory turns are calculated based upon a monthly average of inventory

balances.

(6) During fiscal 2000, to comply with guidance from the staff of the Securities

and Exchange Commission, the Company changed its accounting policy with

respect to the recognition of net commission revenues from the sale of certain

insured extended service contracts sold after November 1995. This change

resulted in a restatement of previously reported financial information.

(7) During fiscal 1994, the Company adopted SFAS No. 109, Accounting for

Income Taxes, resulting in a cumulative effect adjustment of ($425) or ($.01)

per share.

(8) During fiscal 1991,the Company changed its method of accounting for extended

service contracts, resulting in a cumulative effect adjustment of ($13,997) or

($.15) per share.

10 -Year Financial Highlights