Bed, Bath and Beyond 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND PROXY STATEMENT

51

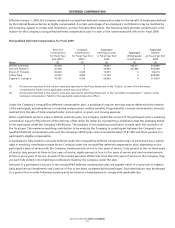

Report of the Compensation Committee of the Board of Directors

The Compensation Committee of the Company’s Board of Directors has submitted the following report for inclusion in this Proxy

Statement:

The Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis con-

tained in this Proxy Statement. Based on the Committee’s review of and the discussions with management with respect to the

Compensation Discussion and Analysis, the Committee recommended to the Board of Directors that the Compensation Discussion

and Analysis be included in this Proxy Statement and incorporated by reference in the Company’s Annual Report on Form 10-K

for fiscal 2009 for filing with the SEC.

The foregoing report is provided by the following directors, who constitute the Compensation Committee:

COMPENSATION COMMITTEE

Dean S. Adler

Klaus Eppler*

Victoria A. Morrison

Fran Stoller*

*Ms.StollerservedasamemberoftheCommitteeonlythroughtheendofscal2009;

Mr. Eppler was appointed to the Committee on March 2, 2010.

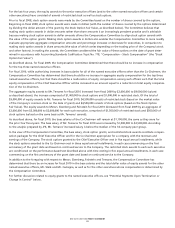

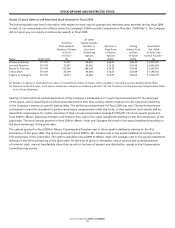

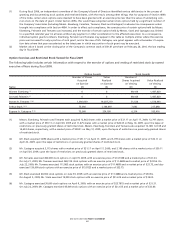

SUMMARY COMPENSATION TABLE FOR FISCAL 2009, FISCAL 2008 AND FISCAL 2007

The following table sets forth information concerning the compensation of the Company’s principal executive officer, principal

financial officer and the three most highly compensated executive officers of the Company other than its principal executive offi-

cer and principal financial officer for fiscal 2009, fiscal 2008 and fiscal 2007 (“named executive officers”).

Change in

Pension Value

and Nonqualified

Stock Option Deferred All Other

Name and Fiscal Salary(1) Awards(2)(3) Awards(2) Compensation Compensation(4) Total

Principal Position Year ($) ($) ($) Earnings ($) ($) ($)

Warren Eisenberg (5) (6) 2009 1,100,000 2,000,013 1,000,007 0 73,518 4,173,538

Co-Chairman 2008 1,100,000 2,000,008 1,000,000 0 78,645 4,178,653

2007 1,100,000 2,400,006 1,478,070 0 60,346 5,038,422

Leonard Feinstein (7) (8) 2009 1,100,000 2,000,013 1,000,007 0 138,476 4,238,496

Co-Chairman 2008 1,100,000 2,000,008 1,000,000 0 140,309 4,240,317

2007 1,100,000 2,400,006 1,478,070 0 66,887 5,044,963

Steven H. Temares (9) (10) (11) 2009 1,500,000 3,500,002 3,500,008 175,889 21,129 8,697,028

Chief Executive Officer 2008 1,468,269 2,400,003 4,600,000 99,932 21,104 8,589,308

2007 1,328,846 2,400,006 2,956,140 37,983 23,621 6,746,596

Arthur Stark (12) (13) 2009 1,055,000 1,000,021 590,011 0 17,182 2,662,214

President and 2008 1,032,788 1,000,004 589,997 0 10,387 2,633,176

Chief Merchandising Officer 2007 928,846 1,000,040 396,063 0 9,911 2,334,860

Eugene A. Castagna (14) (15) 2009 840,000 750,008 590,011 0 14,151 2,194,170

Chief Financial Officer 2008 822,319 749,995 589,997 0 13,468 2,175,779

and Treasurer 2007 738,076 750,019 396,063 0 16,874 1,901,032

(1) Except as otherwise described in this Summary Compensation Table, salaries to named executive officers were paid in cash in fiscal

2009, fiscal 2008 and fiscal 2007, and increases in salary, if any, were effective in May of the fiscal year.

(2) The value of stock awards and option awards represents their respective total fair value on the date of grant calculated in accor-

dance with Accounting Standards Codification Topic No. 718, “Compensation – Stock Compensation” (“ASC 718”), without regard

to the estimated forfeiture related to service-based vesting conditions. All assumptions made in the valuations are contained and