Bed, Bath and Beyond 2009 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2009 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND 2009 ANNUAL REPORT

22

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)

In April 2009, the FASB issued updated accounting guidance related to financial instruments which requires the annual disclosures

about the fair value of financial instruments to be presented in interim financial statements. During the second quarter of

fiscal 2009, the Company adopted this guidance which did not have a material impact on its consolidated financial statements

(See “Fair Value of Financial Instruments,” Note 1N).

In April 2009, the FASB issued updated accounting guidance related to investments in debt and equity securities which modifies

the recognition requirements for other-than-temporary impairments of debt securities and enhances existing disclosures with

respect to other-than-temporary impairments of debt and equity securities, however, it does not modify existing recognition and

measurement guidance related to other-than-temporary impairments of equity securities. During the second quarter of fiscal

2009, the Company adopted this guidance which did not have a material impact on the Company’s consolidated financial state-

ments (See “Investment Securities,” Note 6).

In April 2009, the FASB issued updated accounting guidance related to fair value measurements and disclosures which provides

guidance for determining fair value when there is no active market or where the price inputs being used represent distressed

sales, and also amends the interim and annual disclosure requirements. During the second quarter of fiscal 2009, the Company

adopted this guidance which did not have a material impact on the Company’s consolidated financial statements (See “Fair Value

Measurements,” Note 5).

In January 2010, the FASB issued updated accounting guidance related to fair value measurements and disclosures which amends

and clarifies existing disclosure requirements. This updated accounting guidance requires new disclosures related to amounts

transferred into and out of Level 1 and 2 fair value measurements as well as separate disclosures of purchases, sales, issuances,

and settlements related to amounts reported as Level 3 fair value measurements. This guidance also clarifies existing fair value

disclosure requirements related to the level of disaggregation and the valuation techniques and inputs used to measure fair value

for both recurring and nonrecurring fair value measurements. This guidance is effective for interim and annual periods beginning

after December 15, 2009, except for the separate disclosures of purchases, sales, issuances, and settlements related to amounts

reported as Level 3 fair value measurements, which is effective for fiscal years beginning after December 15, 2010. The Company

does not believe the adoption of this guidance will have a material impact on its consolidated financial statements.

2. ACQUISITION

On March 22, 2007, the Company completed and announced the acquisition of buybuy BABY, a retailer of infant and toddler

merchandise, for approximately $67 million (net of cash acquired) and repayment of debt of approximately $19 million. Based in

Garden City, New York, buybuy BABY operated a total of 8 stores at the time of acquisition, in Maryland, New Jersey, New York

and Virginia. The stores range in size from approximately 28,000 to 60,000 square feet and offer a broad assortment of premier

infant and toddler merchandise in categories including furniture, car seats, strollers, feeding, bedding, bath, health and safety

essentials, toys, learning and development products, clothing and a unique selection of seasonal and holiday products.

(See “Transactions and Balances with Related Parties,” Note 8).

The results of buybuy BABY’s operations, which are not material, have been included in the consolidated financial statements

since the date of acquisition.

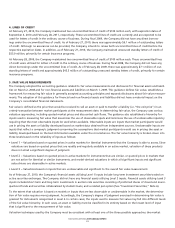

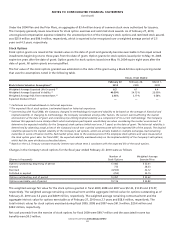

3. PROPERTY AND EQUIPMENT

Property and equipment consist of the following:

February 27, February 28,

(in thousands) 2010 2009

Land and buildings $ 229,954 $ 211,069

Furniture, fixtures and equipment 830,734 774,087

Leasehold improvements 895,581 844,356

Computer equipment and software 401,359 372,720

2,357,628 2,202,232

Less: Accumulated depreciation and amortization (1,238,336) (1,053,797)

$ 1,119,292 $ 1,148,435