Best Buy 2000 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2000 Best Buy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

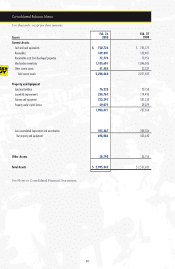

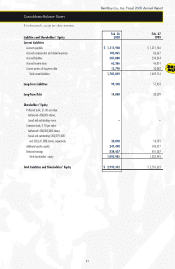

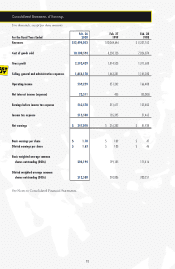

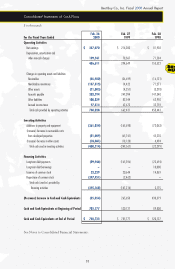

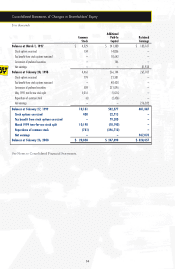

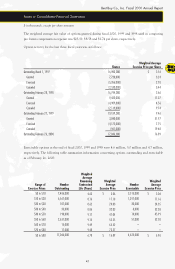

$ in thousands, except per share amounts

Best Buy Co., Inc. Fiscal 2000 Annual Report

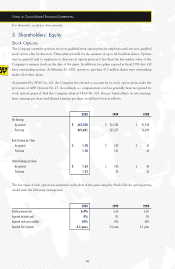

Stock Splits

The Company completed two-for-one stock splits effected in the form of 100% stock dividends distributed

on March 18, 1999 and May 26, 1998. All share and per share information reflects these stock splits.

Revenue Recognition

The Company recognizes revenues from the sales of merchandise at the time the merchandise is sold. Service

revenues are recognized at the time the service is provided.

The Company sells extended service contracts, called Performance Service Plans, on behalf of an unrelated

third party. The Company recognizes net commission revenues for extended service contracts sold in states

where the Company is deemed the obligor ratably over the terms of the service contracts, generally two to

five years. The Company recognizes net commission revenues for extended service contracts sold in states

where the Company is not deemed the obligor at the time of sale.

Pre-Opening Costs

In fiscal 1999, the Company adopted Statement of Position (SOP) 98-5, Reporting on the Cost of Start-Up

Activities. The SOP requires the costs of start-up activities, including store opening costs, to be expensed as

incurred. The Company historically deferred and amortized those costs over interim periods in the year the

store opened. Annual results were not materially impacted by the adoption.

Advertising Costs

Advertising costs, included in selling, general and administrative expenses, are expensed as incurred.

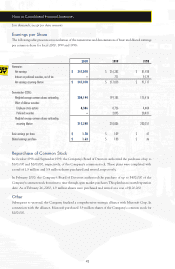

Earnings per Share

Basic earnings per share is computed based on the weighted average number of common shares outstanding

during each period. Diluted earnings per share includes the incremental shares assumed issued on the exercise

of stock options. Convertible preferred securities were assumed to be converted into common stock and any

related interest expense, net of income taxes, was added back to net earnings when the assumed conversion

resulted in lower earnings per share.

Stock Options

The Company applies Accounting Principles Board (APB) Opinion No. 25, Accounting for Stock Issued to

Employees, in accounting for stock options and presents in Note 5 pro forma net earnings and earnings per

share as if the Company had adopted SFAS No. 123, Accounting for Stock-Based Compensation.

Reclassifications

Certain previous-year amounts have been reclassified to conform to the current-year presentation. These

reclassifications had no impact on net earnings or total shareholders’ equity.

Notes to Consolidated Financial Statements