Bed, Bath and Beyond 2009 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2009 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

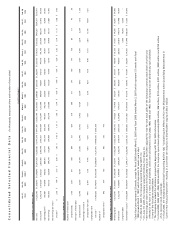

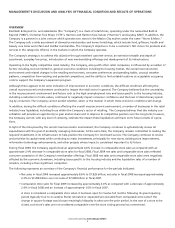

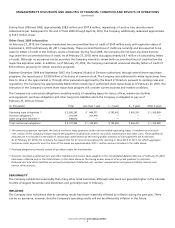

Fiscal Year Ended (1)

Feb. 27, Feb. 28, March 1, March 3, Feb. 25, Feb. 26, Feb. 28, March 1, March 2, March 3, Feb. 26, Feb. 27, Feb. 28, March 1, Feb. 25, Feb. 26, Feb. 27, Feb. 28,

2010 2009 2008 (2) 2007 2006 2005 2004 (3) 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993

STATEMENT OF EARNINGS DATA

Net sales $ 7,828,793 $ 7,208,340 $ 7,048,942 $ 6,617,429 $ 5,809,562 $ 5,147,678 $ 4,477,981 $ 3,665,164 $ 2,927,962 $ 2,396,655 $ 1,857,505 $ 1,382,345 $ 1,057,135 $ 816,912 $ 597,352 $ 437,807 $ 304,571 $ 216,411

Gross profit 3,208,119 2,873,236 2,925,231 2,835,402 2,485,748 2,186,301 1,876,664 1,518,547 1,207,566 986,459 766,801 576,125 441,016 341,168 250,036 183,819 127,972 90,528

Operating profit 980,687 673,896 838,022 889,401 879,171 792,414 639,343 480,057 346,100 272,838 209,340 158,052 118,914 90,607 67,585 51,685 36,906 26,660

Net earnings 600,033 425,123 562,808 594,244 572,847 504,964 399,470 302,179 219,599 171,922 131,229 97,346 73,142 55,015 39,459 30,013 21,887 15,960

Net earnings per share –

Diluted (4)

$ 2.30 $ 1.64 $ 2.10 $ 2.09 $ 1.92 $ 1.65 $ 1.31 $ 1.00 $ 0.74 $ 0.59 $ 0.46 $ 0.34 $ 0.26 $ 0.20 $ 0.14 $ 0 .11 $ 0.08 $ 0.06

SELECTED OPERATING DATA

Number of stores open

(at period end) 1,100 1,037 971 888 809 721 629 519 396 311 241 186 141 108 80 61 45 38

Total sq. ft. of store space

(at period end) 33,740 32,050 30,181 27,794 25,502 22,945 20,472 17,452 14,724 12,204 9,815 7,688 5,767 4,347 3,214 2,339 1,512 1,128

Percentage increase in

comparable store sales 4.4% (2.4)% 1.0% 4.9% 4.6% 4.5% 6.3% 7.9% 7.1% 5.0% 9.2% 7.6% 6.4% 6.1% 3.8% 12.0% 10.6% 7.2%

Comparable store

net sales (5)

$ 7,409,203 $ 6,746,472 $ 6,457,268 $ 6,068,694 $ 5,281,675 $ 4,468,095 $ 3,902,308

Number of

comparable stores (5) 942 874 792 683 605 535 416

BALANCE SHEET DATA (AT PERIOD END)

Working capital $ 2,413,791 $ 1,609,831 $ 1,065,599 $ 1,553,541 $ 1,082,399 $ 1,223,409 $ 1,199,752 $ 914,220 $ 715,439 $ 532,524 $ 360,585 $ 267,557 $ 188,293 $ 127,333 $ 91,331 $ 74,390 $ 56,001 $ 34,842

Total assets 5,152,130 4,268,843 3,844,093 3,959,304 3,382,140 3,199,979 2,865,023 2,188,842 1,647,517 1,195,725 865,800 633,148 458,330 329,925 235,810 176,678 121,468 76,654

Long-term debt – – – – – – – – – – – – – 5,000 16,800 13,300 –

Shareholders’ equity (6)

$ 3,652,904 $ 3,000,454 $ 2,561,828 $ 2,649,151(7) $ 2,262,450 $ 2,203,762 $ 1,990,820 $ 1,451,921 $ 1,094,350 $ 817,018 $ 559,045 $ 411,087 $ 295,397 $ 214,361 $ 151,446 $ 108,939 $ 77,305 $ 54,643

Consolidated Selected Financial Data (in thousands, except per share and number of store data)

(1) Each fiscal year represents 52 weeks, except for fiscal 2006 (ended March 3, 2007) and fiscal 2000 (ended March 3, 2001) which represent 53 weeks and fiscal

1996 (ended March 1, 1997) which represents 52 weeks and 6 days.

(2) On March 22, 2007, the Company acquired Buy Buy BABY, Inc.

(3) On June 19, 2003, the Company acquired Christmas Tree Shops, Inc.

(4) Net earnings per share amounts for fiscal 2000 and prior have been adjusted for two-for-one stock splits of the Company’s common stock (each of which was

effected in the form of a 100% stock dividend), which were distributed in fiscal 2000, 1998, 1996 and 1993. The Company has not declared any cash dividends

in any of the fiscal years noted above.

(5) The Company has added this disclosure prospectively beginning with fiscal 2003 information.

(6) In fiscal 2009, 2008, 2007, 2006, 2005 and 2004, the Company repurchased approximately $95 million, $48 million, $734 million, $301 million, $598 million and $350 million

of its common stock, respectively.

(7) In fiscal 2006, the Company adopted Staff Accounting Bulletin 108, ”Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in

Current Year Financial Statements” resulting in a one-time net reduction to Shareholders’ equity of $34.3 million.

–