Bed, Bath and Beyond 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND PROXY STATEMENT

63

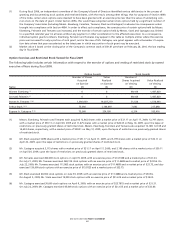

(4) ThesharesshownasbeingownedbyMr.Eisenberginclude:(a)1,751,325sharesownedbyMr.Eisenbergindividually;(b)1,382,446

sharesissuablepursuanttostockoptionsgrantedtoMr.Eisenbergthatareorbecomeexercisablewithin60days;(c)500,000shares

ownedbyafoundationofwhichMr.Eisenbergandhisfamilymembersaretrusteesandofcers;(d)896,250sharesownedby

trustsforthebenetofMr.Eisenbergandhisfamilymembers;(e)738,598sharesownedbyhisspouse;and(f)166,761sharesof

restricted stock. Mr. Eisenberg has sole voting power with respect to the shares held by him individually and in trust for his benefit

but disclaims beneficial ownership of any of the shares not owned by him individually and 448,125 shares in trust for the benefit of

his family members.

(5) ThesharesshownasbeingownedbyMr.Feinsteininclude:(a)881,309sharesownedbyMr.Feinsteinindividually;(b)1,382,446

sharesissuablepursuanttostockoptionsgrantedtoMr.Feinsteinthatareorbecomeexercisablewithin60days;(c)350,000shares

ownedbyafoundationofwhichMr.Feinsteinandhisfamilymembersaretrusteesandofcers;(d)896,250sharesownedbytrusts

forthebenetofMr.Feinsteinandhisfamilymembers;(e)238,598sharesownedbyhisspouse;and(f)166,761sharesofrestricted

stock. Mr. Feinstein has sole voting power with respect to the shares held by him individually and in trust for his benefit but disclaims

beneficial ownership of any of the shares not owned by him individually and 448,125 shares in trust for the benefit of his family

members.

(6) ThesharesshownasbeingownedbyMr.Temaresinclude:(a)128,375sharesownedbyMr.Temaresindividually;(b)1,988,936shares

issuablepursuanttostockoptionsgrantedtoMr.Temaresthatareorbecomeexercisablewithin60days;(c)5,000sharesownedby

afamilylimitedpartnership;and(d)229,443sharesofrestrictedstock.Mr.Temareshassolevotingpowerwithrespecttotheshares

held by him individually but disclaims beneficial ownership of the shares owned by the family limited partnership, except to the

extent of his pecuniary interest therein.

(7) ThesharesshownasbeingownedbyMr.Starkinclude:(a)4,515sharesownedbyMr.Starkindividually;(b)210,000sharesissuable

pursuanttostockoptionsthatareorbecomeexercisablewithin60days;and(c)108,128sharesofrestrictedstock.

(8) ThesharesshownasbeingownedbyMr.Castagnainclude:(a)10,073sharesownedbyMr.Castagnaindividually;(b)210,000shares

issuablepursuanttostockoptionsthatareorbecomeexercisablewithin60days;and(c)83,280sharesofrestrictedstock.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

The members of our Board of Directors, our executive officers and persons who hold more than 10% of our outstanding com-

mon stock are subject to the reporting requirements of Section 16(a) of the Exchange Act, which requires them to file reports

with respect to their ownership of our common stock and their transactions in such common stock. Based solely upon a review of

the copies of Section 16(a) reports that we have received from such persons or entities for transactions in our common stock and

their common stock holdings for fiscal 2009, we believe that all reporting requirements under Section 16(a) for such fiscal year

were met in a timely manner by our directors and executive officers, except that Patrick R. Gaston had a single Form 4 report filed

eight days late.