Best Buy 2000 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2000 Best Buy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

Best Buy Co., Inc. Fiscal 2000 Annual Report

Liquidity and Capital Resources

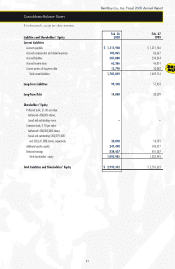

Record financial performance enabled the Company to internally fund its business expansion and repurchase

approximately $400 million of the Company’s common stock, while maintaining its liquidity and strong

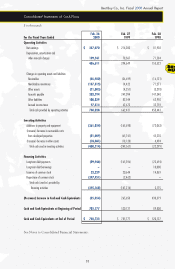

financial position. Cash flow from operations increased $98 million in fiscal 2000, to $760 million, driven

by earnings growth and continued improvement in inventory management. Cash and cash equivalents

totaled $751 million at the end of fiscal 2000, compared with $786 million at the end of fiscal 1999.

Inventories at the end of fiscal 2000 were $1.2 billion, up only 13% compared with one year ago, even with

a 24% sales increase, due to faster inventory turns. The increase in inventories was fully funded by an increase

in accounts payable.

Trade receivables, mainly credit card and vendor-related receivables, increased $57 million from one year ago.

The increase was primarily due to higher business volumes resulting from a 25% increase in fourth-quarter

sales and amounts due from ISP promotion subsidies. Receivables from sales on the Company’s private-label

credit card are sold to third parties, without recourse, and the Company does not bear any risk of loss with

respect to these receivables.

Other assets increased $23 million, with $16 million resulting from the Company’s strategic investments in

other companies made as part of its overall plan to expand its e-commerce business. Acquisition of leasehold

rights, the purchase of insurance policies in connection with the Company’s deferred compensation plan as

well as changes in deferred income taxes contributed to the net change in other assets.

Accounts payable and accrued liabilities increased compared with fiscal 1999, due to higher business

volume. Accrued compensation and related liabilities increased versus one year ago as a result of expenses

associated with the expanding employee base supporting the Company’s growth. The increase in long-term

liabilities was primarily due to the increase in long-term deferred compensation and a net increase in

deferred revenue related to PSPs.

Debt declined $30 million in fiscal 2000 due to the repayment of an $18 million note and scheduled maturities

of capital leases and other loans.

Capital spending in fiscal 2000 was $361 million, compared with $166 million and $72 million in fiscal 1999

and fiscal 1998, respectively. The Company expanded its store base by investing in 47 new stores and 13

remodeled or relocated stores during fiscal 2000, compared with 28 new stores and five remodeled or

relocated stores in fiscal 1999, and 13 new stores and five remodeled or relocated stores in fiscal 1998.

The Company increased its expansion program in fiscal 1999 after the initiatives to improve operations

resulted in an enhanced operating model and improved profitability. Capital spending in fiscal 2000 also

included the initial development for some of the stores scheduled to open in fiscal 2001. Additionally, the

Company expanded its corporate facilities to support the growth of the business, the most significant

investment being the purchase of an additional office building to supplement the Company’s corporate office.

The Company also continued to invest in new systems and technology to better position it for continued

growth and to generate improvements in its existing business.

Management’s Discussion and Analysis of Results of Operations and Financial Condition