Bed, Bath and Beyond 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND 2009 ANNUAL REPORT

30

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)

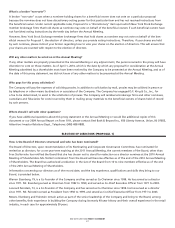

Under the 2004 Plan and the Prior Plans, an aggregate of 83.4 million shares of common stock were authorized for issuance.

The Company generally issues new shares for stock option exercises and restricted stock awards. As of February 27, 2010,

unrecognized compensation expense related to the unvested portion of the Company’s stock options and restricted stock awards

was $25.9 million and $96.9 million, respectively, which is expected to be recognized over a weighted average period of 2.5

years and 4.3 years, respectively.

Stock Options

Stock option grants are issued at fair market value on the date of grant and generally become exercisable in five equal annual

installments beginning one to three years from the date of grant. Option grants for stock options issued prior to May 10, 2004

expire ten years after the date of grant. Option grants for stock options issued since May 10, 2004 expire eight years after the

date of grant. All option grants are nonqualified.

The fair value of the stock options granted was estimated on the date of the grant using a Black-Scholes option-pricing model

that uses the assumptions noted in the following table.

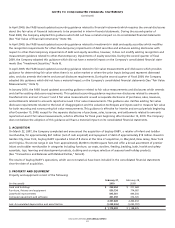

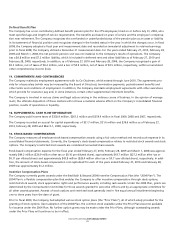

FISCAL YEAR ENDED

February 27, February 28, March 1,

Black-Scholes Valuation Assumptions (1) 2010 2009 2008

Weighted Average Expected Life (in years) (2) 6.3 6.1 6.4

Weighted Average Expected Volatility (3) 40.39% 34.13% 25.00%

Weighted Average Risk Free Interest Rates (4) 2.45% 3.17% 4.58%

Expected Dividend Yield — — —

Forfeitures are estimated based on historical experience.

(2) The expected life of stock options is estimated based on historical experience.

(3) Commencing with fiscal 2008, the Company changed its methodology for expected volatility to be based on the average of historical and

implied volatility. In changing its methodology, the Company considered, among other factors, the current events affecting the market

environment at the date of grant and consistency by utilizing implied volatility as a component of its current methodology. The Company

believes this approach more closely reflects what marketplace participants would likely use when considering the market environment to

determine the expected volatility for the Company’s stock options (which vest over 3-7 years) on the date of grant. The historical volatility is

determined by observing actual prices of the Company’s stock over a period commensurate with the expected life of the awards. The implied

volatility represents the implied volatility of the Company’s call options, which are actively traded on multiple exchanges, had remaining

maturities in excess of twelve months, had market prices close to the exercise prices of the employee stock options and were measured on

the stock option grant date. For fiscal 2007, the expected volatility was based solely on the implied volatility of the Company’s call options,

which had the same attributes as described above.

(4) Based on the U.S. Treasury constant maturity interest rate whose term is consistent with the expected life of the stock options.

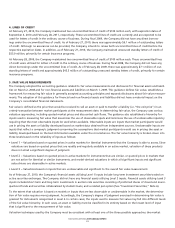

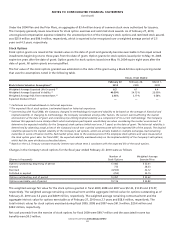

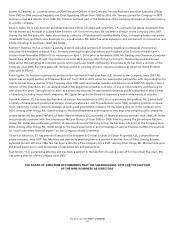

Changes in the Company’s stock options for the fiscal year ended February 27, 2010 were as follows:

Number of Weighted Average

(Shares in thousands) Stock Options Exercise Price

Options outstanding, beginning of period 17,482 $ 32.41

Granted 733 28.33

Exercised (4,503) 22.12

Forfeited or expired (255) 33.15

Options outstanding, end of period 13,457 $ 35.62

Options exercisable, end of period 10,116 $ 35.82

The weighted average fair value for the stock options granted in fiscal 2009, 2008 and 2007 was $12.33, $12.95 and $15.07,

respectively. The weighted average remaining contractual term and the aggregate intrinsic value for options outstanding as of

February 27, 2010 was 3.2 years and $80.9 million, respectively. The weighted average remaining contractual term and the

aggregate intrinsic value for options exercisable as of February 27, 2010 was 2.7 years and $58.6 million, respectively. The

total intrinsic values for stock options exercised during fiscal 2009, 2008 and 2007 were $61.9 million, $20.4 million and

$28.2 million, respectively.

Net cash proceeds from the exercise of stock options for fiscal 2009 were $99.7 million and the associated income tax

benefits were $0.3 million.

(1)