Bed, Bath and Beyond 2009 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2009 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BED BATH & BEYOND 2009 ANNUAL REPORT

21

The Company intends to reinvest the unremitted earnings of its Canadian subsidiary. Accordingly, no provision has been made

for U.S. or additional non-U.S. taxes with respect to these earnings. In the event of repatriation to the U.S., such earnings would

be subject to U.S. income taxes in most cases.

During the first quarter of 2007, the Company adopted updated accounting guidance related to income taxes. The Company rec-

ognizes the tax benefit from an uncertain tax position only if it is at least more likely than not that the tax position will be

sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in

the financial statements from such a position are measured based on the largest benefit that has a greater than fifty percent

likelihood of being realized upon settlement with the taxing authorities.

Judgment is required in determining the provision for income taxes and related accruals, deferred tax assets and liabilities. In the

ordinary course of business, there are transactions and calculations where the ultimate tax outcome is uncertain. Additionally,

the Company’s tax returns are subject to audit by various tax authorities. Although the Company believes that its estimates are

reasonable, actual results could differ from these estimates.

V. Litigation

The Company records an estimated liability related to various claims and legal actions arising in the ordinary course of business

which is based on available information and advice from outside counsel, where appropriate. As additional information becomes

available, the Company reassesses the potential liability related to such claims and legal actions and revises its estimates, as

appropriate. The ultimate resolution of these ongoing matters as a result of future developments could have a material impact on

the Company’s earnings. The Company cannot predict the nature and validity of claims which could be asserted in the future,

and future claims could have a material impact on its earnings.

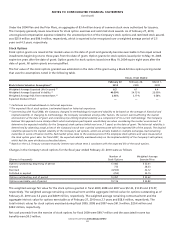

W. Earnings per Share

The Company presents earnings per share on a basic and diluted basis. Basic earnings per share has been computed by dividing

net earnings by the weighted average number of shares outstanding. Diluted earnings per share has been computed by

dividing net earnings by the weighted average number of shares outstanding including the dilutive effect of stock-based

awards as calculated under the treasury stock method.

Stock-based awards of approximately 9.8 million, 15.3 million and 10.9 million shares were excluded from the computation of

diluted earnings per share as the effect would be anti-dilutive for fiscal 2009, 2008 and 2007, respectively.

X. Segments

The Company accounts for its operations as one operating segment.

Y. Recent Accounting Pronouncements

In June 2009, the Financial Accounting Standards Board (“FASB”) issued accounting guidance which established the FASB

Accounting Standards Codification (“Codification”) as the exclusive source of authoritative accounting principles recognized by

the FASB to be applied by nongovernmental entities in the preparation of financial statements in conformity with GAAP. Rules

and interpretive releases of the Securities and Exchange Commission (“SEC”) are also considered sources of authoritative GAAP

for SEC registrants. The Codification supersedes all existing non-SEC accounting and reporting standards, however it does not

change current GAAP. The Codification was effective for all financial statements issued for interim and annual periods ending

after September 15, 2009. Accordingly, the Company has reflected all necessary changes in this filing.

In June 2006, the FASB issued updated accounting guidance related to income taxes. This guidance addresses the determination

of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. A com-

pany may recognize the tax benefit from uncertain tax positions only if it is at least more likely than not that the tax position will

be sustained on examination by the taxing authorities based on the technical merits of the position. The tax benefits recognized

in the financial statements from such a position should be measured based on the largest benefit that has a greater than fifty

percent likelihood of being realized upon settlement with the taxing authorities. This guidance also provided direction on derec-

ognition, classification, interest and penalties on income taxes, accounting in interim periods and required increased disclosures.

On March 4, 2007, the Company adopted this guidance and recognized a $13.1 million increase to retained earnings to reflect the

change to its liability for gross unrecognized tax benefits as required. The Company also recorded additional gross unrecognized

tax benefits, and corresponding higher deferred tax assets, of $35.6 million as a result of the adoption.