Best Buy 2000 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2000 Best Buy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

Best Buy Co., Inc. Fiscal 2000 Annual Report

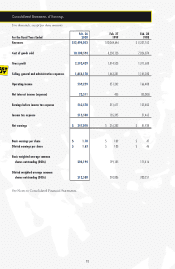

Components of Operating Income

The following table presents selected operating ratios as a percentage of revenues for each of the past three

fiscal years.

2000 1999 1998

Gross profit 19.2% 18.0% 15.7%

Selling, general and administrative expenses 14.8% 14.5% 13.7%

Operating income 4.3% 3.5% 2.0%

Gross profit was 19.2% of revenues in fiscal 2000, an improvement of 1.2% of sales over fiscal 1999. Gross profit

margins improved by more than 5% of sales since fiscal 1997. The current-year increase resulted from higher

product margins, a more profitable sales mix positively impacted by higher sales of PSPs and accessories, and

an enhanced inventory assortment. Inventory turns continued to improve, reaching 7.2 turns in fiscal 2000,

compared with 6.6 turns in fiscal 1999 and 5.6 turns in fiscal 1998. The increase in inventory turns resulted

in lower markdowns, particularly during model transitions. Also, better execution at the retail stores

improved inventory shrink as a percentage of revenues. The Company expects further improvement in gross

profit margins in fiscal 2001, as it continues to benefit from a more profitable mix and product margin

improvements due to programs initiated in the past few years. However, the Company anticipates the rate

of gross profit margin improvement will be less than the significant increases seen over the past two years.

Gross profit margin improved to 18.0% in fiscal 1999 from 15.7% in fiscal 1998, mainly due to the impact

of initiatives to generate a more profitable product assortment, increased inventory turns and improved

advertising effectiveness. An increase in higher-margin PSP sales also contributed to the improvement.

Selling, general and administrative expenses (SG&A) increased to 14.8% of revenues in fiscal 2000,

compared with 14.5% of revenues in fiscal 1999, as a result of increased spending on the Company’s strategic

initiatives and expenses related to the greater number of new store openings. Strategic initiatives in fiscal 2000

included the enhancement of operating systems and processes in the Company’s Services division, which

provides product installation and repair services. Other strategic initiatives included continued development

of the Company’s e-commerce business and development and refinement of the Company’s retail store

operating model. Personnel-related expenses rose due to an increase in the caliber and compensation of

staff in the Company’s retail stores to support the sales of more complex digital products. The more effective

sales staff contributed to higher sales of accessories and PSPs. Additional payroll expenses also were

incurred to hire and train store managers to support the 47 new stores added in fiscal 2000 and in preparation

for the approximately 60 additional stores anticipated in fiscal 2001. Furthermore, the Company has

increased its corporate staff to drive strategic initiatives, build the Company’s e-commerce business and

support the growing base of retail stores. Management believes that investing in strategic initiatives has

Management’s Discussion and Analysis of Results of Operations and Financial Condition